CHARTER CHANGES SINCE 2019

FOR U.S. CREDIT UNIONS

© Callahan & Associates | CreditUnions.com

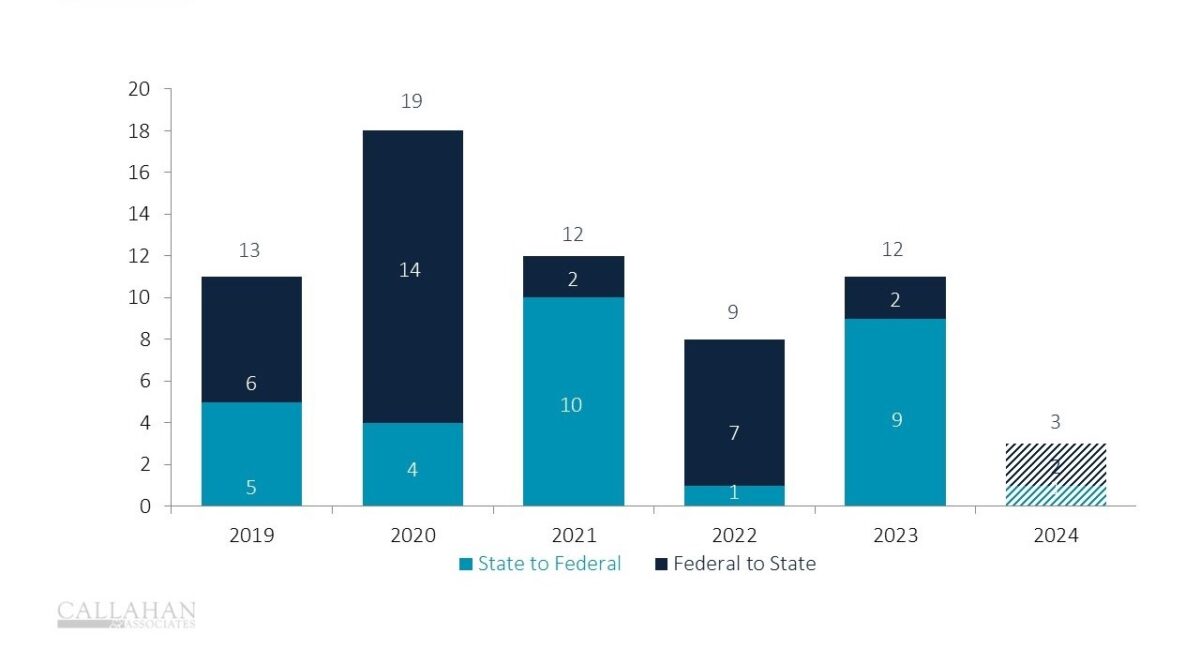

- Selecting a federal or state charter doesn’t just impact how a credit union is regulated — it plays a major role in that institution’s expansion options. Sixty-eight credit unions have converted their charter since 2019, a nearly even split between moving from federal to state-chartered and vice versa.

- One of the major factors driving state-to-federal conversions is the ability to open new branches across state lines, which is much more difficult under a state charter. The Credit Union Membership Access Act of the late 1990s also advanced federal charters by making it easier for credit unions to incorporate multiple common bonds into their fields of membership, casting a wider net for membership growth.

- That’s not to say there aren’t perks to converting from federal to state oversight. In early 2021, for example, Michigan’s TRUE Community Credit Union ($890.7M, Jackson, MI) converted from a federal to a state charter following a merger and rebrand in order to expand its field of membership statewide.

- Although some institutions prefer dealing with the National Credit Union Administration, some institutions feel state-level policies are favorable to their goals. It all comes down to which regulator’s policies are more likely to help each credit union advance its own interests.

- State-chartered shops tend to be smaller than their federal counterparts. The average state charter holds $647 million in assets compared to $1.2 billion for federal charters, according to data from Callahan & Associates. Five-year averages show relatively equal performance between the two when it comes to deposit growth and ROA. State charters, however, have performed slightly better when it comes to asset growth, whereas FCUs have reported better membership growth — both by approximately 65 basis points.

- Regardless of growth, federal charters still make up the lion’s share of the industry. As of the first quarter this year, 2,862 credit unions held a federal charter while just 1,808 were state chartered, a ratio not dramatically different from a decade ago.

- One factor plays a role in federal charters’ dominance from a numbers perspective: At least five states, as well as the District of Columbia, do not have state charters, meaning all credit unions headquartered in those boundaries are federally chartered.