QUARTERLY PROVISION FOR LOAN AND LEASE LOSSES VS. COVERAGE RATIO

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.23

© Callahan & Associates | CreditUnions.com

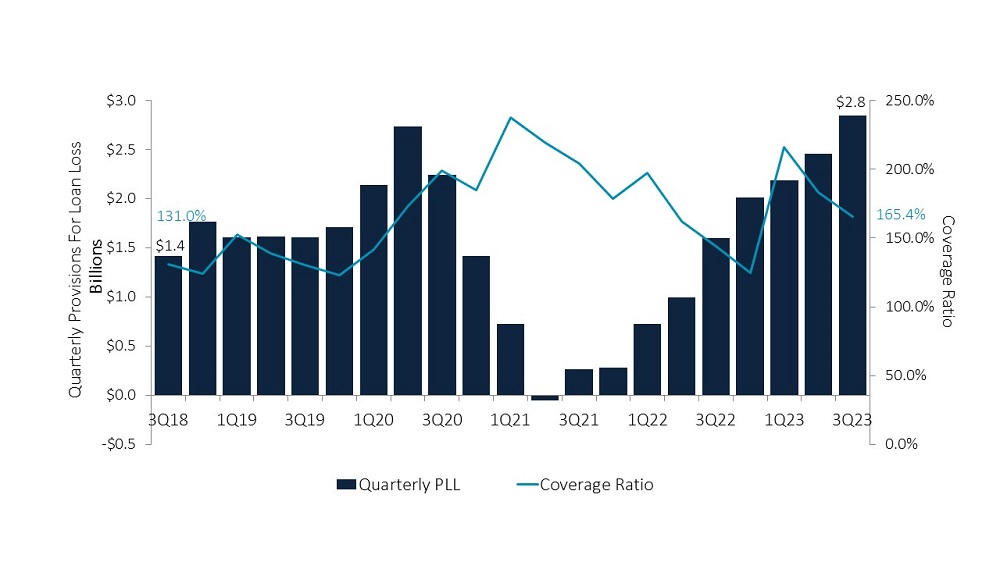

The coverage ratio, the allowance for loan losses to delinquent loans, measures how well a credit union can cover potential losses. Should all delinquent loans suddenly default, can a credit union’s reserves cover the loss?

- The PLL — provision for loan and lease losses — is money every credit union reserves every year to fund its allowance account. Quarterly PLL represents how much money a credit union adds to the allowance account every quarter.

- Delinquency at U.S. credit unions is on the rise. It hit 0.72% in the third quarter of 2023, according to FirstLook data from Callahan & Associates. This is up 19 basis points from one year ago and up 30 basis points from the record low reported in the first quarter of 2022. It is important to note that although delinquency has increased during the past year, it is returning to historic, pre-COVID norms.

- In response, credit unions are increasing provisions to bulk up allowance accounts. As of the third quarter, the industry allowance stood at $19.0 billion — a near all-time high. The only time the allowance account has surpassed $10 billion was when the pandemic hit in early 2020.

- Still, delinquency rates are increasing faster than allowance balances and the coverage ratio is falling. Coverage remains at a healthy 165.4%, or $1.65 reserved for each $1 delinquent, but if delinquency continues on its sharp upward trajectory, credit unions will need to increase provisions to properly fund the allowance account.