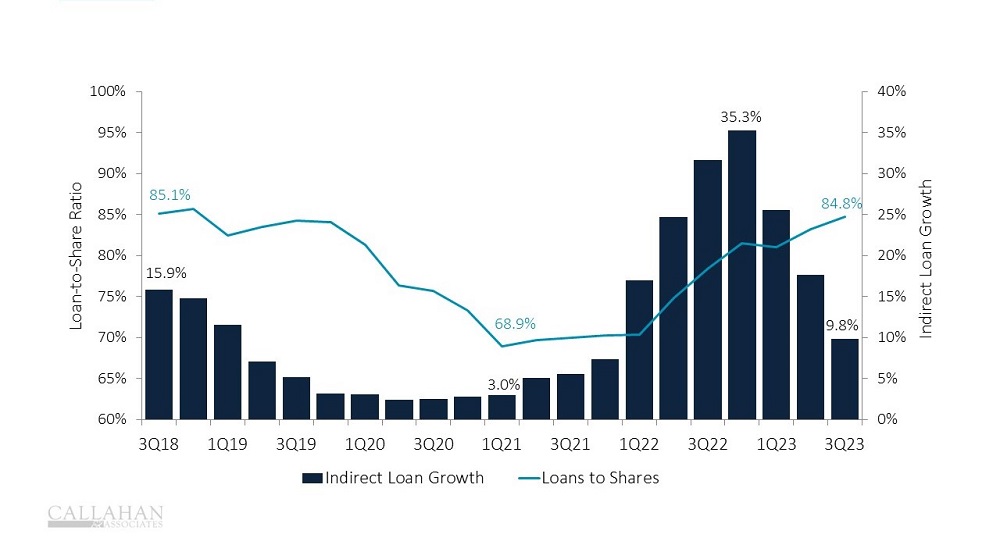

LOAN-TO-SHARE RATIO VS. INDIRECT LOAN GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 09.30.23

© Callahan & Associates | CreditUnions.com

- For the past two years, inflation has tightened member budgets and reduced their ability to save. Credit unions eked out an annual deposit growth of only 0.9% in the third quarter of 2023.

- Consequently, the industry’s loan-to-share ratio has grown to 84.8%, meaning credit unions lent approximately 85 cents for every dollar on deposit in the third quarter.

- Today’s dynamic is in direct opposition to the high-liquidity environment of 2021, when trillions of dollars in CARES Act funding drove the loan-to-share ratio to a record low 68.9%.

- To increase lending activity and bolster interest margins, many credit unions turned to indirect channels, where loan balances grew 35.3% across 2022.

- Today, however, the tight liquidity environment has pushed credit unions to retract from indirect lending once again.

How Does Your Liquidity Compare?

Use the latest industry data to determine how your credit union performs against others, uncover new areas of opportunity, and support your strategic initiatives. Callahan’s credit union advisors are ready to show you how — are you ready to see how you stack up?