CREDIT UNION REBRANDS

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.24

© Callahan & Associates | CreditUnions.com

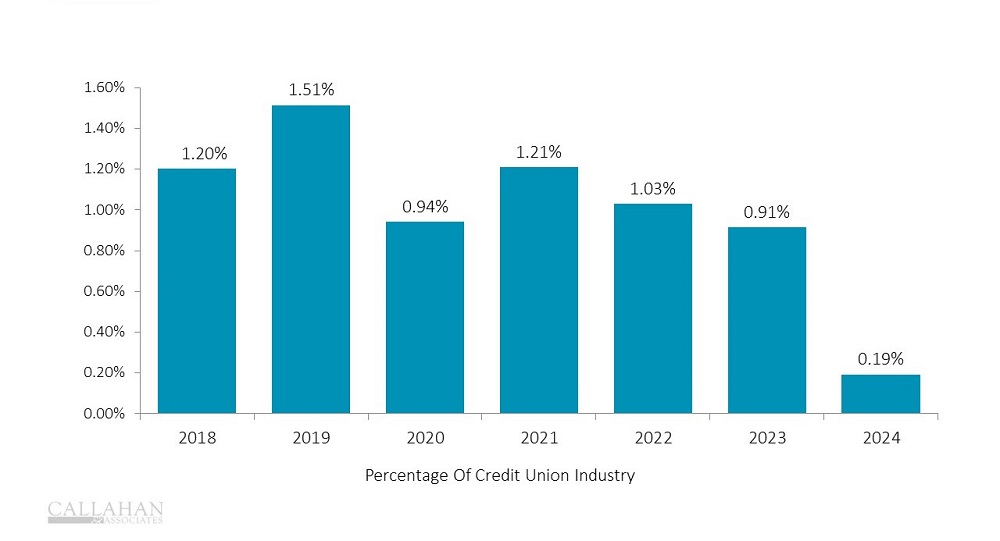

- Credit union name changes occurring outside of a merger have declined slightly since the pandemic. In 2019, 1.51% of all credit unions nationwide underwent a name change. During the pandemic, that percentage dropped to 0.94% and has continued to drop to 0.91% as of Dec. 31, 2023.

- Perhaps not surprisingly given the economic environment, marketing growth bottomed out at -8.8% in the fourth quarter of 2020. It then peaked at 22.3% in the first quarter of 2022. Since then, however, marketing growth has gradually declined, dropping to 0.3% in the first quarter of the year.

- Although growth has dropped, credit unions are not shying away from marketing. Marketing per member increased from $15 at year-end 2019 to $17 as of the first quarter of 2024.

What Does Performance Data Say About Your Marketing Strategy? Dig into key marketing metrics like marketing expense per member, share draft penetration, average member relationship, and more to uncover new areas of opportunity and make informed strategic decisions. How do you compare to peers? What can you do better? Request a free performance packet today.