BENEFITS OF DATA ANALYTICS

FOR U.S. CREDIT UNIONS | DATA AS OF 12.30.23

© Callahan & Associates | CreditUnions.com

- In today’s digital world, companies have a host of information at their fingertips. Being able to effectively turn raw data into actionable insights — i.e., data analytics — can reduce costs, identify risks, and drive innovation regardless of the industry in which a company operates.

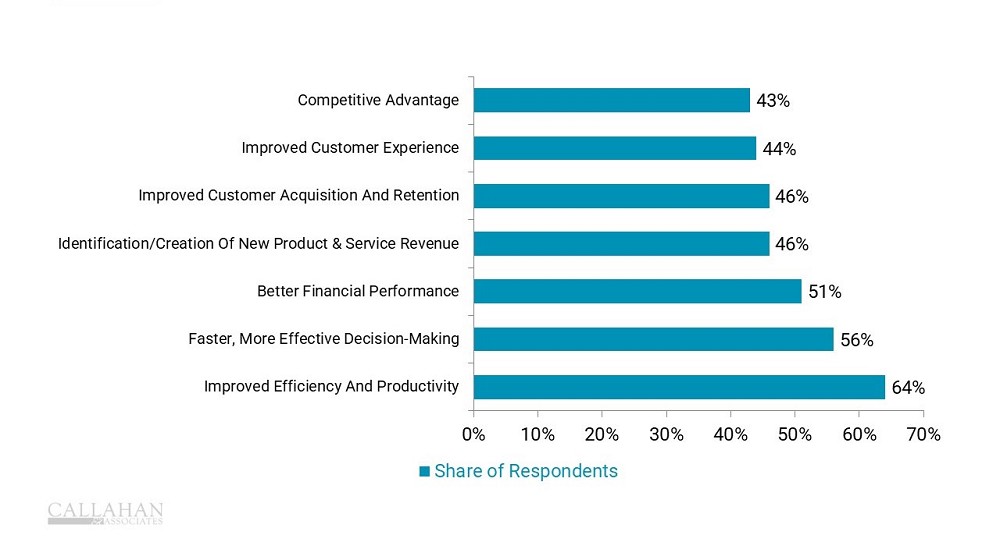

- Data analytics can streamline or automate processes, reducing the amount of labor required to complete them. According to a 2020 report from business intelligence company Microstrategy, only 3% of employees can find information they need when they need it. A full 60% spend hours or days looking for information. In that same report, 64% of companies that use data analytics said they’ve increased efficiency and productivity.

- Data analytics also can help identify patterns and offer new insights into members, markets, and operations, helping leaders make well-informed decisions rather than relying on intuition. In the Microstrategy report, 56% of respondents said data analytics improved decision-making.

- Interestingly, only 43% said data analytics provided a competitive advantage. Indeed, as data becomes more prolific and robust, data analytics will become less an advantage and more a necessary resource to remain on the playing field.

Are You Using Data To Fuel Strategic Decisions?

Callahan’s Peer Suite empowers credit union leaders to make informed, data-backed decisions without wrestling with complex, manual processes. Benchmark against the peer groups your choose, automate your KPIs every quarter, and kick-start your journey to success.

Request A Demo

Request A Demo