Top-Level Takeaways

- Solarity Credit Union has refocused its strategy using a buyer persona it calls “Engaged Elena”

- The credit union analyzes more than 200 data points per member to determine their persona

- Changes in segmentation and branching strategy has helped Solarity reduce employee turnover, improve member engagement, and bulk up products per member

In a financial landscape defined by choice, convenience, and digital speed, the credit unions that thrive are the ones bold enough to choose focus over familiarity. Solarity Credit Union ($813.7M, Yakima, WA) has let go of the idea that member service has to mean serving everyone equally, “…choosing instead to align the organization around serving its most engaged members, those who cooperate in the cooperative.

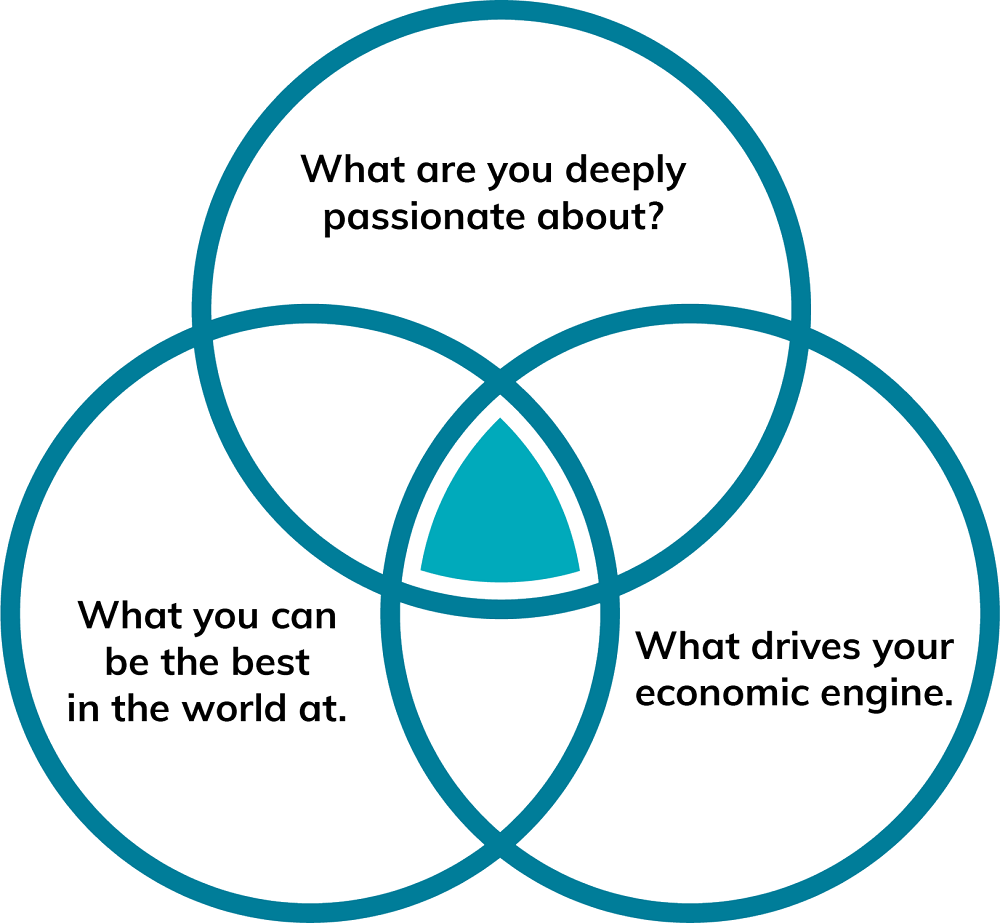

“You and your board have to get comfortable with the fact that you cannot and should not be all things to all people,” says Mina Worthington, president and CEO at Solarity. “Find where your credit union can be truly great, not just present, not just decent, but great. Then, go all in on that space.”

Aiming for greatness, Solarity built a segmentation model to identify its ideal member persona and has reengineered nearly every corner of the organization to serve those members better than anyone else.

Meet Dave And Elena

Solarity had toyed with member centricity since 2015, but it wasn’t until the pandemic hit that the cooperative made segmentation a major element of its strategy.

“We felt a sense of urgency at that point about understanding how members interact with us,” Worthington says. “We knew a lot of, but not all, members used online and mobile banking. We wanted to understand who was coming into the branch to do things they didn’t need to do in person.”

In 2020, Solarity created a buyer persona to represent a digital-first member, someone who conducts 95% or more of their transactions through digital and self-service channels. Focusing on the behaviors of “Digital Dave” helped the credit union understand which members were naturally drawn to digital banking and which ones still relied on branches at a time when physical access was limited.

Channel usage helped Solarity segment its membership for a time, but as it dove deeper into member-centric development, it discovered channel considerations weren’t enough, says David Eldred, chief experience officer at the Washington cooperative.

“So, we redid our segmentation methodology and came up with a different way of looking at our members,” Eldred says. “That’s where Engaged Elena emerged.”

Engaged Elena is a Latina woman between the ages of 38 to 42. She is married with two kids and tends to be a homeowner. She’s also very active with her debit card and prefers digital and self-service channels. In fact, she probably visits a branch three times or less per year.

“She belongs to a Claritas segment called ‘Fast Cash Families,’ which brings in additional external insight about her lifestyle and financial patterns,” Eldred says.

As the name suggests, Fash Cash Families generally need rapid access to funds. Although they are not necessarily below the poverty line, these households are often living paycheck to paycheck. This makes trustworthy and accessible financial services invaluable.

Solarity has names for other member personas, too. For example, a “Branch Betty” is a member who does all of their banking in person with staff assistance.

Behaviors, Not Guesswork

Solarity’s new segmentation system employs a two-by-two matrix based on engagement and sustainability. The credit union examines more than 200 data points per member, combining internal behavioral data with external demographic information.

“We looked at 10 million transactions pre-COVID to set our baseline,” Eldred says. “Every single member was plotted in this.”

The goal is to reflect what members actually do, not just what they say they do. The credit union found 34% of its membership falls into the highly engaged and sustainable quadrant, with Engaged Elena representing the bullseye of that target.

“She’s a personification of the ideal member,” Eldred says. “We make all of our decisions around what Engaged Elena wants.”

The CXO says this has made the credit union’s strategy more accurate, more actionable, and more aligned across departments.

CU QUICK FACTS

SOLARITY CREDIT UNION

HQ: Yakima, WA

ASSETS: $ 813.8M

MEMBERS: 48,557

BRANCHES: 6

EMPLOYEES: 132

NET WORTH: 16.9%

ROA: 0.45%

Perhaps the most obvious example of this shift of strategy is Solarity’s branch evolution. In the past five years, the institution has fully transitioned to tellerless branches equipped with non-video ITMs that handle 99% of traditional teller transactions without needing live video assistance. According to Eldred, 85% of members report that using these is “easy” or “very easy”, with 94% of members having a good experience using the kiosks.

Worthington says the goal wasn’t to cut costs by reducing staff but to improve member experience by freeing up staff for more complex services. In fact, according to the CEO, the credit union didn’t reduce staff at all; it took them off the teller lines, trained them, and promoted them.

“When Engaged Elena walks in, she has a problem or a situation she wants to talk about,” Worthington says. “That’s why the human support still matters.”

Results And Refinement

Two years since shifting its strategy, employee turnover has dropped by 50%.

“The front line used to be our most challenging as far as maintaining staff,” Eldred says. “The satisfaction of being able to spend more quality time with members results in greater job satisfaction.”

That job satisfaction also comes in the form of new internal career paths and promotion opportunities. Instead of tellers, the credit union now has financial guides, relationship guides, and personal advisors. In turn, these new career and promotion paths have improved member experience, with deeper relationships and more cross-selling, Worthington adds.

At Solarity, the average number of products and services per member has increased from 4.5 to 6.11. In recent surveys, 75% of members reported their interactions with staff were “high value” where the employee “made a difference” during their interaction. It’s also led to improved fraud mitigation and prevention.

“It is sometimes difficult to quantify, but we get tidbits and anecdotes, and we estimate that hundreds of thousands of dollars have been saved,” Eldred says.

Bold moves will always require certain trade-offs, but Solarity’s leadership says these moves were worth making. Such moves also require constant refinement and internal communication.

“We are realigning ourselves to the strategy as an executive team on a quarterly basis,” Worthington says.

In addition to scheduling quarterly touchpoints, Solarity updates member data weekly to track migration across the engagement spectrum, allowing the credit union to make decisions based on the most recent insights.

“An example is monitoring those ‘Branch Betty’ type members as they became more and more digital and self-service,” Eldred says. “Watching members evolve their behavior has been interesting.”

Your Next Great Idea Is A Webinar Away. Build off the insights of industry experts and take your credit union to the next level. Callahan Webinars show you how, and with a robust library of archived events and multiple live webinars each month, there is no shortage of valuable ideas at your fingertips. Learn how to engage employees, foster a stronger credit union, better serve members, and more. Don’t miss out — click here to gain access.