After a summer of anticipation, the Federal Reserve finally began loosening monetary policy by cutting its benchmark interest rates. Now, the financial world waits on whether the Fed will do it again.

The cuts have already affected the credit union balance sheet and will continue to do so in the future. Monetary policy and today’s rate environment will shape the economy, the credit union industry, and the lives of members and communities for years to come. The credit union mission shines in moments like this, where the cooperative model makes a difference.

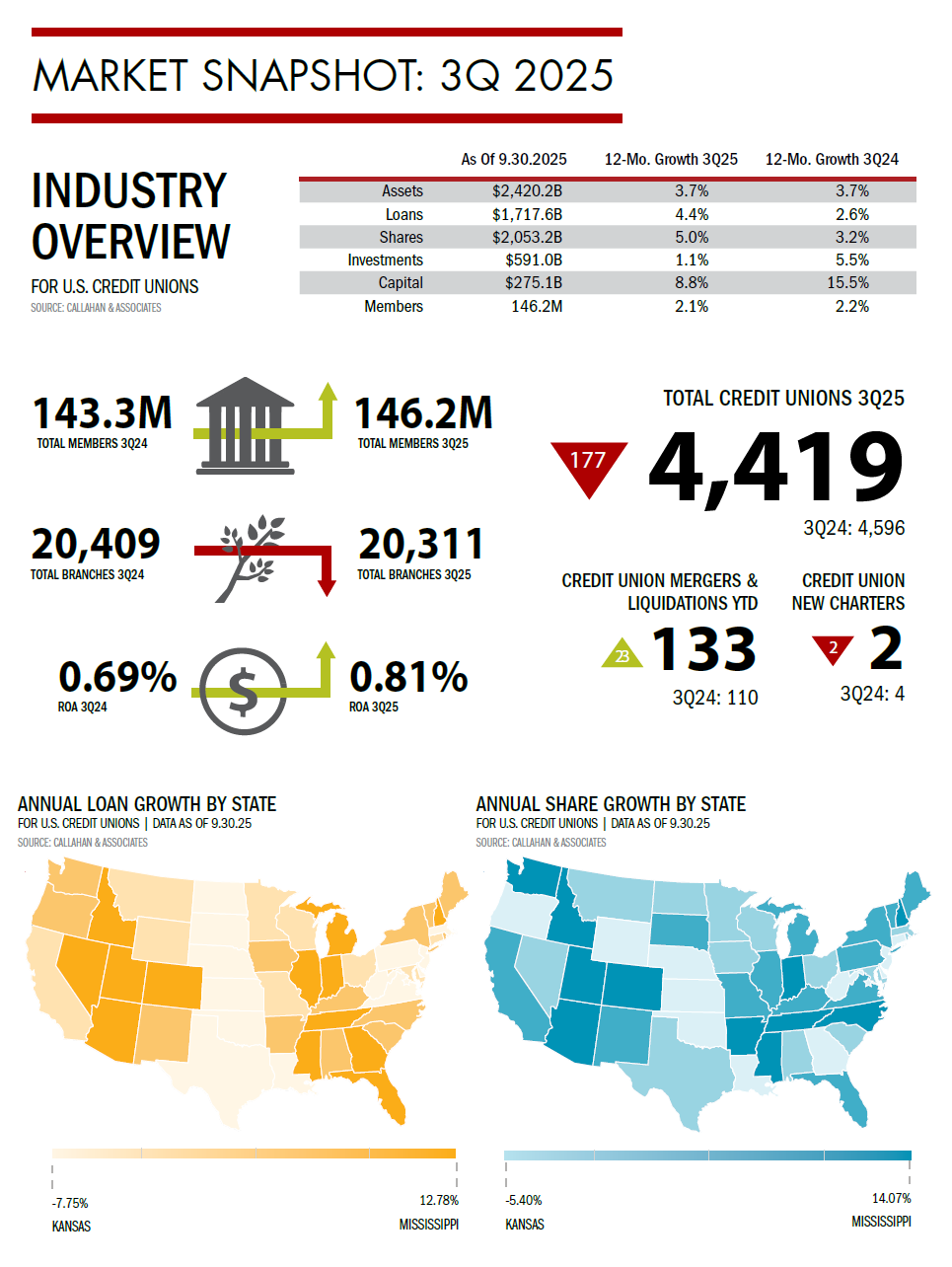

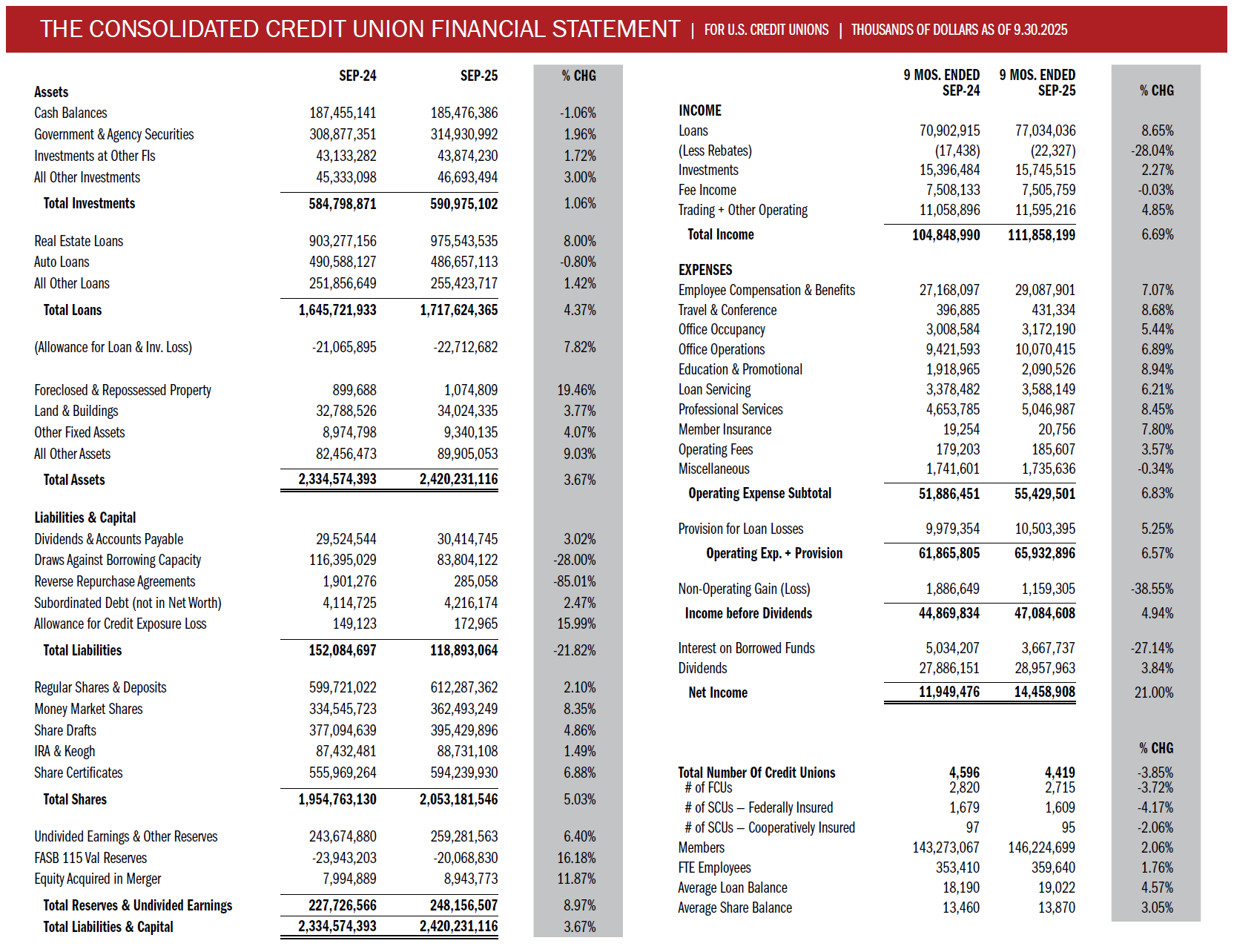

The following Market Snapshot and Two-Year Financial Statement provides a useful measuring stick for assessing industry data and incorporating those insights into planning for the quarters and years to come.

Credit Union Performance Reports

Callahan’s Market Snapshot and Two-Year Financial Statement equip credit union leaders with the tools they need to be more informed stewards of members’ money during these changing times.

Quarterly Performance Webinar

The Latest Insights – Available On Your Schedule: Callahan & Associates takes a look at third quarter credit union performance trends, exploring where the movement stands today and where opportunities lie for tomorrow. Watch it now.

Quarterly Performance Coverage

5 Takeaways From Trendwatch 3Q25: Despite economic uncertainty, credit unions and their members are displaying resilience through methodical improvement. Read more.

The K-Shaped Recovery And An Economy Divided: Inflation, debt, and income inequality are fueling a K-shaped, post-pandemic recovery, widening the gap between different economic segments and challenging lower-income households. Read more.

Members Are On The Move. Credit Unions Are Here For Them. Accelerating membership growth signals the increasing influence of credit unions amid evolving interest rate trends and economic challenges. Read more.

3 Ways Falling Rates Are Poised To Impact Credit Union Balance Sheets Falling interest rates are changing the game for credit unions. Explore how potential shifts in lending, savings, and margins are set to affect the bottom line. Read more.

How Asset Size Shapes Credit Union Performance Across 3 Metrics: Explore how credit union size influences growth, lending, and efficiency. Read more.

Let’s Review Your Performance Together. Join Callahan for a complimentary 1:1 session to analyze your performance reports using key insights from second quarter performance data. We’ll benchmark your credit union against two to three peer groups of your choice and provide a detailed report of our findings at the end of the session to help your team make informed strategic decisions. Request now.

See You Next Quarter! CreditUnions.com updates this page with fresh credit union data every quarter, so don’t forget to come back for insights into the fourth quarter of 2025.

See You Next Quarter! CreditUnions.com updates this page with fresh credit union data every quarter, so don’t forget to come back for insights into the fourth quarter of 2025.