Whether in the branch, over the phone, or via email, members of Northwest Community Credit Union ($1.4B, Eugene, OR) have been able to scheduleappointments for years. But when the coronavirus forced the credit union to move to an appointment-only lobby operation in March of 2020, the Beaver State cooperative made it a priority to roll out an online scheduling tool that was more useful formembers and the credit union.

CU QUICK FACTS

Northwest Community Credit Union

Data as of 09.30.20

HQ: Eugene, OR

ASSETS: $1.4B

MEMBERS:38,568

BRANCHES: 15

12-MO SHARE GROWTH: 18.1%

12-MO LOAN GROWTH: -2.0%

ROA: 0.85%

In just two months, Northwest Meets was live. Not only does the tool provide ease of access for members to schedule their own appointments at a time convenient for them, but it also helps the credit union better manage staffing needs and branch traffic.

Our in-house developers worked on a solution that would fit our members’ needs, says Johnathan Boggs,regional manager at Northwest Community Credit Union.From the credit union’s perspective, thisis a great tool for providing the best member service possible. It ensures we have a specialist available to help the member with their needs.

Here, Boggs talks about the nuts and bolts of how the system works, response and adoption, and the lessons Northwest Community learned while developing this in-house tool.

How long has Northwest Community Credit Union offered appointment scheduling? What benefits does it offer, and have those benefits changed since COVID?

Johnathan Boggs, Regional Manager, Northwest Community Credit Union

Johnathan Boggs:For years we’ve made banking easier for members by providing appointments. Members could make an appointment in the branch, over the phone, or via email for times that were convenient for them.

In March 2020, our lobbies were open by appointment only, and we needed a way to control the number of members in the branch at one time. This made an online scheduling tool a priority for us. We had a temporary solution our marketing team put togetherin hours. It was clunky and required a lot of work on the back end. From there, our in-house developers worked on a solution that would fit our members’ needs.

By May, we had our new Northwest Meets scheduling tool live. Our in-house developers created the tool, which we run in the cloud using Microsoft Azure.

Talk more about your system. What’s it like from the members’ point of view? What is the back-end user experience?

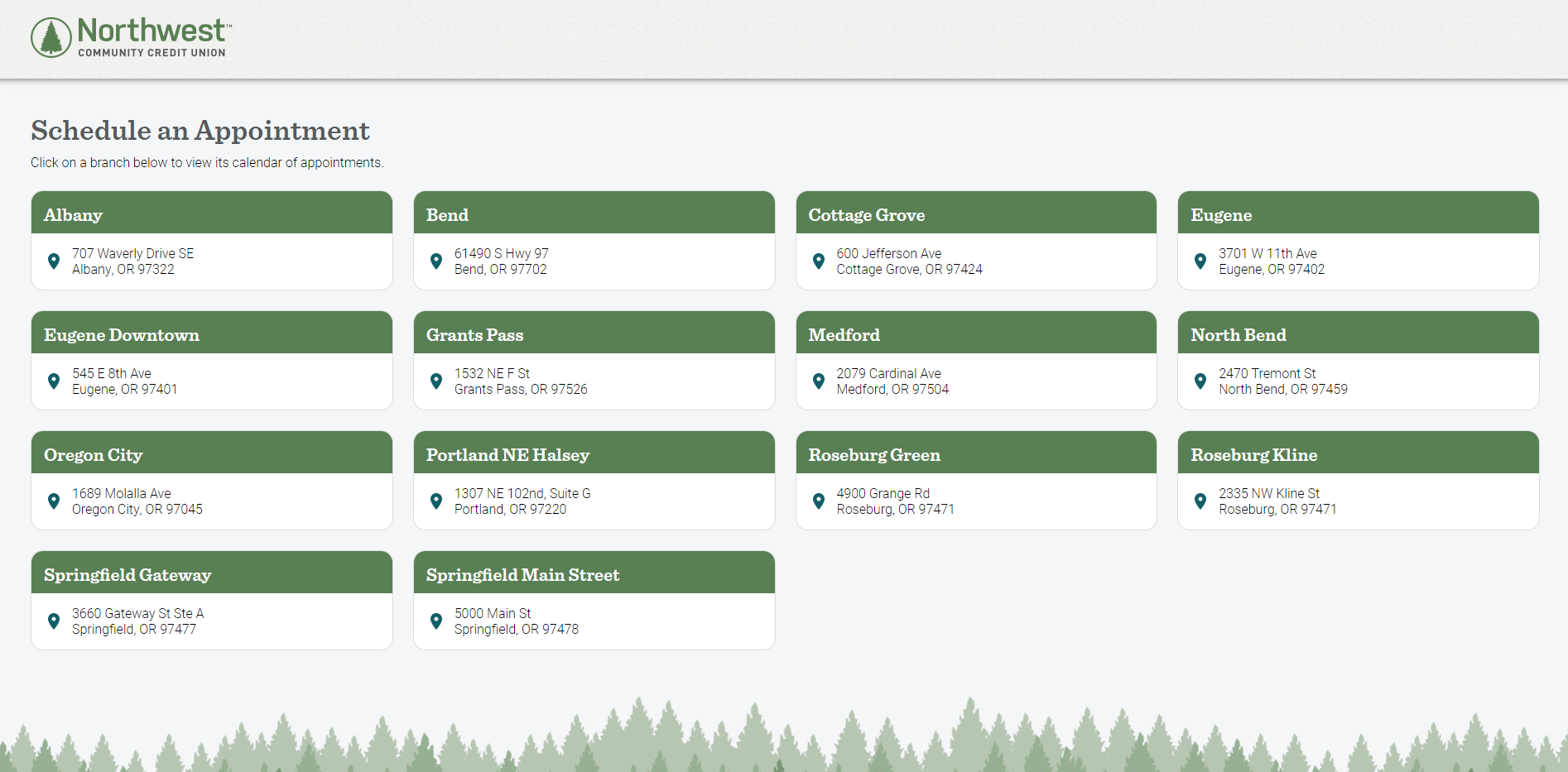

JB: Northwest Meets is an easy way for members to schedule an appointment online, over the phone, or at the branch. They can directly access our branch scheduler at meet.nwcu.com. There, theychoose a branch, select a date and time slot, and enter basic information. We request their name, email address, phone number, and the appointment reason. Member ID is optional. Once they reserve, we send a confirmation email to the member and thebranch. We also send an email reminder the day before appointment.

See it in action! Visit meet.nwcu.com to see Northwest Community’s appointment scheduling tool firsthand.

From the credit union’s perspective, this is a great tool for providing the best member service possible. It ensures we have a specialist available to help the member with their needs. It also tracks how many appointments we set, how many cancelswe have, what members make appointments for, and branch traffic.

Each branch manages its own calendars, and many have recurring templates that copy open slots from week to week. We create half-hour slots with a 15-minute buffer in case appointments run over. We don’t open slots for all available member servicespecialists because we allow for walk-ins, too. If all member service specialists are helping members, we have walk-ins schedule an appointment or wait for the next available specialist.

If an appointment runs over its allotted time, including the 15-minute buffer, and the other member service specialists are with walk-ins, then managers or universal employees will help members who have appointments.

What communications did you use to support the roll out the scheduling?

JB:We communicated our rollout by email, branch signage, telephone hold messages, website, online banking messages, and word-of-mouth.

How did members react to the new tool? What about your staff?

JB:There was a little bit of a learning curve for members as they were used to walking in without an appointment. Now that members have gotten used to it, they like that they get to walk in and be helped.Employees also likeit because they get to plan their day and know what they need to be ready for it.

The great thing about this tool being developed by our employees is that we can customize and keep adjusting to member needs. Members give us feedback, and our developers jump right on it to make our tool better.

NWCU Meets has exceeded our expectations. Our developers and members have made this process such a huge success. The great thing about this tool being developed by our employees is that we can customize and keep adjusting to member needs.Membersgive us feedback, and our developers jump right on it to make our tool better.

Do you have adoption data you can share?

JB:From June to October, we had more than 12,000 appointments scheduled. This is amazing, especially when the old method of scheduling was so manual. Of those 12,000-plus appointments scheduled, approximately 1,500 were canceled.It probably would have been impossible to keep up with that kind of demand the old way.

What lessons did you learn while rolling out Northwest Meets? What advice do you have for credit unions considering adding this as an offering?

JB:With COVID, we had an immediate need, and we were able to produce something quickly with the resources we had to use temporarily.This was needed, and we would do it again. However, it would have been nice if we had alreadystarted the process pre-COVID. The short timeline put pressure on our developers to roll out a finished product quickly.

To other credit unions, you should take a good look at a scheduling tool. It has many benefits, and we have learned many of our members like to go online and make an appointment at their leisure at a time that works best for them.

This interview has been edited and condensed.

Return to Online Scheduling Tools: 3 Stories Of Deployment And Adoption