The fourth quarter of 2016 represented quite an achievement for Texas Trust Credit Union($1.0B, Mansfield, TX). That was the quarter the institution crossed $1 billion in assets.

Jim Minge took over as CEO for the Texas-based institution more than five years ago. For the past 60 months, the credit union’s No. 1 strategic goal has been to hit 100,000 members. Texas Trust is not quite there yet membership increased 9.9% year-over-year and totaled 84,568 as of Dec. 31 but reaching $1 billion in assets has put an exclamation point on five years of impressive growth for the community-based credit union.

CU QUICK FACTS

Texas Trust Credit Union

Data as of 12.31.16

HQ: Mansfield, TX

ASSETS: $1.0B

MEMBERS: 84,568

BRANCHES: 14

12-MO SHARE GROWTH: 10.3%

12-MO LOAN GROWTH: 14.3%

ROA: 0.53%

For us to reach $1 billion, we had to work hard on two things, Minge says. The first was increasing our convenience. The second was increasing our technological capability.

To that end, in the past five years, the credit union has increased its branching footprint from nine to 17, introduced a new mobile app, overhauled its online banking, and partnered with a new bill pay provider.

During this time, Texas Trust also discovered something essential for its growth: focus.

It’s tempting to try and fix everything at once, Minge says. But if you try and do everything at once, you’ll do nothing well. That has been the biggest lesson for us.

On its way to $1 billion, Texas Trust focused on different areas of business at different times.

Click through the tabs below for a deeper dive into Texas Trust’s financial performance.

$(‘.collapse’).collapse()

1. 3-Year Auto CAGR

By the time Jim Minge took over as CEO in May 2011, Texas Trust had posted five consecutive quarters of negative growth greater than 20% in its auto loan portfolio. That’s about the time Texas Trust partnered with DM Leasing. Today, the credit union’s auto leasing portfolio is a large driver of Texas Trust’s auto loan success. The credit union’s three-year compound annual growth rate has been better than or comparable to others with $1 billion to $10 billion in assets this despite being the seventh smallest institution in this peer group.

2. Auto Leases

In the years since partnering with DM, Texas Trust has increased both the number and total balances of leases it holds in its auto portfolio. As of fourth quarter, it held 5,343 and $172.6 million, respectively.

It’s an advantageous product for the credit union, Minge says, because average yields are 1% higher than a comparable indirect loan. Plus, DM thrives on repeat business, and the strength of the partnership between the two entities is strong.

According to Minge, DM closely monitors borrowers’ payment history and reaches out to re-up the lease with a newer car when the borrower is right-side up on the loan. Minge estimates DM flips between 85%-90% of the credit union’s leases before they come to term. And although that sounds scary, the credit union has historically retained each one of these loans and is rarely concerned with members turning in their cars at the end of the loan term.

Similar to an indirect loan, the credit union pays a flat fee to DM and has introduced co-branded loan statements with the logos of both institutions.

It’s a way to recognize DM as a great partner, Minge says.

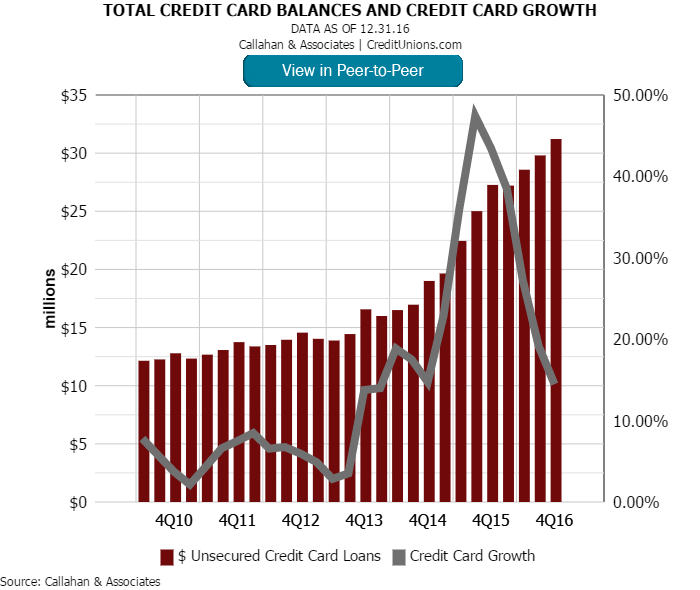

3. Total Credit Card Balances And Credit Card Growth

Four years ago, Texas Trust started retaining the servicing on its credit cards. In doing so, Minge says, its cards became more visible to tellers and member service representatives.

It became less of an add-on product and one of our core product offerings, Minge says.

For years, total credit card balances at Texas Trust sat between $11 million and $16 million. In the past three years, however, portfolio performance has jumped significantly. The credit union’s fourth quarter total of $31.2 million was nearly double the $16.6 million total posted in fourth quarter 2013.

4. Average Credit Card Loan Balance Growth

Texas Trust’s credit card success required more than simply retaining the servicing on its portfolio, however.

In November 2014, it introduced the first of what’s become a bi-annual balance limit increase for members who hit certain repayment criteria and satisfy other benchmarks. According to Minge, the credit union has increased balance limits five times since 2014. The following shows when and the total dollar amount extended to members:

- November 2014: $8.9M

- April 2015: $19.9M

- November 2015: $27.3M

- April 2016: $27.7M

- November 2016: $31.2M

These increases, coupled with balance transfer promotions and the introduction of a rewards component, have attracted new cardholders and deepened usage.

It’s not rocket science, Minge says. By saying this is one of our core products and asking how can we focus on it, we’ve been rewarded with growth.

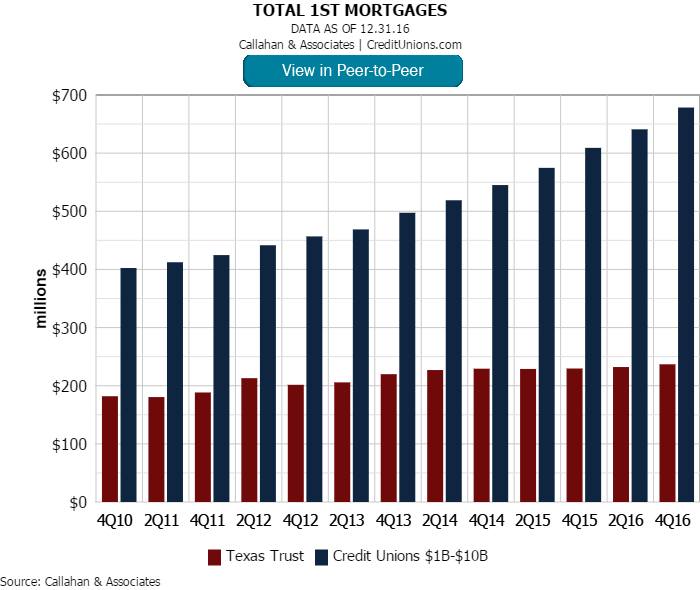

5. Total First Mortgages

The credit union’s first mortgage growth isn’t as extreme as that of its consumer loan portfolio, but Minge feels optimistic about the future performance of this portfolio.

For one, Minge says, the credit union’s local-first lending and word-of-mouth advertising have positioned it to compete against the market’s large banks such as Bank of America, Wells Fargo, and Chase and recruit former customers of these institutions.

In addition, the economics of Texas Trust’s local market are positive.

In April 2016, WalletHub published a list of the 300 best real estate markets in the United States. Six of the top 10 and five of the top six cities on the list are in Texas, and all but one are in the greater Dallas-Fort Worth area, which Texas Trust serves.

It’s an amazing market for a credit union to try and make a difference, Minge

6. Average First Mortgage Origination

Affordable home prices help the Dallas-Fort Worth housing market stand out. According to Zillow, the average home value in Dallas as of January 2017 was $160,300. That’s more than $25,000 lower than the national average of $188,900 per the National Association of Realtors.

At Texas Trust, the number of first mortgage originations has grown, but the average value of each origination has remained relatively steady.

In the next few years, Minge would like to build better mortgage relationships within its communities. This means partnering with local real estate agents and title companies.

We’ve focused on the auto and credit card side, Minge says. I think over the next three years, mortgage is going to be our next big story.

7. Member Growth

The combination of auto, credit card, and mortgage strategies have aided Texas Trust’s member growth. The credit union’s year-end member growth of 9.9% outpaces the 5.7% average posted by credit unions with assets of $1 billion to $10 billion.

But the credit union wants to differentiate itself from other financial institutions in ways broader than lending.

One program, which Minge says borrows heavily from Suncoast Credit Union in Florida, pays $0.10 to an organization of the member’s choosing when that member swipes the credit union’s branded debit card. According to the CEO, the credit union has given back $1.3 million to local schools through the program in the past five years.

You are never going to see Dallas Cowboy Stadium sponsored by Texas Trust, he says. But if we’re good community partners, provide community support, and show our difference, we’ll be rewarded.

8. Total Branches

In the past five years, the credit union has added five new branches to its network. Three of those were inherited through two mergers, but operating a larger branch footprint plays into the credit union’s expansion strategy.

We need more of a footprint if we are really going to grow in the market, Minge says.

In 2014, Texas Trust merged with $50 million Security One Credit Union and absorbed two branches. In September 2016, Texas Trust merged with $7 million Trust Credit Union and absorbed its one branch. In mid-February 2017, Texas Trust announced a merger with Qualtrust Credit Union, which has nearly $200 million in assets and five branches.

According to Minge, Texas Trust is not opposed to new mergers if the merger is for the right reason.

I will not be on the phone with other people saying, Hey you need to merge with me,’ Minge says. We are trying to be good corporate citizens in credit union land and help the people that want help.

Use Callahan’s Peer-to-Peer tofind out which technologies credit unions like yours are using to spur growth. Request a demo.