There are things AI does better than humans and things only humans can do. We need the right people doing the right things.

AI is reshaping the lending landscape, and credit unions are finding ways to make the technology work for people as well as portfolios.

A white paper published by the World Economic Forum this year found 70% of financial services executives believe AI will directly tie to revenue growth in upcoming years, and several credit union leaders who have spoken to CreditUnions.com have noted the role it has played in increasing efficiency and member satisfaction at their organizations.

Marine Credit Union ($1.1B, La Crosse, WI) started its AI in lending journey five years ago with an in-house model geared toward scalability and faster decisioning.

“Our lenders and underwriters were spending a lot of time on applications where the human interaction wasn’t adding a lot of value,” says Kenneth Brossman, chief lending officer at Marine. “We wanted to reduce that as much as possible.”

Since then, AI has enabled measurable growth in Marine’s consumer lending. The organization even sold some consumer loans to the secondary market in 2024 and might do so again in 2025.

“Our yield and net interest margin have been strong, and charge-offs have been solid, even lower than peers in some cases despite taking on more risk,” Brossman says. “AI helped us scale, improve profitability, and make good decisions without adding excessive risk.”

Inside Implementation

MCU’s first surprise during the implementation process was how long it took. In total, Brossman says it required roughly 10 months with continuous testing to ensure the results were what the lending team was looking for.

“We didn’t have as big of a team to cover that lift as we should have,” the CLO explains. “So, there was a bit more work needed on the back end than we expected.”

CU QUICK FACTS

MARINE CREDIT UNION

HQ: LA CROSSE, WI

ASSETS: $1.1B

MEMBERS: 75,248

BRANCHES: 17

EMPLOYEES: 414

NET WORTH: 12.1%

ROA: 0.66%

When the credit union’s lending team launched the new system, it started with 20% auto-decisioning before quickly moving up to 40%. For the first six months, a dedicated team reviewed all turndowns and approvals. Brossman says only three out of 100 decisions on average differed from what live loan officers would have decided.

“That 3% difference helped us feel comfortable,” he says. “We decided the trade-off was worth it for the time savings and member experience.”

Fast forward to 2025, and Marine’s lending department hovers between 55% to 60% auto-decisioning with approximately 34% approvals and 22% declines on a monthly basis.

“We have a process where lenders can request an override, but it’s rare,” Brossman says. “Human review is really focused on complex loans such as credit, LTV, and DTI issues.”

That’s approximately 40% to 45% of applications. Occasionally, MCU auto-approves low-risk loans even if a member’s credit is lower, especially if the loan amount is small. On the flip side, some applications are a clear denial regardless of story.

Brossman says the credit union originally aimed for 80% auto-decisioning, but for the sake of its desired model, it was important to leave more room to better understand a member’s situation.

“If we go further, it could negatively impact our ability to say “yes” to members who just need a little more work to get approved,” he says.

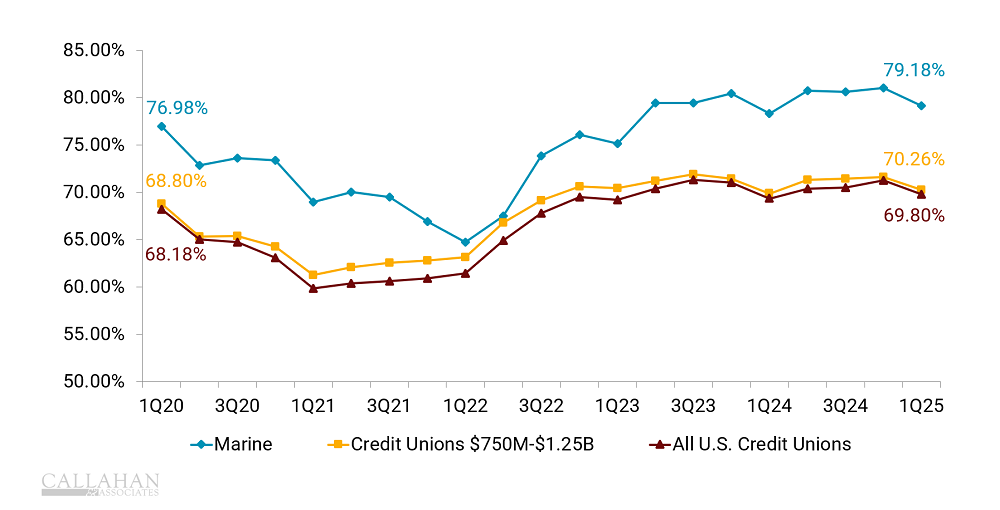

LOANS TO ASSETS

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

Happy Employees, Happy Members

MCU believes innovations like AI are essential for keeping up with consumer preferences.

“Member expectations are changing,” Brossman says. “Responsiveness is key. They expect the Amazon or Google experience. Being better positioned to serve members is critical, and this is a great way to do that.”

Lenders at the cooperative can now tell members they’re approved within minutes, and when an application does require manual review, team members are able to take that time to understand the member’s circumstances. This has resulted in happier, more engaged employees despite some initial skepticism and distrust in the beginning.

“Our team quickly got on board once they realized that AI would remove ‘easy’ approvals and declines, freeing them to work on cases where their expertise adds value,” Brossman says.

As for whether AI has resulted in fewer full-time employees, Brossman says the credit union’s underwriting team has actually grown since implementation.

“People often assume AI will replace humans, but that hasn’t been the case in lending or other areas where we’ve introduced AI,” he says. “It’s helped us approve more loans, and their productivity has gone up. It’s been a big win.”

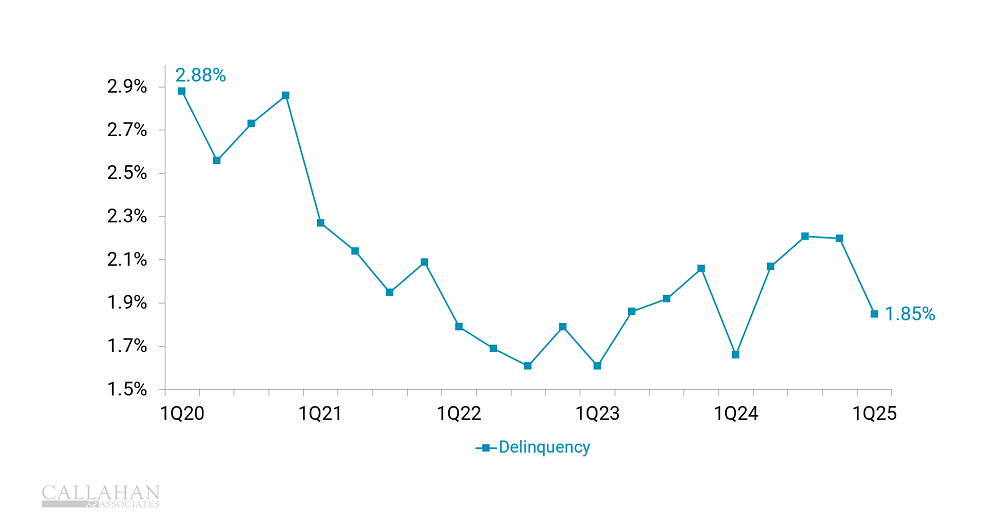

DELINQUENCY TO TOTAL LOANS

FOR U.S. CREDIT UNIONS

SOURCE: Callahan & Associates

The Bottom Line

This year has been one of ongoing economic uncertainty. It is still unclear if interest rates will fall, and with increasing debt for auto and personal loans, many financial institutions are paying close attention to risk.

“Rising delinquency on the unsecured front is a big topic, and it’s part of why some peers haven’t adopted auto-decisioning,” Brossman says. “But by using this technology, we’ve kept our consumer delinquency and charge-offs in check.”

Of course, implementing AI into its consumer lending is not a set-it-and-forget-it initiative. The credit union holds a monthly underwriting summit where it reviews the percentage of auto-decisioned loans, manual reviews, look-to-book rates, and default rates comparing auto-decisions to manual ones.

“We challenge assumptions and look for ways to keep improving the model, but we’re pretty comfortable with it today,” Brossman says.

Looking ahead, MCU has plans to build a model for mortgage loans as well.

“We’ll likely start at 20% auto-decisioning on that side, but we’ve been doing consumer this way for five years and feel good about it,” Brossman says.

His No. 1 take away for other credit unions?

“Don’t rush,” he advises. “Start small with maybe one product or a small loan pool and get comfortable. There are things AI does better than humans and things only humans can do. We need the right people doing the right things.”

Smarter Lending Starts With Better Data. AI is changing how credit unions lend — but smart strategy still starts with knowing your numbers. Peer Suite gives you the performance insights you need to track trends, measure impact, and make confident, data-backed decisions as you innovate your lending approach. Book your analysis session with a Callahan advisor today, and see what Peer Suite can do for you.