Mike Lee stood in front of his new staff for the first time and laid it on the line.

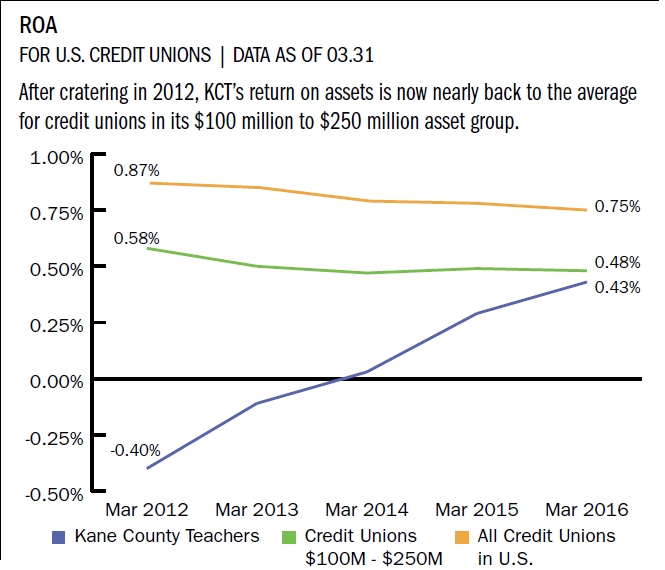

This credit union has lost money for the past two-and-a-half years, he told the team at Kane County Teachers Credit Union ($214.0M, Elgin, IL). I believe we can turn this place around, but it will take a team effort.

Join him shoulder-to-shoulder and they’ll make it, he promised.

But if you don’t, two years from now I will be forced to look for a merger partner, he warned. And I can’t promise even one of you will have a job if that happens.

CU QUICK FACTS

Kane County Teachers Credit Union

Data as of 03.31.16

- HQ: Elgin, IL

- ASSETS: $214.0M

- MEMBERS: 16,744

- BRANCHES: 3

- 12-MO SHARE GROWTH: 5.87%

- 12-MO LOAN GROWTH: 25.96%

- ROA: 0.43%

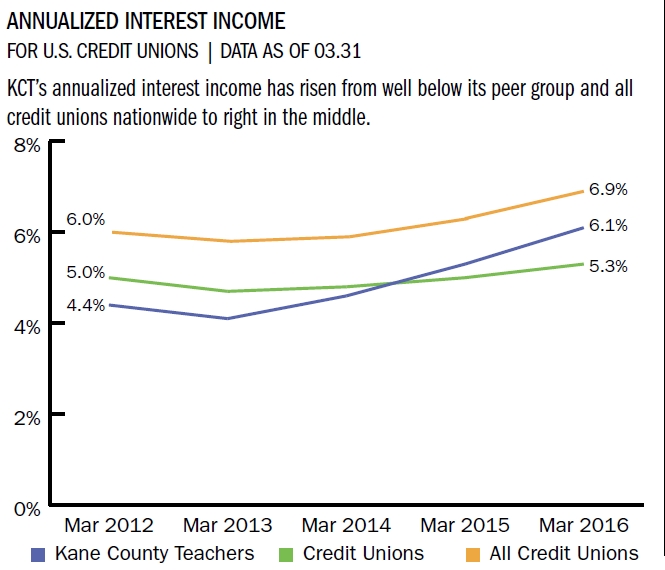

That was in August 2013. Fast-forward to first quarter 2016, and the numbers paint a different picture at the state-chartered, privately insured institution.

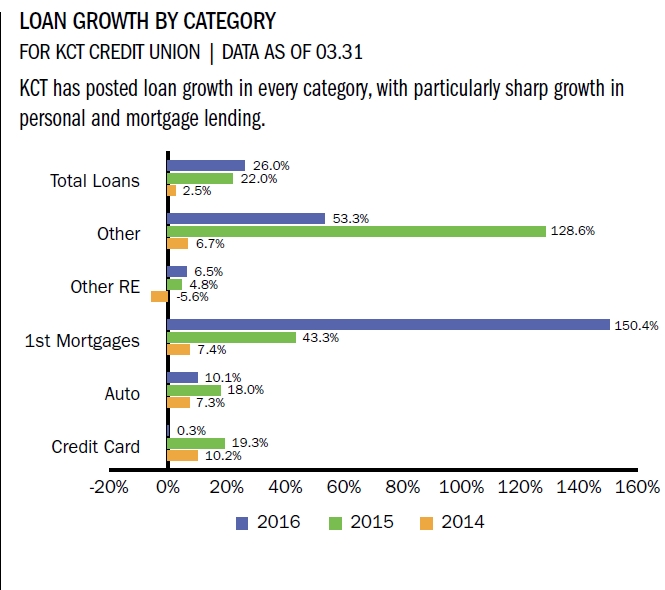

Branch traffic has doubled, despite awkward locations, including one on a dead-end street. Lending is up in every category, growing sharply above industry averages, and the loan-to-share ratio has increased from the low 20s to slighty more than 40%.

Member growth is inching toward the positive after several years of decline. Share balances are spiking, a reflection of the credit union’s emphasis on financial wellness, and ROA has again turned positive.

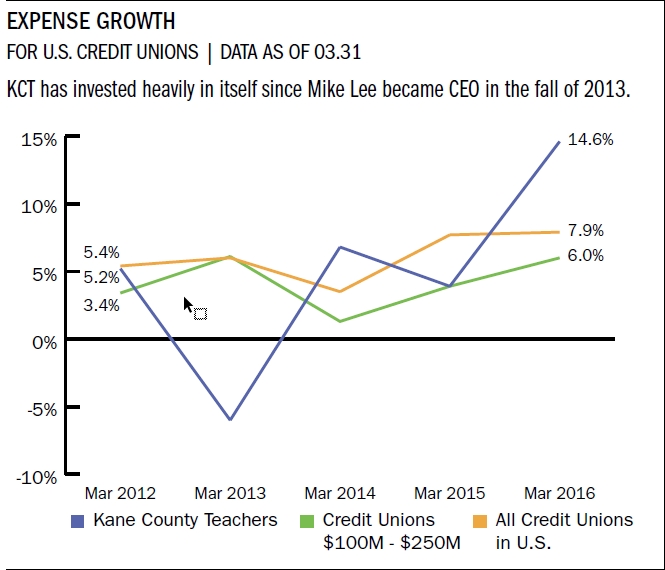

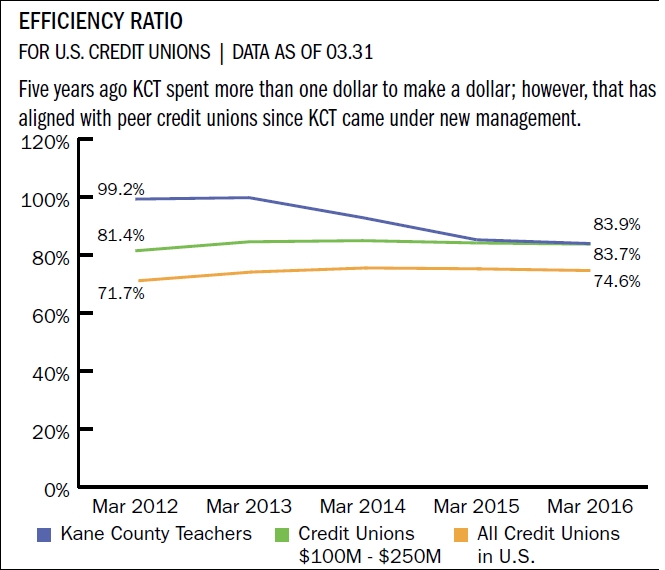

After losing nearly $700,000 in 2012 and 2013, KCT made $459,666 in net income in 2014 and $877,714 in 2015. For 2016, the credit union projects it will exceed $900,000. And that’s with sharply higher operating expenses resulting from investments in people who hadn’t seen raises in three years or more and buildings that hadn’t been upgraded in decades.

This has all happened around a new core strategy that focuses on face-to-face interactions, lending driven by member needs and not the credit union’s, and debt checkups altogether a philosophy that is financial wellness in action.

How Do You Compare?

Check out KCT’s performance profile on Search Analyze. Then build your own peer group and browse performance reports for more insightful comparisons. Start today at CreditUnions.com/analyze.

Aggressive Progress

KCT is currently rebuilding relationships among its approximately 200 SEGs, ties it had largely ignored since KCT went to a community charter in 1997. Its charter covers seven counties in and near Chicago, but it still primarily serves the Elgin and Aurora communities.

The credit union also has refurbished its branches to make them more welcoming and uses them as a base to spread the gospel of financial wellness and positive cash flow.

The reference to the gospel is not misplaced. Lee is active in lay ministry work and brings the same zeal to improving members’ financial lives as he does to the work he does in his private life. He also is an unabashed salesman, a skill honed in decades of success in the corporate sphere, including at Alloya Corporate Federal Credit Union before making the move to KCT in 2013.

When he did, he was ready to invest in people and places.

Financial literacy without application means nothing. I can’t imagine what would happen if the monster credit unions in the nation adopted this debt checkup and we started advertising this: ‘Come to your local credit union, do a debt checkup, and change your financial future.’

I had to spend a lot of money to get this credit union back to where it could serve the members and compete, he says. That has been the challenge since I walked into this place that for 10 years or more did nothing.

Lee admits KCT remains below peer averages in some major metrics, such as member growth and ROA, but he prefers to look at where the credit union is going and not dwell on where it has been or where it is at this one point in time.

Remember where we came from, he says. We’ve accomplished a lot so far and there’s more ahead of us.

BEST PRACTICE: Planning Makes Perfect

Detailed strategic plans that list specific priorities for each coming year help keep the KCT management team focused and the credit union on task.

Strategies And Financials

As CEO, Lee is tasked with figuring out how to make money while doing the right thing for members.

KCT has begun to again do that, using a cultural change powered by the priorities outlined in the strategic plans Lee and his team create each year. The first plan called for immediately implementing a break-even budget, then added actively renewing stagnant SEG relationships, boosting staff incentives and recognition, and adding new mobile and online banking services.

Other priorities in the plans touched upon risk-based lending, including engaging Sallie Mae for student lending, and marketing to the community’s large Hispanic population.

The list of strategic priorities was long, but there was a sense of urgency.

We didn’t have a choice, says Joe Menolascino, the KCT vice president of lending and operations who came over from Alloya with Lee. We had to make these changes. We did every one of them.

A Fast-Growing Loan Portfolio

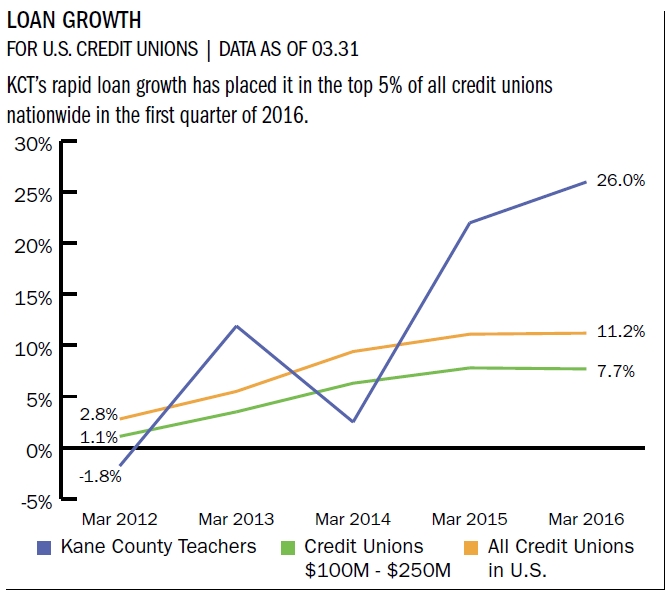

Perhaps the most dramatic evidence of KCT’s renaissance is in its loan portfolio, which has grown 60.7% in less than three years from $48.7 million in September 2013 to $78.2 million in April 2016. Its 26.0% loan growth year-over-year in first quarter 2016 was 32nd among the 728 credit unions in its $100 million to $250 million asset class, according to Callahan Associates.

Major drivers of that growth include first mortgages, which went from a total of $3.8 million to $14.5 million since Lee and Menolascino arrived, and the auto lending portfolio, which jumped from $15.6 million in 2013 to $21.8 million in first quarter 2016.

There was no mortgage program, really, when we arrived, Menolascino says. We’re working to grow this in a methodical way.

But that growth comes from more than just mortgages and cars. KCT now has an array of specialized loan offerings.

Get Out Of Debt Loans: These three-year loans are often the linchpin of a new financial wellness plan. They carry a limit of $10,000 sometimes more and have proven to build relationships as well as help the borrower develop financial discipline.

Share-Secured Loans: These loans vary in terms and target people with low or no credit scores and/or troubled debt-to-income ratios. They carry higher rates to cover the risk but offer substantial savings compared to other short-term lenders in the market.

New Hispanic Teachers Loans: Each year a group of new teachers arrives from Spain and Puerto Rico to help serve the fast-growing Hispanic population in the local schools. These loans typically reach $1,000 and come with direct deposit, a checking account, and a $500 limit credit card. The credit union has approximately 30 to 50 of these loans outstanding at any given time. Also, KCT uses its relationship with Enterprise to help the new arrivals buy a car.

Citizenship Loans: These loans help pay for the costs of citizenship as well as serve as an alternative to payday and title lenders. Like the share-secured loans, they carry a higher rate to cover risk, and the borrower can use a car as collateral.

We’re now growth-oriented and progressive. We need vendors who are constantly looking toward the future and trying to develop their products. Our philosophies have to align.

Participation Loans: These loans accounted for $4.4 million, or 5.79%, of KCT’s total loan portfolio in first quarter 2016. Much of the participation segment is in taxi medallion loans from San Francisco Federal Credit Union. Menolascino says he’s familiar with that niche from his days at Alloya and is confident that market has weathered the Uber/Lyft storm well. Church lending is another niche, something Lee is familiar with from his volunteer work in that area.

BEST PRACTICE: Don’t Lend By Committee

Requiring the board to approve all loans is a throwback practice that hindered lending and growth at KCT Credit Union. When he joined the executive team, one of the first things Lee did was eliminate the practice.

Making SEGs The Sweet Spots

A good day for Yvonne Irving is sitting in a school bus garage, talking about her credit union and signing up members. She’s opened dozens of accounts that way.

Now KCT’s vice president of business development, Irving joined the credit union four years ago as community relations coordinator. She took over business development two years ago and hired an associate to divide up the work required to re-establish long-dormant relationships with SEGs some of whom the credit union had not visited in 10 years or more and build connections with new and potential new employer groups.

They leave the laptops behind on many of their visits, relying on pen and paper to sign up new members deep inside the massive school buildings and factories that prove so unfriendly to wireless signals.

We’ve got it down to a science, Irving says. It takes five to seven minutes. We don’t just sit there and shuffle through papers.

As for finding potential new SEG partnerships, Irving keeps up with who’s new and who’s growing through local publications and her work with the Chamber of Commerce. Irving, herself, is a board member for the Elgin chamber.

It’s hard to get new organizations to partner. We are community based, so anyone can join. We have to sell [potential new SEGs] on the benefits of making us part of the benefits plan.

It’s hard to get new organizations to partner, Irving says. We are community based, so anyone can join. We have to sell [potential new SEGs] on the benefits of making us part of the benefits plan.

To reach businesses, CEO Lee advises beginning with the HR people.

You’ve got to sell who you are first. Lee says. If you do that, they’re going to be more accommodating, more open to hearing what you’ve got to say.

Community events are a prime spot for building relationships with the higher-ups and influencers who can spread the word. Lee offers an example of the time a library director at one SEG event told him about being turned down, despite her sterling credit, by her longtime bank for a bridge loan on a condo.

KCT handled the loan and gained a loyal member. It also earned the chance to replace a competitor’s ATM with one of its own, garnering some fee income and exposure from a prime location in a busy public space. Not only that, the happy library director gave KCT a TV screen to promote its products and services.

I tell this story because I don’t want just members, I want advocates, Lee says. She’s my advocate now, and as a bonus, she’s a person of authority in this organization.

Another new advocate is Kim Wagner, managing director of student financial services at Elgin Community College and a two-year member of the KCT board.

Wagner’s work revolves around helping students pay for school, which often involves navigating debt issues.

These students need a champion, she says. Word has gotten around that this credit union has the people and the products to help.

A Man With A Plan

Mike Lee’s frst three years at Kane County Teachers Credit Union were guided by strategic plans intended to help the credit union turn around its dismal prospects and then build on that progress. They included priorities for lending, staffng, SEGs, IT, and member onboarding, just to name a few. Here’s one from each year so far.

Strategic Partners (2014)

KCT will be evaluating and identifying business partners that best mirror our business goals, guiding principles, and vision. We will be aligning with business partners that will enhance productivity and proft in 2014 and beyond. The implementation of our vendor management program will facilitate the process of a selecting, monitoring and evaluating our partnership success annually. Management will implement a succeeding or exit strategy with all our business partners on an annual basis.

Premier Member Program (2015)

Beginning in 2015 the Premier Member program will have its frst allocated payout of $25,000 to qualifed members. This program was enacted in 2014 to reward members that contribute to the success of KCT. To attain a Premier Member status KCT members will be required to use a mix of proftable products and services. The required products and services include an active use of checking and debit card, credit card, and a term loan (excludes credit cards and real estate loans) or large deposit ($25,000). When a member attains a Premier Member status they will join a pool of members that will receive a cash reward/dividend. The Premier Member $25,000 payout will be highly marketed in 2015 to entice additional current and new members to qualify for the huge beneft payout.

Facilities Improvement (2016)

In 2016 we will continue to improve the image and safety of our facilities for our members and employees. Maintaining a positive image helps attract and retain members. Adding offce, training and meeting rooms will help with adding and training staff to better serve our members. The large-scale facility improvement in 2016 will be the build-out of the basement in Elgin. Among other improvements will be cleaning and repairing windows, replacing carpet and tiles, and many handyman projects to keep our facilities well-maintained.

Time For A (Debt) Checkup?

Middle America is in a quiet crisis that Mike Lee and his team are taking head-on: the lack of financial security brought on by un- and underemployment, spending habits, and mounting debt.

Fully 47% of Americans cannot cover a $400 emergency expense without selling something or borrowing money, according to the Report on the Economic Well-Being of U.S. Households in 2014 by the Federal Reserve. And fully three-fourths of Americans are living paycheck-to-paycheck.

Callahan partner Jay Johnson talks about financial wellness in Financial Wellness Is A Big Idea For 2016. Read it on CreditUnions.com today.

The next big epidemic issue that’s hitting Americans in the workplace is financial wellness, Lee says. The American worker is losing productivity because of financial stress.

KCT is tackling that challenge through what the credit union calls debt checkups, something it has completed hundreds of throughout the past couple of years.

We go over credit reports and amortization tables. We talk to members about the importance of cash flow, how it’s not just about lowering rates.

We go over credit reports and amortization tables, Menolascino says. We talk to members about the importance of cash flow, how it’s not just about lowering rates. We usually have better rates, but you’ve got to do the math. We show them all the options and help them decide what would be best for them.

That might include looking at the true cost of a car, which might have a sticker price of $30,000 but costs $36,000 after financing. If that’s a budget stretch, KCT staffers help the member decide if a less expensive car would work just as well.

KCT also trains its staff to encourage members to come back every six to 18 months to check on their debt. Often that leads to refinancing into a better rate and term.

Financial literacy without application means nothing, says CEO Lee. I can’t imagine what would happen if the monster credit unions in the nation adopted this debt checkup and we started advertising this: Come to your local credit union, do a debt checkup, and change your financial future.’

KCT member service representative Daisy Flores spends some quality time with 11-year credit union member Taylor Stark.

Face-to-face contact for these debt checkups is essential to develop trust and intimacy.

I don’t think you can do that on an application on the web, Lee says.

Menolascino does a lot of those sessions. He and his staff use spreadsheets to show members how much they can save by refinancing and consolidating.

It can easily be tens of thousands of dollars, even when they’re loans they already have from us, Menolascino says.

For example, members regularly get offers to pay off their existing credit at KCT and replace it with lower-cost debt. Cannibalizing their own ledgers isn’t an issue for KCT lenders, Menolascino says, adding that one of the first things he did at KCT was purge a lot of low- or non-performing loans.

We make it up on volume, he says. And we’re doing the right thing by our members. They remember that, and they keep coming back.

BEST PRACTICE: Foster Financial Wellness

A focus on financial wellness with personalized, get-out-of-debt plans and annual debt checkups helps KCT improve its members’ lives while building brand through word-of-mouth.

Aligning The Vendors

KCT has nearly turned over its vendor lineup, with one notable exception in its core processing system, an in-house version of Fiserv’s XP2.

KCT’s three IT staffers are integrating a lot of new technology into that core, including the Alkemi online and mobile banking system that includes additional offerings such as bill pay and account aggregation.

We’re pretty small on its scale of customers, so I had to do the negotiation of my life on that one, Lee says.

Another major new relationship is ACH origination through Alloya, which allows better capability for recurring payments and deposits. Other newcomers are providers of mortgage and card processing and credit, life, and disability insurance.

Menolascino says his talks with vendors begin with some straight talk.

This is not a customer/client relationship; this is a partnership, he says. We’re not going to tiptoe around the problems and issues we’re having. Nor should the vendor do that with us.

Such candidness has resulted in better vendors and better products at the same price or less, says Jeremy Shipley, a 14-year veteran at KCT who’s now the vice president of finance. That’s a healthier environment than existed before, when cost cutting inside and out was reaching the point it was affecting KCT’s ability to deliver quality services.

We’re now growth-oriented and progressive, Shipley says. We need vendors who are constantly looking toward the future and trying to develop their products. Our philosophies have to align.

BEST PRACTICE: Be Demanding Of Vendors

When vendors act as partners, there is open communication and an expectation for product development and support. If that’s not met at KCT, it prompts the credit union to look elsewhere.

Incenting The Staff

KCT employs 57 people and its personnel expenses have grown at a pace well above industry average.

We spend a lot on employee pay, Lee says. Most of the employees when I came here had not had a raise in more than three years and morale was terrible.

Therein was opportunity. Pay levels were low enough that KCT could implement an aggressive incentive plan for front-line staffers without lowering anyone’s base. There are separate plans for branch managers, member service representatives, and tellers.

KCT’s three incentive plans are among the many documents, policies, and templates borrowed from fellow credit unions and posted in Callahan’s Executive Resource Center. Check it out at CreditUnions.com/connect

Employees who hit the aggressive targets can significantly raise their pay. For example, the minimum monthly goal for personal loans is 21, at which point the incentives kick in and the MSR gets $15 for each one. For credit cards, it’s a monthly goal of $9 with a payout of $10 for each.

That’s helped drive income per employee from $121,894 annualized in the quarter that Lee arrived in 2013 to $144,959 in the first quarter of 2016. Loans per employee jumped from $1.0 million $1.3 million at the same time. Those are well below industry averages but a sharp increase and a sign of things to come, KCT’s senior managers say.

Not having incentive programs is promoting mediocrity, Lee says. We’ve changed the culture here to recognize and reward performers.

Credit unions, Lee adds, are not for-profit institutions, but they’re also not charities. And they can certainly be a power for good.

I didn’t get it until I got in the trenches and saw how we could change people’s destinies, the direction of their lives, he says. It’s an incredible responsibility.