Top-Level Takeaways

- Coloramo FCU has launched a digital-only brand aimed at attracting young consumers by combining features of popular platforms like Chime and Acorns.

- It aims to offer its technology to other credit unions to enhance accessibility and efficiency for the industry.

- The new fintech includes an educational platform and transactional accounts with plans to expand to savings, investments, and more.

Coloramo Federal Credit Union ($174.5M, Grand Junction, CO) has launched a digital brand aimed at attracting younger consumers, but it’s not planning to keep that growth opportunity to itself.

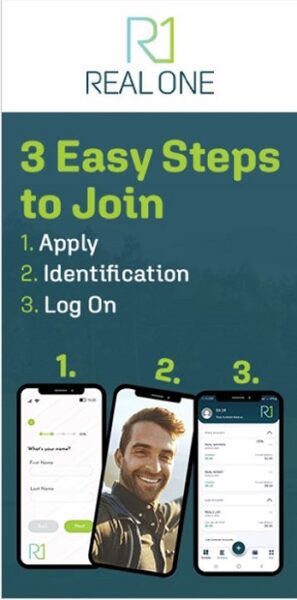

The Colorado cooperative recently launched Real One, a digital-only brand that combines the best bits of platforms like Chime, Venmo, Acorns, and others to attract younger members, specifically Gen Z, who have dramatically different preferences and expectations from older generations. The new fintech will allow Coloramo to engage with younger consumers on their terms while still serving older members under the established brand.

“We’re not trying to disrupt the Coloramo brand,” says CEO Anthony Restivo. “Coloramo serves the members it has today, and as they evolve, that brand will evolve with them. There are banks that have tried to re-create their brand to go after new generations, and it upset their existing customer base. We didn’t want to do that to our members.”

But Coloramo is thinking beyond its own members. Once the credit union has proven internally its platform works, it plans to make Real One available to other financial institutions. According to Restivo, credit unions already share policies, procedures, and even personnel; so, why not technology?

“I’m not going to earn any more or less money by sharing the Real One brand with other organizations,” the CEO says. “My organization might benefit monetarily because we will have reduced expenses over time, we see that as a benefit to our organization, but it’s also bringing the right banking to the right people in the right way. Let’s make that available for institutions that are trying to do that already.”

Know Your Audience

To build the digital brand, Coloramo first had to make sure it understood the target demographic.

“They want information, and they want to get it from people they know, not necessarily the rest of the industry,” Restivo says. “They want that ‘trust but verify.’”

CU QUICK FACTS

COLORAMO FCU

HQ: Grand Junction CO

ASSETS: $174.5M

MEMBERS: 12,299

BRANCHES: 3

EMPLOYEES: 43

NET WORTH: 9.1%

ROA: 0.62%

To that end, Real One includes an educational platform that allows users to share information in ways similar to social media sharing. The fintech also offers transactional accounts — in part because that’s the account type young consumers need most — and over time will expand to include savings as well as self-directed investment opportunities. The long-term plan is to offer the same products as Coloramo offers — which includes everything from student loans and car loans to mortgages and more — but through a digital-only platform.

In fact, from a products perspective, Real One and Coloramo aren’t dramatically different. The differentiator lies in the service channels. Approximately 30% of Coloramo members want a digital-only experience, Restivo says. The other 70% want human interaction on a fairly consistent basis. Real One offers an experience for members seeking the opposite of that, even older members. Importantly, the same people will staff the contact center for both brands to ensure uniform member experiences and service levels.

“It’s not so much about what gets delivered or the intention behind it, but the channel it gets delivered through,” Restivo says. “What remains the same is that when you want a real person, whether you’re a Coloramo member or a Real One member, you’re getting that real person.”

Reach Your Audience

A FINTECH FOR CUs

Although for-profit banks have invested heavily in digital-only brands in recent years, credit unions have been slower to dip a toe in those waters.

-

USAlliance FCU and others launched Dora in August 2021.

-

Michigan State University FCU introduced Collegiate and Alumnifi in 2023.

-

Vantage West debuted HUSTL, a virtual brand for freelancers and gig workers, in 2024.

To reach the intended demographic, Real One organizers are planning an outreach campaign that includes advertising on Instagram, Facebook, and other platforms. They also are working with a digital marketing firm to tailor a brand message that highlights the fintech’s core values in a way that appeals to its target audience.

Real One promotions are currently running in the eight Western Colorado counties Coloramo serves with the goal of attracting a few hundred users by the end of this year. Restivo admits that’s not an impressive number, but it’s big enough for the credit union to understand what works and what doesn’t before it begins pitching the product to other credit unions. Organizers have begun preliminary discussions with other credit unions, but the selling phase won’t come until later.

“There are roughly 4,000 credit unions in the United States, and the average credit union is on the smaller side,” Restivo says. “For a lot of folks, it can be difficult to deploy a digital product that does transactional banking with a debit card. It takes resources and money and leadership.”

As other credit unions sign on to offer the platform to their field of membership, those shops will earn the interchange income from the members onboarded through their field of membership. A portion of the interchange will go to Coloramo to cover administrative costs. There will be opportunities for participating credit unions to use the balances for liquidity as well, but Restivo cautioned it’s unlikely to be a major source of liquidity. The more realistic scenario, he said, is opening the door to younger consumers and establishing relationships that can grow over time.

“We want to create an environment that delivers banking the way they want it,” he says.