Fall strategic planning is in full swing. This year, the big question leaders should be asking isn’t whether they have a road map, it’s how they’ll weather the storms the road map doesn’t cover.

Uncertainty around tariffs, taxation, technology, and more have leaders grappling with a wide range of “what ifs” and investing more time in scenario planning — not just to prepare for disruption but to build organizational agility.

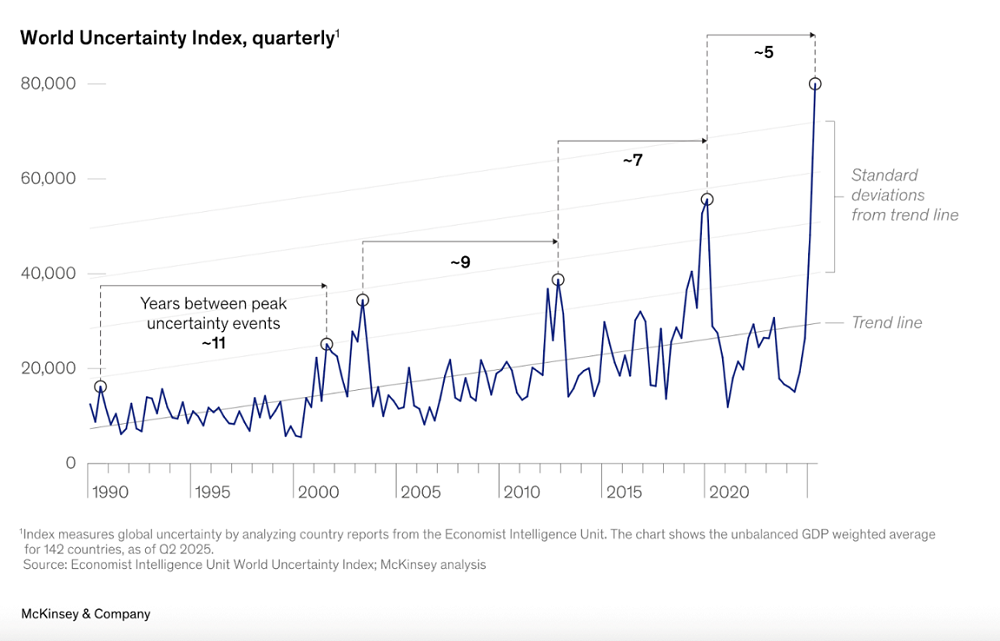

UNCERTAINTY IS ON THE RISE

FOR 142 COUNTRIES | DATA AS OF 06.30.25

SOURCE: World Uncertainty Index

Based on the CreditUnions.com article “Build Resilience, Not Road Maps,” by Jay Johnson, chief collaboration officer at Callahan & Associates, the following quiz helps leaders assess how well their credit union is embracing adaptability and building resiliency for years to come.

Scoring Guide

- Mostly “Yes” — You’re on the right track. Your credit union is building resilience, not just following a road map.

- Mixed responses — You likely have some resilience practices but could strengthen areas like scenario testing or iterative adjustments.

- Mostly “No” — You might be overly reliant on fixed strategic plans. Time to pivot toward flexibility, dynamic thinking, and a resilience-first mindset.

- Are you prioritizing flexibility over fixed planning?

Do you treat your strategic plan as a living document that evolves in response to change? Are you ready to shift tactics when emerging risks appear? - Are employees empowered to act in the face of change?

Do your teams understand how their work supports the strategy? Do they feel empowered to make decisions during uncertainty? Do they feel responsible for adapting systems and processes when unexpected situations arise? - Are you helping members build resilience, too?

Do you support members in building their own resilience (e.g., financial education, crisis tools), not just selling products? Does your strategic plan include specific efforts to improve member financial wellbeing, especially for vulnerable populations? - Is your technology integrated to enhance the member journey?

Are your digital tools — from core systems to chatbots — working together to create a seamless, human-centered experience? Technology shouldn’t be flashy for its own sake; it has an important role to play in unifying touchpoints, anticipating member needs, and delivering value in real time. - Are you building solutions with your community?

Do you engage local leaders and organizations to understand shared challenges? Is your credit union positioned as a collaborator in creating solutions that improve financial health and long-term community prosperity? - Are you telling the story of your credit union?

Do you consistently communicate your strategic goals and progress toward them through clear, human stories your staff and members can relate to? Strategy without storytelling is invisible. Sharing your “why” builds understanding, alignment, and momentum across the organization.

Having a plan is table stakes for 2026. A truly resilient credit union has the people, mindset, and processes to adapt it.

Is Your Strategic Plan Built To Bend, Not Break? Uncertainty is rising — and long-term road maps alone won’t cut it. Strategic planning is now as much about learning to adapt as planning for the future. That kind of agility requires time and resources all year long, not just in the fall. Let Callahan & Associates help you explore how resilient organizations empower teams, evolve their strategies, and support members through change. Start a conversation today.