The effects from the coronavirus pandemic on the credit union industry have been significant, from a rise in the usage of digital payment methods to a shift in the ways in which members interact with their credit unions. One area in particular that experienced historic fluctuations is delinquency. PSCU the nation’s premier payments credit union service organization (CUSO) recently concluded a study of 20 credit unions, taking a deep dive into the fluctuations in delinquency during the last 18 months and how credit union performance was impacted. The findings are both surprising and telling.

The Study

PSCU randomly selected 20 credit unions from across the United States averaging $3.1 billion in assets. Ten of the credit unions were utilizing outsourced collections support for early-stage calls, while 10 were performing this function in house. PSCU set out to answer the following questions: Which credit unions fared best during the past 18 months, and what will the future hold for both those that utilize outsourced collections and those that do not?

As coronavirus emerged in early 2020, spending sharply dropped as consumers stayed at home and unemployment soared. This reduced spending enabled consumers to pay off debt. From December 2019 to June 2020, data for the 20 credit unions in PSCU’s study showed a 50% drop of 30-59 days delinquent accounts. As 2020 entered the third and fourth quarters, spending returned and so did early- stage delinquency. However, as coronavirus cases soared in late 2020 and into early 2021, an additional stimulus package and other factors including extended unemployment benefits, mortgage forbearance, and renter eviction moratoriums contributed to another steep decline in early-stage delinquency in early 2021.

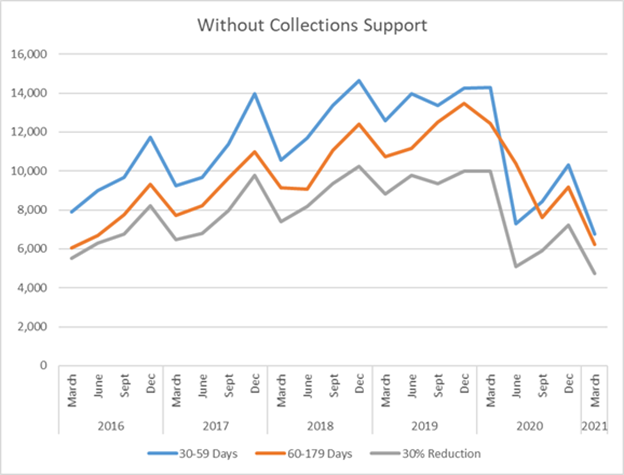

PSCU then divided this data by the 10 credit unions utilizing outsourced collections compared to those that were utilizing in-house resources. The data showed a dramatic difference: The credit unions not using outsourced collections were unable to consistently match the 30% drop in accounts from 30-59 days delinquent and 60-179 days delinquent, as shown in the below graph. In fact, since March 2016, performance-to-expectation has been eroding:

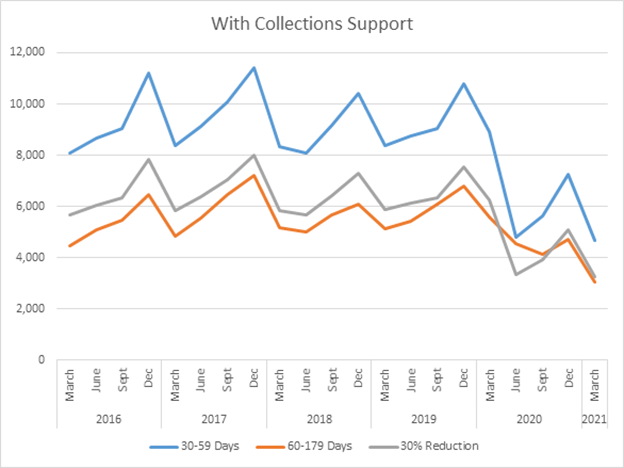

Credit unions that were utilizing outsourced collections saw much different performance, consistently meeting or exceeding the 30% benchmark, as shown in the following graph:

As fewer accounts were going into delinquency during this historic period, credit unions outsourcing collections reduced the work being sent to their vendor partners which, in turn, reduced expenses. Those that were performing the work in- house suddenly found themselves overstaffed while their expenses remained constant, as many credit unions tried to hold onto employees versus letting them go prematurely due to the uncertainty of the economy.

On the other hand, if delinquency were to suddenly spike to historic levels, credit unions outsourcing collections would immediately increase workflow to their partners, incurring only the added expense to work those additional accounts. Credit unions handling collections in-house would be faced with a need to hire and train staff quickly before the accounts flow through to charge-off. This rush to hire and train could also lead to increased compliance risk should inexperienced staff not handle member inquiries and needs as required and expected.

Looking Ahead

Bearing all of this data in mind, what does the future hold for delinquency? No one could have predicted, planned, and staffed for the delinquency pattern that emerged, and no one expects delinquency to remain as low as it has been recently. As vaccinations and the reduced number of coronavirus cases continue to help reopen the economy, some key dates all of which are still subject to change lie ahead that may add to delinquency in the near future. These include:

- National renter eviction moratorium ends on June 30

- Mortgage forbearance ends for most loans on June 30

- FHA mortgage foreclosure moratorium ends on June 30

- Enhanced unemployment insurance benefits expire on Sept. 6 (24 states have announced earlier expiration dates in June and July)

- Pandemic unemployment insurance benefits expire on Sept. 6

- Student loan deferrals end on Sept. 30

The pandemic brought awareness to the value of outsourcing collections to reduce costs versus keeping it all in-house. Credit unions would be remiss to not consider all options when determining their best plan of action for delinquency in the future.

Wendy Elieff oversees the success of the Client Service and Marketing teams for CU Recovery and The Loan Service Center, a PSCU subsidiary. Wendy has worked for CU Recovery for the past 22 years. She is responsible for developing, implementing and monitoring cohesive marketing strategies to increase brand awareness, as well as building and maintaining client relationships by staying abreast of and responding to changes in the credit union marketplace.