Americans are still adjusting to a rapidly changing economy. Savings and borrowing are both slowing as the economy cools from relief-fueled COVID-era highs. However, multiple quarters of positive economic

growth and cooling inflation have brightened consumers’ long-term outlook. At the end of June, the Conference Board’s Consumer Confidence Index rose from 102.5 to 109.7. However, only 30.3% of respondents to the same survey reported they expect their family finances to improve in the next six months, and 69.3% of respondents believed a recession is somewhat or very likely during the next 12 months.

This mixed-to-negative near-term outlook will greatly affect how Americans interact with their financial institutions and has the possibility to spark a self-fulfilling prophecy across the economy itself.

Don’t Miss Out! Callahan’s quarterly Credit Union Strategy & Performance is available for download in the Callahan Client portal today. Not a client? Learn how you can gain access to our award-winning publications, intuitive benchmarking tools, collaborative networks, and more.

Key Points

- The average member relationship inched up 1.4% year-over-year. Loans per member climbed 8.0% year-over-year, whereas the average share balance fell 3.0%.

- Stronger certificate demand and higher cost of funds boosted annual dividends per member $103 year-over-year to $153, the highest amount since the third quarter of 2009.

- Annualized loan originations per member fell sharply year-over-year, declining 33.8% to $4,079. Amidst higher rates, members are less inclined — or less able — to borrow.

Performance At-A-Glance

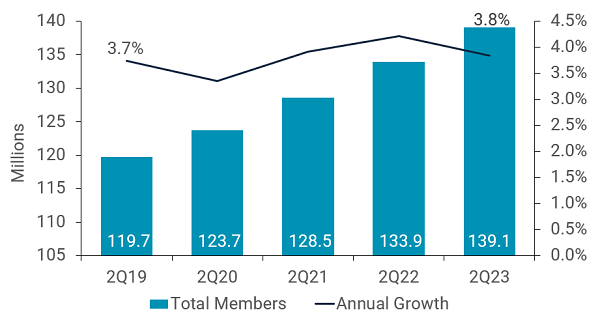

MEMBERSHIP GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.23

© Callahan & Associates | CreditUnions.com

Membership grew 3.8% annually at credit unions as Americans trusted cooperatives with their savings and lending needs.

REVENUE AND DIVIDEND GROWTH PER MEMBER

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.23

© Callahan & Associates | CreditUnions.com

Liquidity has been a concern for credit unions, and cooperatives are using increased interest earnings to reward savers with greater dividends per member.

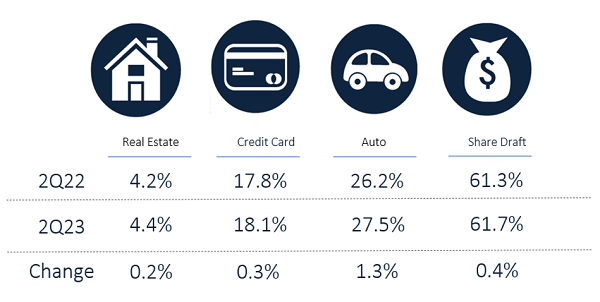

PRODUCT PENETRATION

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.23

© Callahan & Associates | CreditUnions.com

Penetration rates increased across the board. Indirect channels remain hot and drove the notable increase in auto lending across membership.

The Bottom Line

The way members interact with their credit union has changed substantially during the past few years.

In 2021 and 2022 — when rates were low — loan demand hit record highs, and members dumped excess savings into liquid deposit products that bore little interest. Now, after a year of rising rates, consumers are more reluctant to take on costly financing. Additionally, inflation has eaten up much of the savings members had set aside, creating liquidity concerns at cooperatives. Credit unions have raised new deposits predominantly in the form of high-yield certificates and other term products.

Credit unions have had to accommodate both of these dramatically different member engagement profiles in a short period of time, which highlights their ability to be flexible to meet members’ needs no matter what challenges the economy throws their way.

How Do You Compare?

Learn More Today