Top-Level Takeaways

-

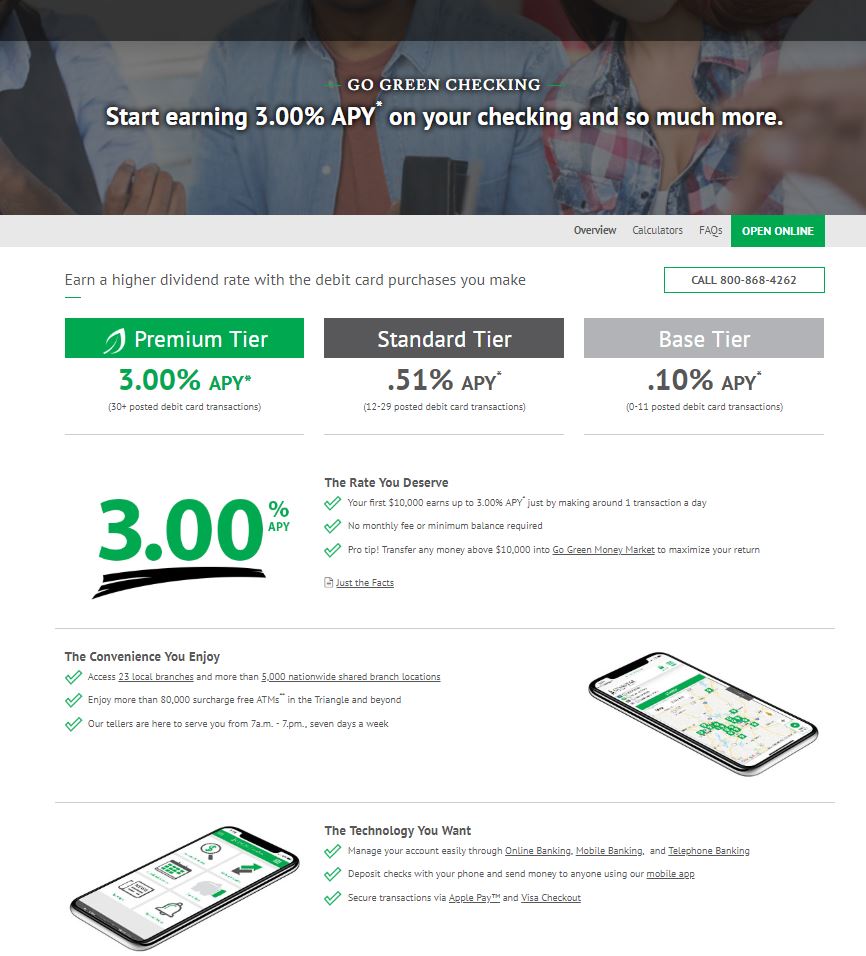

Coastal FCU has a three-tiered checking dividend payout based on debit card use.

-

The top two rates are currently 3% and 0.51%, well above industry averages.

-

The credit union attributes the account’s success to the simple rate strategy.

CU QUICK FACTS

Coastal FCU

Data as of 12.31.18

HQ: Raleigh, NC

ASSETS: $3.2B

MEMBERS: 257,090

BRANCHES: 22

12-MO SHARE GROWTH: 8.1%

12-MO LOAN GROWTH: 12.0%

ROA: 1.05%

Coastal Federal Credit Union ($3.2B, Raleigh, NC) went green with its flagship checking account more than a decade ago and has since attracted millions of dollars in deposits from sticky members who enjoy its high interest rates and simple structure.

The Go Green account is one of four the credit union offers, but it’s the only one that pays dividends. Coastal divides the account into three tiers, with the top rate paying 3% on up to $10,000 in balances for members who post at least 30 debit transactions per month.

Joe Mecca, Coastal’s vice president of communication, says the credit union created the account with the idea that members would stick around for an account that had just a short list of requirements for earning the highest available interest rate.

Joe Mecca, Vice President of Communication, Coastal FCU

That’s been the case. Go Green accounts now account for slightly more than 64% of total checking accounts as well as total share balances, which totaled 147,094 and $150.7 million, respectively, at the end of 2018.

That heavy use pushes the average share draft interest rate at the Tarheel State credit union to 2.96%, making it the third highest among the 302 credit unions of $1 billion to $10 billion in assets at year-end, according to data from Callahan Associates.

Here, Mecca shares more about Coastal’s Go Green account.

What makes this a green account? Can a member still use paper checks to draw on it?

Joe Mecca: We don’t advertise it as checkless, and members aren’t restricted from getting checks to go with it. However, it was designed for members who primarily use debit cards to transact. It’s a high-yield dividend checking account, and the dividend tiers are tied to monthly debit card use. We also encourage members to use online bill pay, electronic notices and statements, and other electronic means over paper.

When did Coastal create the Go Green accounts? Why?

JM: We designed the product in 2007 and launched it at the start of 2008. At the time, the checking account portfolio was shrinking. With increased competition from other high-yield checking accounts and online accounts, we wanted to create something that would be a strong incentive for consumers to choose Coastal for their checking needs.

We looked at some of the other high-yield options that were out there, and felt that they put too many requirements in the way of earning a rate. They required a certain number of transactions, online banking, online bill pay, e-statement, direct deposit, etc.

The industry consensus at the time was that those things were what made an account sticky. We were confident they were the effect of a loyal account relationship, not the cause. So, we opted for a high-yield checking account with one requirement with the belief that if we built a good account that people found value in, the rest would follow.

Visitors to Coastal’s website can easily find information about the Go Green checking account, including that it pays 3% on the first $10,000 for heavy debit users.

What are the primary differences between the Go Green accounts and the other checking accounts?

JM: Go Green is our only checking account that pays a dividend. We offer three rate tiers based on monthly debit card usage. We pay a high yield on balances up to $10,000 for those who qualify.

A few years ago, we added a companion money market account that also has a tiered rate structure based off the same card transactions. It’s designed for members who have more than the $10,000 but still want more liquidity than a certificate account offers.

A three-page fact sheet provides a detailed list of features for Go Green checking. View the full PDF here.

Do you automatically move people’s tiers based on their behavior? Do they choose? How does that work?

JM: It’s automatic. The program looks at the number of debit card transactions that posted to the account during the month, then assigns the rate tier, and then calculates the dividend based off of that tier. That’s for the first $10,000 in the account. Anything above that is paid at the Base tier. The member sees one dividend, and we report it on their statement as a blended rate.

Of Tiers And Balances

Joe Mecca, vice president of communication at Coastal FCU, breaks down how much Go Green contributes to Coastal’s total checking. According to Mecca, part of the skew is due to members who have balances higher than the $10,000 cap for the Premium and Standard tiers.

They qualify for those tiers up to $10,000, Messa says. The rest falls to the Base tier.

He also notes that members who have more than 30 transactions per month often don’t have very high balances.

THE ROLE OF GO GREEN CHECKING AT COASTAL FCU

FOR COASTAL FCU | DATA AS OF 12.31.18

Callahan Associates | CreditUnions.com

| By # | By $ | |

|---|---|---|

| Premium (30+ debit transactions) | 32% | 19% |

| Standard (12-29 debit transactions) | 16% | 7% |

| Base (0-11 debit transactions) | 53% | 74% |

Coastal’s loan-to-share ratio was 101% as of the fourth quarter of 2018. What deposit-raising strategies do you have in place?

JM: Our deposit growth the past two years has been very strong. Loan demand has been even better than forecast, which accounts for the 101%. Our aim is to stay as close to 100% as we can, and we want to keep loans and deposits growing at a balanced rate. For 2019, we’re targeting slightly higher deposit than loan growth, which should get us back to 100%.

We recently increased the rate on Go Green checking, which should help. We’re also looking to develop a new checking account to introduce this year.

We’ve been pricing our certificates and money market account ahead of the market, which is helping to shift deposits our way and retain some money that might be in motion. We also reworked our IRAs and introduced a high-yield IRA savings account.

How Does Your Loan-To-Share Ratio Compare?

Coastal’s loan-to-share ratio was 101% as of 4Q18. Where do you stand? It takes minutes to compare your loan-to-share ratio to other credit unions using Peer-to-Peer. Request a demo and let us show you.

How do the Go Green accounts fit into your deposits strategy?

JM: It’s a key component. We still open more than 1,000 Go Green accounts every month, and it’s an important entry product for new members. We’ve projected checking accounts to be our second-largest area of deposits growth for this year, after certificates.

How do you market the Go Green accounts vs. the other checking offerings?

JM: Right now, Go Green is the only checking account that we actively market. We also market other deposit products, including certificates, the Go Green money market, IRAs, and wealth management.

What are a few best practices you’ve learned from the Go Green accounts?

JM: Keep it simple. Members see too many requirements as a hurdle and not worth it. If you try too hard to shape member behavior, you’ll only get those willing to perform those behaviors in the first place. Members are going to gravitate toward what works best for them, and asking them to do something that doesn’t meet their needs just causes friction and dissatisfaction.

Accept the fact that some people will game the system and do the bare minimum to get the rate. They’ll park the maximum amount that’s allowed, especially if it’s your highest-rate product. We mitigated this by adjusting our balance cap to what was more representative of a typical account that had normal card use and created the companion money market account for people who really were looking for just a good savings rate. Rising certificate rates has helped shift some of that away, too.

Keeping it simple makes it easy to advertise, too, but be prepared to communicate. Because it’s a dividend account, we’ve adjusted our rate several times as overall rates have changed over time. That triggered notification and advertising updates.

Finally, don’t change rates in the middle of the month.

This email interview has been edited and condensed.