QUARTERLY SHARE GROWTH

FOR U.S. CREDIT UNIONS | DATA AS OF 12.31.22

© CALLAHAN & ASSOCIATES | CREDITUNIONS.COM

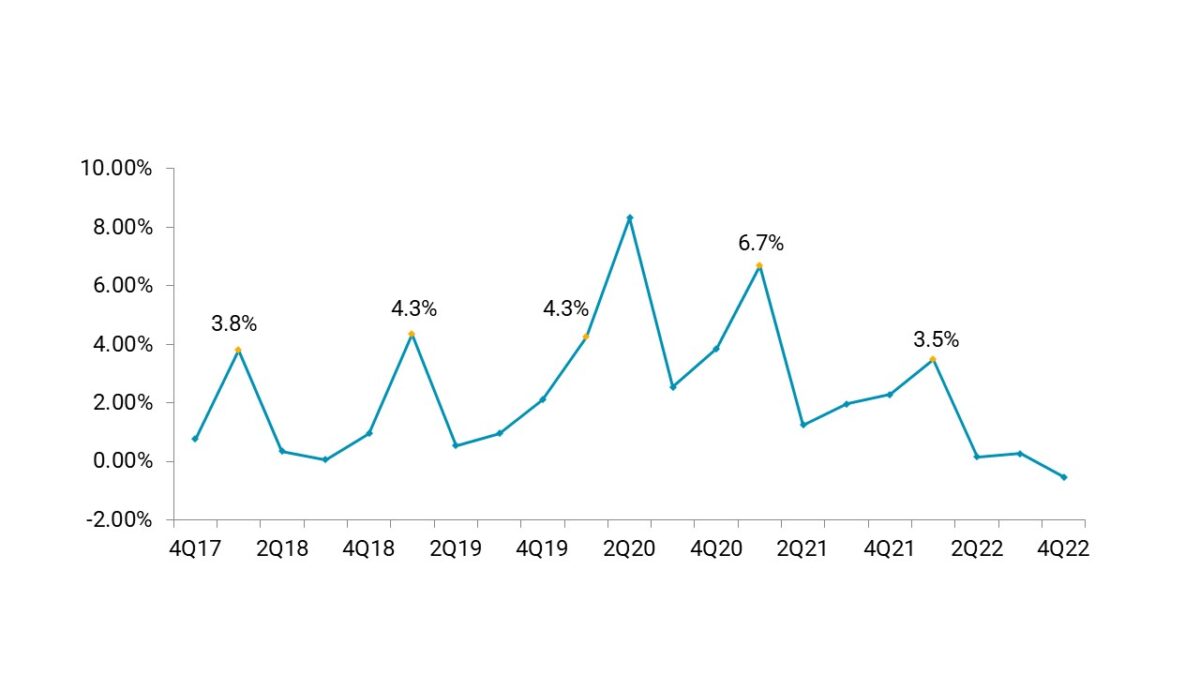

- Members typically deposit their tax refunds in the first quarter of the year, leading to the quarter being the best for credit union deposit growth. With the exception of 2020, quarterly share growth was the highest in the first quarter of each of the past five years.

- This year, these deposits are especially welcome. Share balances declined 0.5% quarter-over-quarter in the fourth quarter of 2022 while loan balances expanded 3.3%. Tightening liquidity means many credit unions need new deposits to keep funding loans.

- Some credit unions have raised rates on share certificates to attract funds; however, if historical patterns continue, deposits from first quarter tax refunds might naturally alleviate some liquidity concerns. Now, credit unions must evaluate for themselves how changes in deposit rates will influence the deposit behavior of their membership.

How Do You Compare?

Use industry data to determine how your credit union performs against others, uncover new areas of opportunity, and support your strategic initiatives. Callahan’s credit union advisors are ready to show you how — are you ready to see how you stack up?

Schedule Your Peer Demo

Schedule Your Peer Demo