At all U.S. credit unions, net interest income covers approximately 91.5% of total operating expenses. However, net interest income at individual institutions fluctuates based on economic factors such as the rate environment.

When rates come down there’s a general tendency for margins to squeeze, says Steve Murray, CFO at Members 1st Federal Credit Union($3.01B, Mechanicsburg, PA). The longer they are low, especially as they have been over the last eight years, the more margins get squeezed, so we’re constantly looking for other means of income to supplement the ebb and flow of the net-interest margin and net-interest income.

To augment its net interest income, Members 1st operates insurance and mortgage settlement CUSOs as well as an investment services group. They also earn non-interest income in the form of deposit and loan account service fees, courtesy pay, interchange fees, and other general fees.

And for more than 15 years, the credit union has originated mortgages specifically to sell on the secondary market and earn non-interest income.

Fee Generation And Risk Mitigation

According to Murray, the credit union’s average mortgage loan runs between $100,000 and $300,000. It sells between 70 and 100 mortgages per month for a total of $20-$21 million each month in mortgages sold, or a little more than $250 million per year.

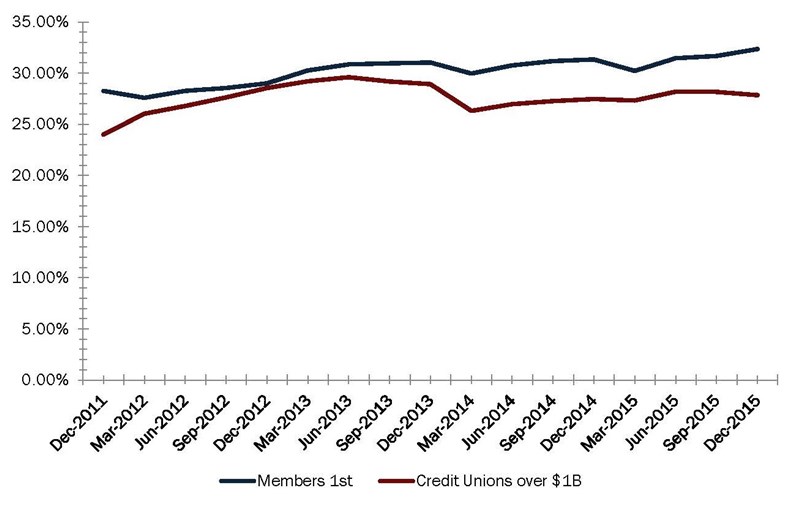

The strategy has certainly boosted the credit union’s non-interest income. For the year 2015, the credit union’s annualized non-interest income of nearly $51.5 million represented 32.36% of its total income. These totals beat the performance of asset-based peers by nearly $20 million and 4.5% respectively.

Save Time. Improve Performance.

NCUA and FDIC data is right at your fingertips. Build displays, filter data, track performance, and more with Callahan’s Peer-to-Peer analytics.

The strategy also offers interest rate and liquidity risk mitigation benefits. Placing hundreds of 20-, 25-, or 30-year mortgage loans on its books introduces risk in an uncertain rate environment. Selling them alleviates that risk.

Plus, selling the loans provides Members 1st with a source of liquidity to continue lending and growing.

We can’t sustain putting long-term mortgages on our books and keep growing, Murray says. But by selling, we increase liquidity.

According to Murray, the credit union booked $3.6 million in mortgage fee income in 2015, approximately $2.8 million of which was sale premiums.

How Members 1st Sells Mortgages

Members 1st is a SEG-based institution that serves more than 7,000 members within seven southcentral Pennsylvania counties. Out of common courtesy to its members, the credit union always notifies borrowers upfront that the credit union might sell their loan.

We don’t want them to think we were going to keep and service their loan and then sell it to somebody five minutes later, Murray says.

NON-INTEREST INCOME / TOTAL INCOME VS $1B+ PEERS

For all U.S. credit unions | Data as of 12.31.15

Callahan Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan Associatesc

The credit union underwrites loans according to secondary market guidelines, and it sells primarily to US Bank, SunTrust, and the Federal Home Loan Bank of Pittsburgh. It makes the loan available for sale, locks directly with the investor when the rate is set, sells the loan before it gets to the credit union’s books, and waits for buyer funding.

If there are no extenuating circumstances, we sell our longer term mortgages on the secondary market, Murray says. Otherwise we put it in our own portfolio. But those are few and far between.

For example, the credit union offers a construction-to-permanent loan that it once held in portfolio. Now, the credit union uses the FHLB’s MPF program to sell them.

Not Retaining Servicing

The credit union utilizes the services of a third party, Midwest Loan Services, to service the majority of their portfolio loans for the sake of efficiency.

If Members 1st retained servicing, Murray says, the credit union would have to build up its support staff. Releasing the servicing means it doesn’t have to add operational expenses.

Read Find your next partner in Callahan’s onlinecBuyer’s Guide.cBrowse hundreds of supplier profiles by name, keyword, or service area.

Currently, the credit union has a group of loan officers and processors who put together the loan packages and close the loans.

These employees must keep up with new and changing rules, regulatory or operational, as well as changes in pricing. They also work closely with MidWest. And Members 1st has a thorough list of qualifications it prefers in its servicer.

They have to be able to do everything, Murray says.

Everything in this sense applies to not only serving the loan capably, but also creating reports, answering member questions, and notifying members with additional information when necessary.

Members 1st also plans to plans to expand its mortgage sales process by dispatching a new team of mortgage loan originators into a Pennsylvania county not currently within its branch footprint. That, Murray hopes, will allow the credit union to continue growing.

Maybe we’ll be able to sell $300 to $400 million per year, he says.

You Might Also Enjoy

- A Strategy To Build Non-Interest Income One Transaction At A Time

- Clear Connections Emerge Between CUSO Activity And Diversified Earnings

- Hype The Swipes To Boost NII