As credit unions look ahead to 2025, they face a dynamic economic landscape shaped by shifts in the Federal Reserve’s interest rate policies, consumer sentiment, and inflation trends. The Fed’s recent rate cuts might influence how credit unions price loans and savings products, potentially narrowing their margins in the short term. Meanwhile, steady GDP growth and consumer spending could spur loan demand, while inflation remains a concern despite easing.

Understanding these factors — along with employment trends and the housing market — will be essential for credit unions to navigate the upcoming year and strategically position themselves for success.

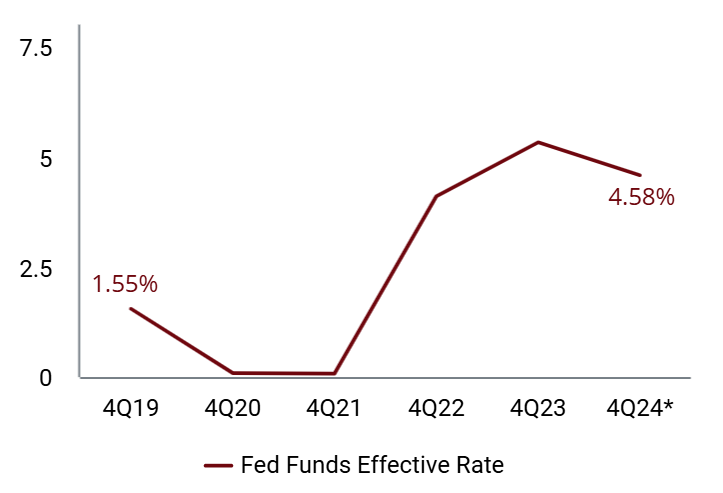

Fed Funds Rate

In the third quarter, the Federal Reserve lowered its benchmark interest rate from 5.25% to 4.75%. It did so again in the fourth quarter to 4.50%.

A further decline in interest rates in 2025 could push credit unions to price assets — such as loans and investments — lower than they have been while also lowering savings rates on term deposits. However, given the long-term nature of lending versus the shorter-term nature of a certificate, the net interest margin might at first move in the credit union’s favor.

Fed Funds Rate

FOR THE U.S. ECONOMY | DATA AS OF EARLY DECEMBER 2024

SOURCE: Board of Governors of the Federal Reserve System

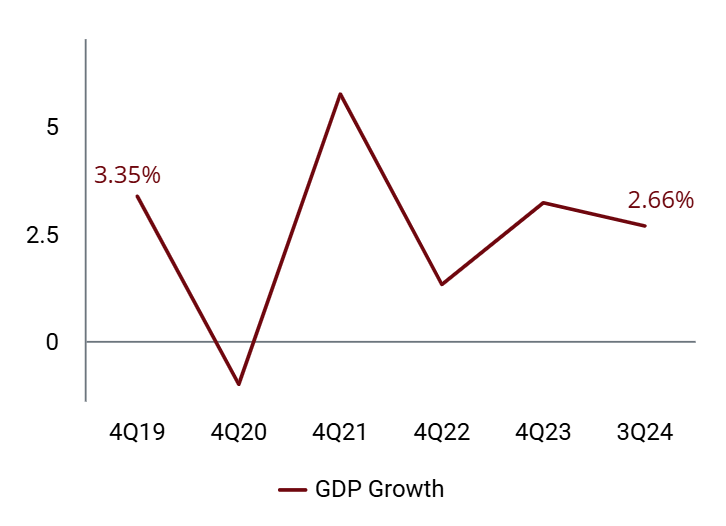

Gross Domestic Product

Driven by consumer spending, which collectively makes up two-thirds of the nation’s economic activity, GDP has steadily grown since the pandemic-era recession. If the economy continues to grow at this rate, loan demand could increase in the coming year.

According to the Bureau of Economic Analysis, consumer spending contributed 2.37 percentage points to annual GDP growth, whereas capital expenditure provided 0.21 and the government provided 0.83. Net exports reduced growth by 0.57 percentage points.

Gross Domestic Product

FOR THE U.S. ECONOMY

SOURCE: Bureau of Economy Analysis

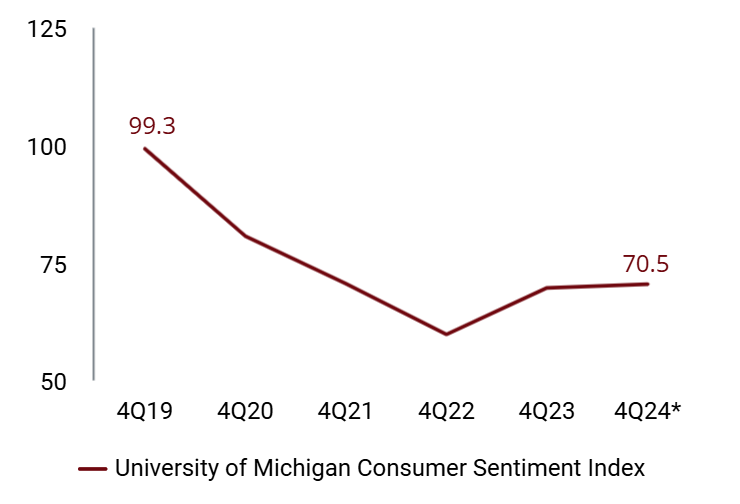

Consumer Sentiment

Consumer sentiment as measured by the University of Michigan remains relatively low. The baseline rate for the index is 100 but was 70.5 as of October 2024.

Residual impacts of inflation, high interest rates, and dissatisfaction with Washington have led consumers to feel generally uneasy about economic conditions. Although traditional indicators such as GDP growth and unemployment are healthy, many Americans — credit union members included — are not optimistic.

Consumer Sentiment

FOR THE U.S. ECONOMY | DATA AS OF OCTOBER 2024

SOURCE: University of Michigan Surveys of Consumers

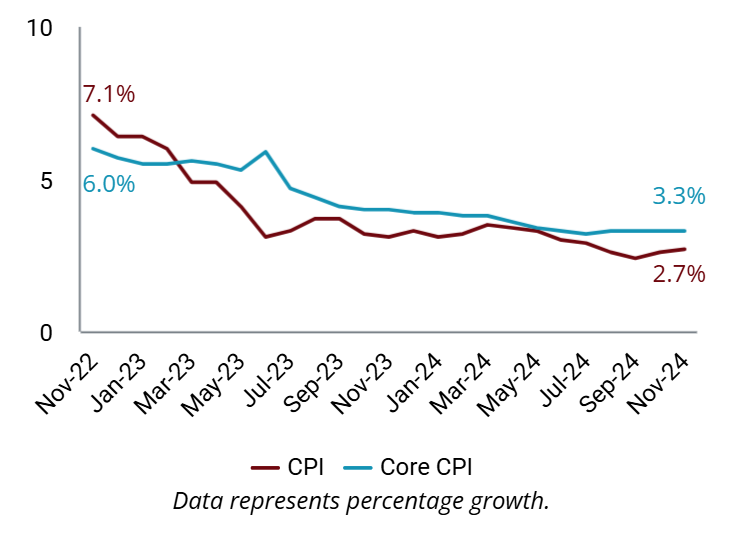

Inflation

Inflation is inching closer to historic norms; however, prices have not come back down and are unlikely to. Falling prices — or deflation — is an economic phenomenon that many economists consider even more detrimental than inflation.

Economists expect inflation to remain in the 2.5% range in the year ahead. That is lower than the elevated levels of the past few years but higher than the Federal Reserve target rate of 2.0%.

Inflation

FOR THE U.S. ECONOMY

SOURCE: U.S. Bureau of Labor Statistics

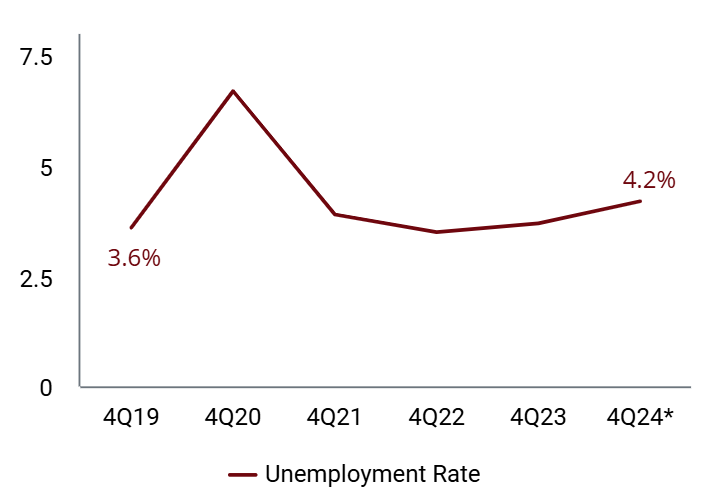

Unemployment

The unemployment rate ticked up to 4.2% in November. Many economists expect the economy to hover around this rate in 2025.

Economic growth, stable inflation, and steady payroll expansion continuing into the new year make it unlikely that unemployment will move higher. Meanwhile, the prime-age working rate, or the percentage of Americans between the ages 25 and 54 with a job, was a near-record-high of 80.4% in November.

Unemployment

FOR THE U.S. ECONOMY | DATA AS OF NOVEMBER 2024

SOURCE: U.S. Bureau of Labor Statistics

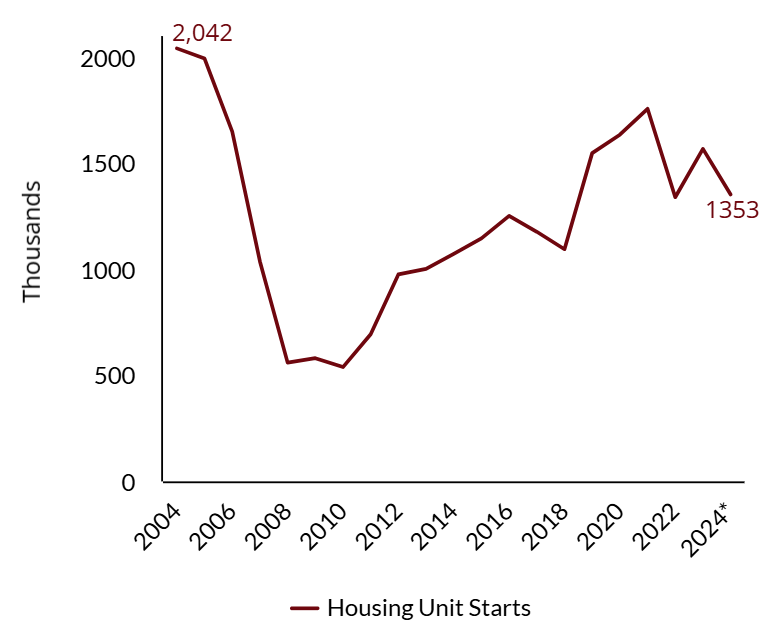

Home Building Starts

Home building slumped in 2014 after more than a decade of clawing back from the 2008 recession. Many home builders went out of business in the wake of that recession, which had ramifications across the broader economy. After all, home building creates jobs as well as inventory. When supply drops, it increases prices for would-be homeowners.

Increasing home builds has been a priority for federal, state, and local governments during the past few years. Striking the right balance presents significant consequences for the macroeconomy.

Home Building Starts

FOR THE U.S. ECONOMY

SOURCE: U.S. Department of Housing and Urban Development