AUTO LOAN GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.23

© Callahan & Associates | CreditUnions.com

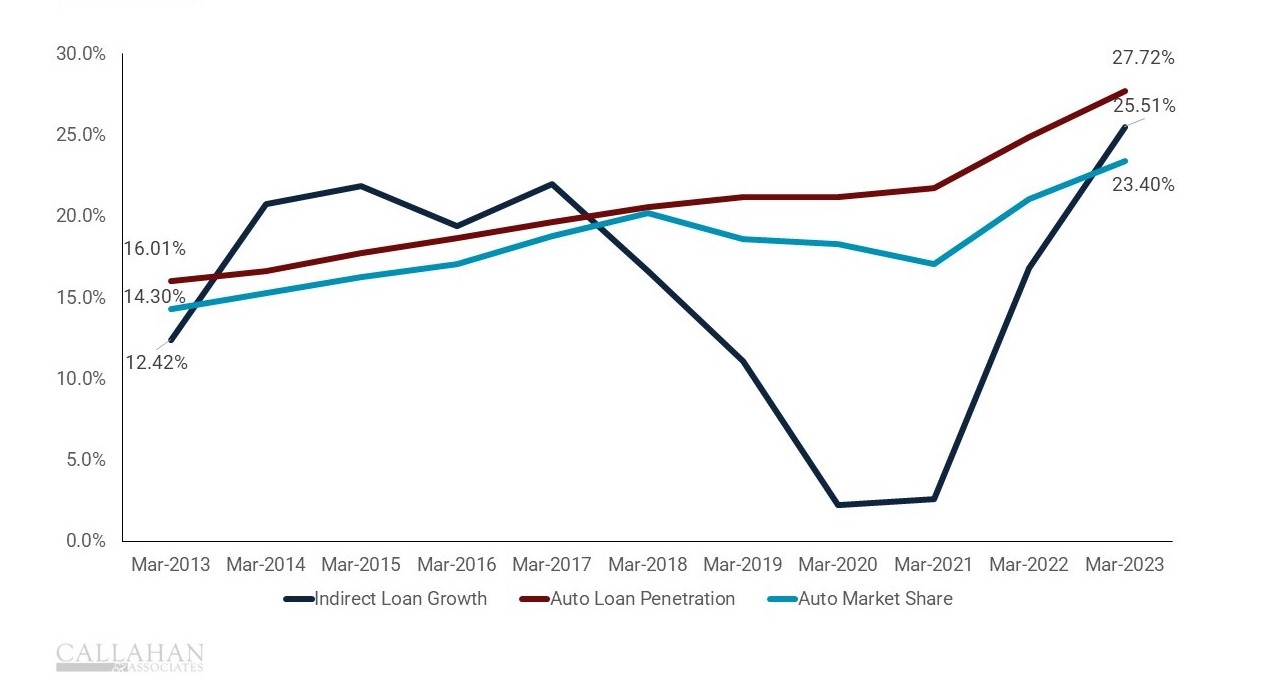

- As of March 31, 2023, indirect lending was up 25.5% year-over-year. Such loans primarily — but not exclusively — come from car dealerships.

- Thanks in part to the increase in indirect lending, credit union auto loan penetration as well as auto market share have both increased. In the past 10 years, auto loan penetration for credit unions has risen nearly 12 percentage points; market share has similarly jumped.

- Unfortunately, indirect lending presents problems as well as opportunity. It can be a reliable way to source loans and generate immediate income; however, many indirect members do not stick around. Also, acquiring and servicing those loans and members can be costly — requiring much more than the $465 the average credit union spends on operating expenses per member.

- Given the tightening liquidity environment and the fact the loan-to-share ratio has risen to 80.9%, credit unions might soon need to take a step back from indirect lending. But what does that mean for auto loan penetration and auto market share? Most Americans rely on a car for transportation, and autos are expensive items for which many owners need financing. That is where credit unions can make a difference in their communities. Offering competitive rates on car loans can help keep auto penetration rates steady.

Benchmark Your Auto Performance With Ease

Learn how your institution’s auto performance stacks up against peers and the industry. Callahan’s Peer Benchmarking Suite makes it easy for credit union leaders in any role to measure performance, identify new opportunities, and support strategic plans.

Request A Demo Today