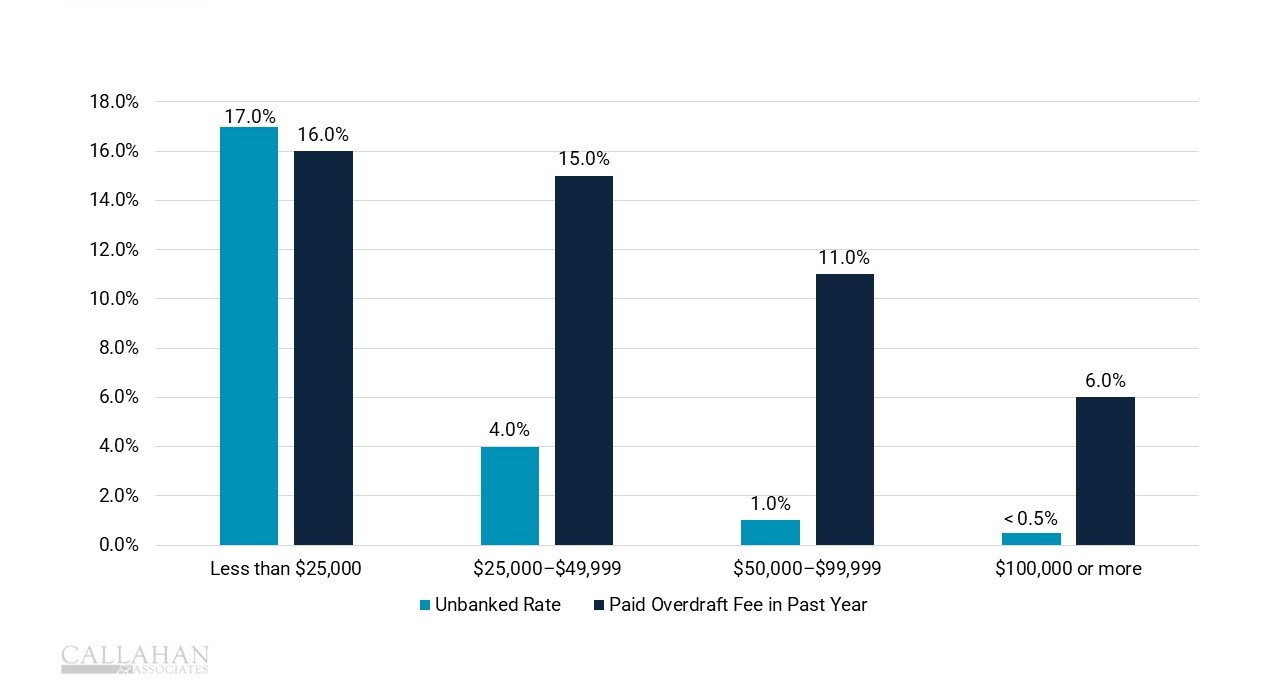

UNBANKED RATE AND OVERDRAFT FEES BY INCOME

FOR FED SURVEY RESPONDENTS | DATA COLLECTED 10.21.22-11.01.22

- Seventeen percent of individuals who earn less than $25,000 annually are unbanked, according to data gathered from the Fed’s Survey of Household Economics and Decisionmaking (SHED). Sixteen percent of this group paid an overdraft fee in the 12 months prior to the survey. By contrast, fewer than 0.5% of those who make more than $100,000 are unbanked, and only 6% paid an overdraft fee.

- Age, ethnicity, and disability play a significant role in economic wellbeing. Younger individuals are more likely to be unbanked or overdrafted. African Americans and Latinos also are more likely to be unbanked or overdrafted. Lastly, those with disabilities are twice as likely as non-disabled Americans to report being unbanked.

- Banking deserts, areas that lack a nearby banking facility, also put economic wellbeing at risk. The distances that constitute a banking desert vary — two miles for urban areas, five miles for suburban areas, and 10 miles for rural areas — but according to 2023 data released by FedCommunities, banking deserts were present in 4% of U.S. census tracts with another 4% at risk if branches close. Among these, 66% are suburban, 14% rural, and 20% urban, with 39% lacking home internet. Additionally, the majority or residents in 15% of deserts and 17% of at-risk areas are African American, Hispanic, or Indigenous residents.

- Marginalized communities remain largely unbanked or underserved. Proactive steps taken by credit unions — such as providing comprehensive services and actively promoting financial education — could bolster financial inclusivity and enhance the financial wellbeing of these communities.