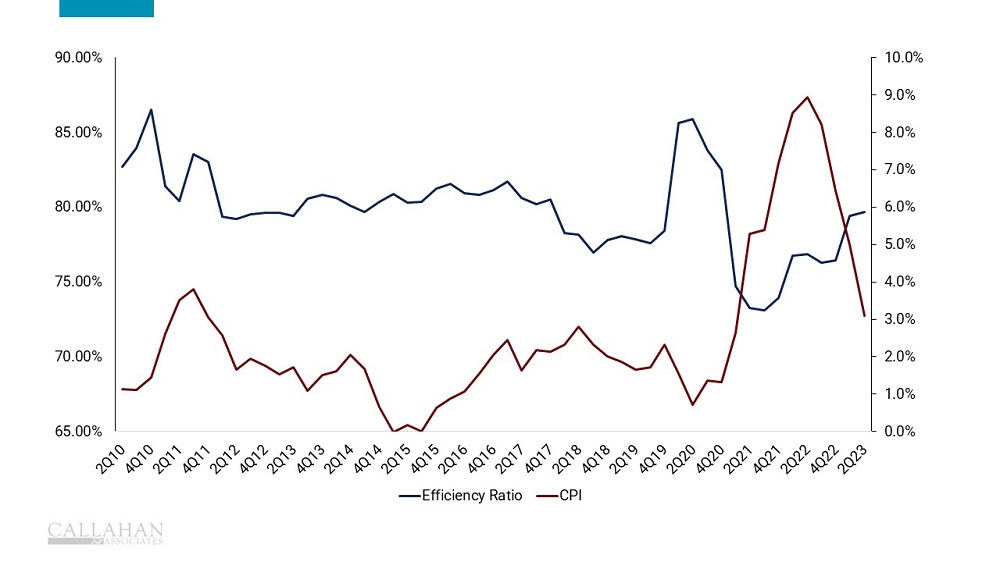

CONSUMER PRICE INDEX VS. CREDIT UNION EFFICIENCY RATIO

FOR U.S. CREDIT UNIONS | DATA AS OF 06.30.23

© Callahan & Associates | CreditUnions.com

Inflation has exceeded historical norms in recent quarters, and when inflation rises, the cost of doing business often rises with it. This presents an ideal time to review efficiency ratio trends. The efficiency ratio measures how much a credit union spends to earn $1 in income — the higher the number, the more money the organization spends. Given that inflation raises the costs of inputs, it would make sense if the efficiency ratio and inflation moved in lockstep; however, they have moved inversely in recent quarters.

- In the third quarter of 2022, the efficiency ratio slipped to a low of 73.1% just as inflation was starting to climb. But despite the fact inflation has cooled in recent quarters, the efficiency ratio has risen.

- Higher interest rates allowed credit unions to collect more interest income from new loans before having to accommodate a rise in interest expenses. An increase in investment yields, namely from Treasury securities, also provided a bump in income.

- But interest expenses eventually caught up. Credit unions started offering higher dividends on shares and faced higher borrowing interest rates, pushing up the cost of funds. In the third quarter of 2022, the average cost of funds was 0.46%; by the first quarter of 2023, it had more than doubled to 1.17%. Higher interest expenses have resulted in a higher efficiency ratio, which could persist if rates keep increasing.

Benchmark Your Efficiency With Ease

Learn how your institution’s performance stacks up against peers and the industry. Callahan’s Peer Benchmarking Suite makes it easy for credit union leaders in any role to measure performance, identify new opportunities, and support strategic plans.