Dan McGowan joined Pioneer West Virginia Federal Credit Union($196.9M, Charleston, WV) as its CFO in late 2010 and became CEO in 2014. Economic distress in its marketplace, which covers 10 counties in West Virginia, and a heavily authoritarian management style had left the credit union with six-figure losses and an anemic loan-to-share ratio.

In this QA, McGowan discusses the challenges the credit union faced and how the organization has turned things around to become a profitable as well as enjoyable place to work.

What challenges was the credit union was facing when you joined in 2010?

Dan McGowan: As we closed out 2010, the credit union had its second year of six-figure losses. Employee morale was low and the loan-to-share ratio was approximately 62%. Basically, all our metrics were going in the wrong direction and the board decided a change was needed. The authoritarian, Theory X management style was just not working.

CU QUICK FACTS

Pioneer West Virginia FCU

Data as of 12.31.16

HQ: Charleston, WV

ASSETS: $196.9M

MEMBERS: 17,242

BRANCHES:7

12-MO SHARE GROWTH:-3.2%

12-MO LOAN GROWTH: 1.0%

ROA: 0.68%

The credit union had become a laughingstock in our area. The relationship Pioneer West Virginia had with the NCUA was contentious. In a short period of time, the top three positions in the credit union turned over. Dana Rawlings was the new CEO and I was the CFO. The path forward was clear for our new management team, we had to get the ship in order and turn things around.

With so much to do, how did the new team prioritize? Where did you start?

DM: The credibility issue came into play very quickly. We had trust issues on multiple levels and we understood we had to be open, honest, and approachable to engender trust among staff. There was cautious optimism among employees tempered by skepticism.

We also needed to focus on growing our loan portfolio. Our new leadership team had experience in the world of banking but were all converts to the credit union world. We brought an enthusiastic, aggressive competitiveness to the forefront we like to aggressively convert bank customers to credit union members and bring them all the benefits of the cooperative.

The credit union had a portfolio of $60 million of sub-optimized cash investments, so we went to work on getting those positioned into higher-yielding investments while we continued to build the loan portfolio.

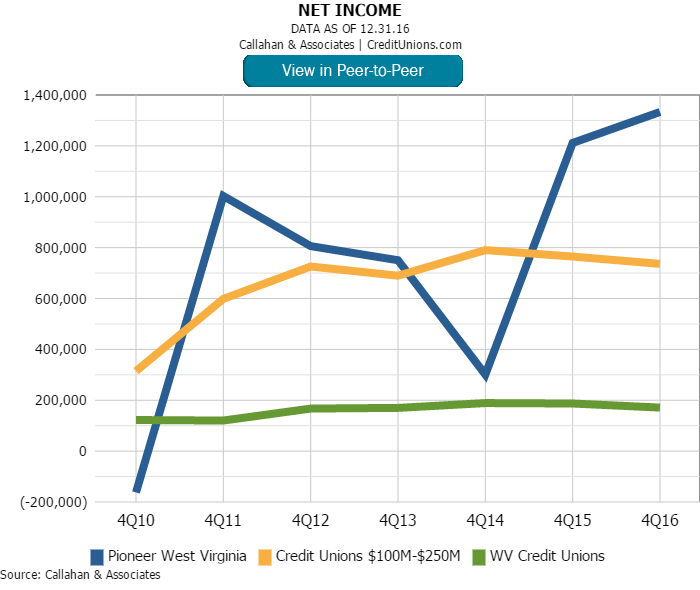

In 2011, we had a phenomenal year and went from six-figure losses to a seven-figure net income. Today we have a loan-to-share ratio of approximately 107% and have continued the positive momentum.

Click through the tabs below for a deeper dive into Pioneer West Virgina’s financial performance. Click on the graphs to view in Peer-to-Peer.

1. Loan-To-Share Ratio

2. Net Income

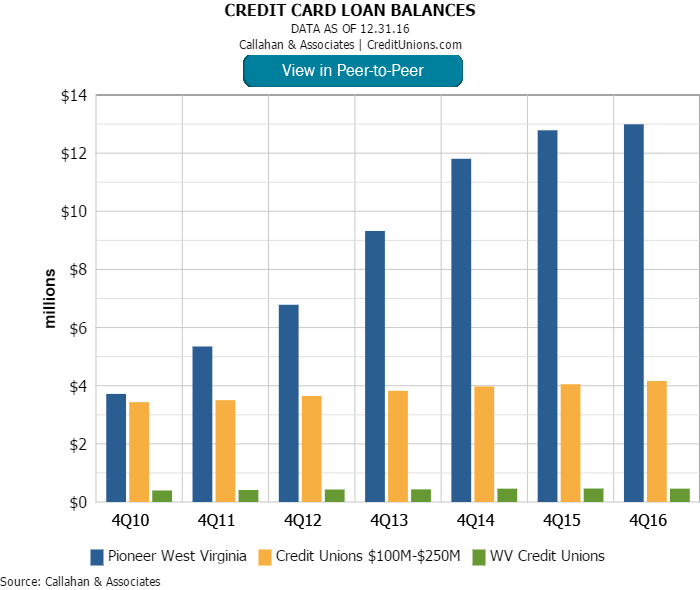

3. Credit Card Loan Balances

What specific changes made an immediate, positive impact?

DM: Going back to the human element, we had to start at the top with a vision of what we could do together. We wanted to let everyone know we could do bigger and better things, so we started by rolling the snowball. We pointed out small successes, and the snowball grew over time. My immediate predecessor sent emails to all employees with the title Can you believe? and pointed out specific successes that emphasized we are something special.

We also developed Today’s Pioneer Status Report the TPS Report to keep everyone engaged and paying attention to the vital areas of the business every day. It includes activities like loans made and call center stats. We start each day by examining where we are in the key areas. That daily awareness, not just monthly reports, keeps our staff focused.

We have the best deal in the nation for people who carry a balance on their credit card.

How did Pioneer West grow its loan portfolio despite the economic strain within the communities it serves?

DM: We believe in growing business by removing obstacles that are in front of members. We have the best deal in the nation for people who carry a balance on their credit card rates as low as 5.25% APR with a cap of 17.95%. Even on the higher-end of the scale, this is much better than the 24% rate or higher that members likely pay elsewhere. We don’t do teaser rates or charge balance transfer fees, we try to make it easy for members to bring their balances to us.

How Do You Compare?

How does your loan portfolio stack up against Pioneer West? How does it stack up against your peers? It’s easy to find out with Callahan’s Peer-to-Peer benchmarking software. Learn more today.

Our Financial Advocates, which is what we call loan officers or member services representatives, take the time to get to know each member’s situation and provide the best solutions. I recently met a member who was worried about her large credit card balance. She was responsible, but life events had led to debt. She qualified for our credit card and transferred the entire balance, saving on interest and monthly payments. She was fighting back tears of gratitude for what we had done for her, relative to what the banks were doing to her.

That’s why we call these staff members Financial Advocates instead of loan officers. We expect more from them than just lending. We want them to advocate for the members, to do something for people and to protect them.

Another member in her mid-50s had come to us concerned that she’d never be able to retire because she had so much debt. It wasn’t unusual debt a mortgage, student loans, a car, and credit cards. We ultimately bundled every penny of debt into one 10-year loan. This made it possible for the member to be completely debt-free by age 65. Not only that, we also reduced her overall debt payments by $2,000 a month so she can save for retirement. That’s an extra $240,000 over the next 10 years that will help her reach her goal of retiring on time. Those are the stories that make all of us at Pioneer West Virginia feel good about who we are and what we’re doing for our members.

She was fighting back tears of gratitude for what we had done for her, relative to what the banks were doing to her.

How did the credit union repair its relationship with others, the NCUA in particular?

DM: The previous CEO had a contentious relationship with the regulators, so we had to repair the damage. Being genuinely decent human beings is a good place to start. We tried to be candid and up-front as we talked with the regulators. It takes time to earn back trust, but once the examiners saw we were doing wise things and getting results, they felt more comfortable with us.

We have a superb relationship with the examiners now a number of them cycle through, and we always enjoy the interchange. One of the first things we say during the entrance interview is tell me what you see out there. These examiners are all over the country, so we like to pick their brains and have a tremendous amount of respect for them.

What advice do you have for a credit union experiencing similar challenges?

DM: A leader or a manager is only as good as the people who support them, so make sure you have good people on board and the right people in the right seats.

I had to make some adjustments when I got here, but giving people the support, encouragement, and infrastructure they need to be successful works. Also, reward staff with tangible rewards, not just a pat on the back, tied to the organization’s success.

And lastly, articulate your vision and inspire your staff. If they are proud to work for your organization, it will show and will lead to success.

When I joined the credit union, we had employees who didn’t want to wear our logo shirts out in public because they were ashamed of our reputation. In 2014, we did an employee survey and the first response was I am proud to work for Pioneer West Virginia.

That’s the bottom line for me.

This interview has been edited and condensed.