Read all 10 or skip to the section you want to read.

NO. 1: HONOR FLIGHTS TO THANK THEM FOR THEIR SERVICE

NO. 2: (NOT SO) RANDOM ACTS OF KINDNESS

NO. 3: A FOUNDATION OF GIVING

NO. 4: CONNEX CONNECTS WITH COMMUNITY

NO. 5: MSUFCU PAYS IT FORWARD

NO. 6: JUST FOR THE CHILDREN

NO. 7: PFCU JUMPS THE SHARK WITH SPARK

NO. 8: A BED FOR EVERY CHILD

NO. 9: PUCKER UP, PAL

NO. 10: CHECK, CHECK, AND CHECK

The credit union movement was birthed around the notion of providing a hand up to people of modest means. It remains animated by this cooperative spirit today.

Throughout the year, credit unions work with communities, business partners, and even other credit unions to provide more than mere fairly priced, accessible financial services. They devote time, money, effort, and resources to raising funds and awareness for causes that are important to members, communities, and more.

Sure, they present checks and smile for photo ops, but they also regularly go the extra mile and make the extra effort when the cameras are no longer pointed their way. From escorting aging wars heroes on a flight of memory to building beds for kids in need, surprising coffee shop patrons with a free cup of joe to providing shelter for families, here are credit union stories from the past year that illustrate cooperative principles in practice.

Honor Flights To Thank Them For Their Service

America First staffers Matt Dice and Deborah Murphy pose with Ralph Reggans and Richard Wellington. The credit union employees were escorting the 84-year-old veterans on an Honor Flight from Las Vegas.

Two employees from America First Credit Union ($11.5B, Ogden, UT) seized the opportunity to serve as guardians during a recent Honor Flight from McCarran International Airport in Las Vegas, NV, to the war memorials in Washington, DC.

America First participated through the Honor Flights of Southern Nevada program, part of a 15-year-old nationwide effort that provides free trips to veterans of World War II, Korea, and Vietnam.

It’s a true honor and privilege, Matt Dice, the branch manager who escorted veteran Ralph Reggans, said in a press release. Witnessing the group’s emotions at the veterans memorials is moving.

(Not So) Random Acts Of Kindness

Mortgage originator Amanda Prew brought lunch to the Bridgewater (MA) Police Department as part of Bridgewater Credit Union’s random acts of kindness week.

After weeks of brainstorming and planning, approximately 40 employees of Merrimack Valley Credit Union ($1.1B, Lawrence, MA) and the newly merged Bridgewater Credit Union spent $6,000 spreading goodwill and doing good deeds for a random acts of kindness week earlier this month.

Along with providing lunch to several local police and fire departments, the credit union staffers picked up tabs for breakfast, groceries, and student lunches and provided gifts and sweets to local day cares, schools, and senior living facilities.

We aim to give as much back to the communities as we gain, MVCU president and CEO John Howard told South Coast Today. This is just one of the many ways we do just that.

The new random acts tradition began last year at Bridgewater Credit Union, which now operates as a division of Merrimack Valley Credit Union after a merger completed earlier this year.

A Foundation Of Giving

Coastal Federal Credit Union president and CEO Chuck Purvis speaks at the North Carolina credit union’s fourth annual Power of Sharing gala in May.

Coastal Federal Credit Union ($3.3B, Raleigh, NC) is among the growing number of credit unions using a foundation to create a larger pool of resources for charitable activities. In May, the Research Triangle institution used its fourth annual Power of Sharing gala to highlight the work of 13 area non-profits.

The Coastal Credit Union Foundation and its business partners AT&T, BASF, Blue Cross Blue Shield of NC, Fidelity Investments, and Lenovo together donated more than $1.5 million to organizations serving in the areas of education, minority opportunities, children’s activities, veterans affairs, and more.

Callahan’s Credit Union Guide To Foundations

Credit unions interested in standing up their own foundations need look no further than this Callahan Collection* from Callahan & Associates. It’s got credit union insights on what it takes to launch, lead, and fund a credit union foundation.

Read More

*Callahan Collections are exclusive content on CreditUnions.com and require a paid account.

The foundation created the Power of Sharing program in 2016 to demonstrate a commitment to bettering the community through collaborative funding and to recognize the impact that local non-profit organizations make throughout the community.

Connex Connects With Community

At the credit union’s flagship North Haven (CT) branch, Connex Credit Union employees Gina Stone (left), MaryAnn Apuzzo (middle right) and JoAnna Grodkiewicz (far right) join marketing director Louise Nestor (second from left) in welcoming donations for families in need.

Connex Credit Union ($694.8M, North Haven, CT) is giving back by taking in items for families in need.

Through its ConnexCares philanthropic program, the Connecticut cooperative is participating with the New Reach non-profit group there to adopt a single mother and her two young children.

The family was safely removed from an unsafe domestic situation and now will receive assistance to re-establish a new home with basic household items and toys the credit union is collecting at its branches through Dec. 12.

At Connex, we feel it’s tremendously important for our employees and members to pause and remember that while the holiday season may be a joyous time of year for them, it can often be a great source of stress and difficulty for struggling families, Carl Casper, the credit union’s executive vice president and chief operating officer, said in a press release. Each year, we are astounded by, and so thankful for, the support we receive and look forward to another prosperous year of making the holidays a bit merrier for a family in need.

MSUFCU Pays It Forward

MSUFCU staffers warmed up a cold day in western Michigan by paying for gas at a Grand Rapids station.

Michigan State University Federal Credit Union ($4.5B, East Lansing, MI) celebrated its 82nd anniversary this year by spending a week paying it forward.

Now the world’s largest university-sponsored credit union, MSUFCU celebrates its anniversary on Nov. 15 and spent that week Pay IT Forward Week sharing goodwill across eight communities and two college campuses where it has branches.

It takes more than superb financial performance to run a truly successful credit union. Check out strategies and stories of credit unions making a positive impact on their members and in their communities in the Callahan Collection* Credit Unions And Their Community Impact.

*Callahan Collections are exclusive content on CreditUnions.com and require a paid account.

Employees spent $8,200 paying for surprised recipients coffee, tea, gas, and lunch at a variety of businesses. The credit union also made special donations of $500 each to Alliance LGBTQ in Ferndale and Relay for Life Eaton County as well as to a provider of rides for children with special needs and a Lansing resident who converts donated wedding dresses into handmade burial gowns for infants who pass at Sparrow Hospital’s NICU.

We look forward to sharing kindness in our communities by handing out gift cards, paying for meals, and donating to area charities selected by our employees, Whitney Anderson-Harrell, the credit union’s chief community development officer, said in a press release. Pay It Forward is an important and impactful credit union tradition.

Just For The Children

Orange County’s Credit Union participates in the 2019 CHOC Walk in the Park at Disneyland.

Credit unions across the country have been major supporters of children’s hospitals for years. That includes Orange County’s Credit Union ($1.7B, Santa Ana, CA), whose employees and members raised more than $44,000 for Children’s Hospital of Orange County and got to spend the day at Disneyland.

More than 200 members and staff participated in the CHOC Walk in the Park on Aug. 11, joining more than 14,000 others strolling a course that included Disneyland and Disney California Adventure parks.

Orange County’s has been participating in the CHOC fundraiser for the past 10 years. This year, the credit union exceeded its $35,000 goal by $9,000 through a combination of shred days, raffles, give-back days at local restaurants, and other fundraisers.

The credit union and its associates are beyond grateful for the exceptional services support that CHOC provides local children and their families, Stefanie Rupp, the Southern California credit union’s community development manager, said in a press release. We’re proud to show them our continuing support.

PFCU Jumps The Shark With Spark

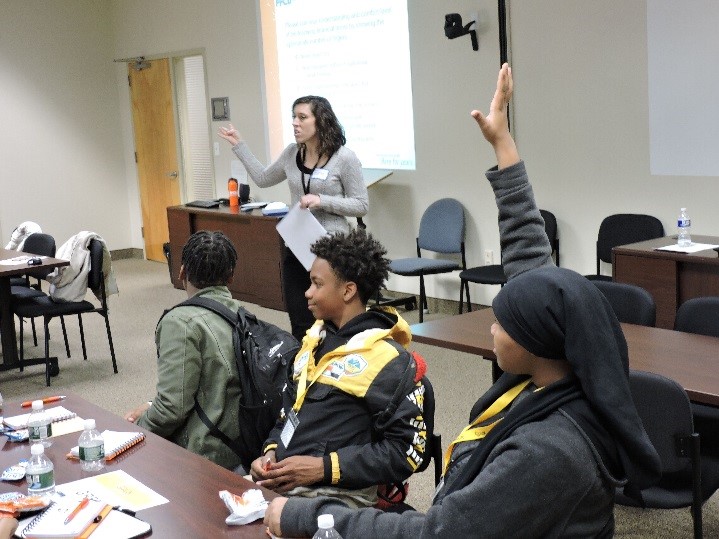

Erin Ellis, accredited financial counselor at PFCU, guides a financial literacy workshop for middle school students.

Philadelphia Federal Credit Union ($1.2B, Philadelphia, PA) gave the gift of learning by putting on a workshop with students at Mary McLeod Bethune School in the City of Brotherly Love.

PFCU partnered with Spark Business Academy on the two-hour program, which focused on responsible decision-making through the lens of financial literacy. Erin Ellis, an accredited financial counselor, led the hands-on activities and taught the students terms such as risk, alternatives, consequence, and opportunity cost.

Part of our mission at PFCU is to ensure the next generation is equipped and prepared to work in Philadelphia and support the economic future of our city, Ellis said. By reaching kids when they’re young 13 or 14 years old we can lay a solid foundation of financial literacy that they’ll build on for years to come.

A Bed For Every Child

Aubrey Catalfomo, a banking associate at St. Anne’s Credit Union, measures the wood to begin building a bed for a child in need.

St. Anne’s Credit Union ($985.4M, Fall River, MA) hosted a coalition of credit unions from the Southern Massachusetts Chapter of the Cooperative Credit Union Association in an effort to ensure children in need have a bed.

Nearly 80 volunteers from 15 credit unions spent a day in October assembling 40 beds for the A Bed for Every Child project of the Massachusetts Coalition for the Homeless. Catholic Social Services distributes the beds in and around Fall River.

The idea of so many children throughout Massachusetts not having their own bed is undreamed-of, CCUA president and CEO Ron McLean told BusinessWest. We believe in the good work that the coalition accomplishes and are happy to do our part in helping children get a good night’ sleep to prepare them for a better future.

Also participating were Goldmark Federal Credit Union, New Bedford Credit Union, PCT Federal Credit Union, Santo Christo Federal Credit Union, Southern Mass Credit Union, St. Anthony of Padua Federal Credit Union, and Taunton Federal Credit Union.

The bed building is a first, but the state’s credit unions have provided more than $2 million in donations as well as blankets, toys, and books to the coalition in the past 10 years.

Pucker Up, Pal

David Miller, business education teacher at Bensalem (PA) High School, puckers up to kiss Raines, the pot-bellied pig at TruMark Financial’s ninth-annual Kiss A Pig Financial Literacy fundraiser.

TruMark Financial Credit Union ($2.3B, Fort Washington, PA) has been paying people to pucker up for porkers for the past nine years.

The suburban Philadelphia cooperative held its annual Kiss-A-Pig Financial Literacy Fundraiser on Oct. 2 at the Abington Art Center in Jenkintown, PA. Local TV and radio personalities emceed the annual soiree, which raised more than $35,000 this year to support financial literacy programs in area schools.

The credit union has donated more than $325,000 in grants since the program began nine years ago. Grant recipients have used the money to buy resources such as calculators, computer software, and textbooks to help teach the value and importance of responsible money management.

Check, Check, And Check

Staff members at Wright-Patt Credit Union presented $240,000 to three Dayton-area non-profits: St. Vincent de Paul, Homefull, and Artemis Domestic Violence Center.

When it comes to gifting, the fundraisers at Wright-Patt Credit Union ($4.9B, Beavercreek, OH) know you can’t go wrong with the gift of cash.

The big Ohio credit union recently presented $240,000 to three worthy causes through its Sunshine Community Fund. This year’s Sunshine Community Champions are St. Vincent de Paul, an organization for the homeless and impoverished; Homefull, a provider of services to the homeless; and the Artemis Center, a domestic violence resource agency.

The credit union’s employees, vendors, and other business partners have raised more than $900,000 for the Sunshine Community Fund in the past six years, according to Tracy Szarzi-Fors, Wright-Patt’s vice president of marketing and business development.

The Sunshine Community Fund embodies the credit union’s mission of helping people through life, she told the Dayton Business Journal.

The fund got its name from the Sunshine Fund, which began when government workers at what is now Wright-Patterson Air Force Base began contributing 25 cents every pay period to help an ill co-worker. Employees kept the money in a shoebox, and as the tradition continued, it morphed into the creation of what is now Wright-Patt Credit Union in 1932. An employee-led committee selected this year’s beneficiaries after hearing presentations from applicants.

For consumers feeling a financial pinch, the holidays can be a time of stress, anxiety, and worry. Help For The Holidays is a Callahan Collection* dedicated to those credit unions that have stepped up with products and education to help members stretch and stick to their budgets.

*Callahan Collections are exclusive content on CreditUnions.com and require a paid account.