New York City has the highest concentration of United Nations employees, retirees, and affiliate organization members in the United States. It’s also home to United Nations Federal Credit Union ($4.4B, Long Island City, NY).

Washington, DC, however, has the second-highest concentration and is home to the country’s largest UN advocacy group, the United Nations Association of the United States of America (UNA-USA), whose headquarters are within a stone’s throw of the White House. When UNFCU added members of UNA-USA to its field of membership in 2014, it prompted the credit union to expand into the nation’s capital to more conveniently serve this membership base.

That expansion coincided with the credit union’s focus on what chief lending officer Eric Darmanin calls “controlled loan growth.” A timely initiative, considering UNFCU reported loan growth of 2.55% in the first quarter of 2013. According to data from Callahan Associates, that’s below the 6% reported by its asset-based peer group.

From NYC To DC

At the time of the expansion, UNFCU was not unfamiliar with the District of Columbia. There are double-digit UN-affiliated agencies there, and credit union employees had for years traveled from New York to DC for assorted presentations, meetings, and seminars. But opening a new outpost, especially one nearly four hours away on a good traffic day from its principle locations, required the organization to smartly coordinate its operations and collaborate across departments.

CU QUICK FACTS

United nations FCU

DATA AS OF 12.31.15

HQ:Long Island City, NY

ASSETS: $4.4B

MEMBERS: 116,716

BRANCHES: 5

12-MO SHARE GROWTH: 3.67%

12-MO LOAN GROWTH: 18.7%

ROA: 0.60%

“We worked with many resources throughout the credit union,” Darmanin says. “Facilities, accounting, legal, IT, branch operations, and, of course, lending.”

The credit union opened two offices in the DC-metropolitan area, both LEED certified and consistent with the UN’s and UNFCU’s global sustainability objectives. The first, on 18th and H streets, is a near-full-service branch that opened in the spring of 2014. The branch lies in close proximity to the majority of UN organizations, according to Darmanin.

UNFCU’s other DC-area location opened in the spring of 2015 in Tysons Corner, VA, just a few miles west of the city proper. Unlike its downtown counterpart, the office in Tysons Corner is strictly focused on mortgage production.

According to Darmanin, UNFCU selected Tysons Corner to best serve the UN community and because the rent was more reasonable than DC where a square foot of rented class-A office space fetches $54.53 a month, reports the National Real Estate Investor yet the location still brought the credit union closer to the District.

The Staff

Because each location has different objectives, UNFCU staffed the offices differently, too.

When the DC office opened, it had a local director of mortgage that brought more than 15 years experience to the credit union. UNFCU also hired two experienced local loan officers and relocated two member service representatives from New York City.

“It was important to combine new talent with knowledge of the community with experienced staff from UNFCU who were able to bring our culture to the new office,” Darmanin says. “That diversity of culture and experience provides tremendous value to our operations and our community.”

In Tysons Corner, the credit union hired additional loan officers and two sales assistants.

The DC and Tysons Corner offices share three processors and two underwriters who work from the Tysons Corner location. And although staff members from UNFCU’s headquarters offer loan closings and additional support, most of the personnel needed for the loan process reside in the DC-area.

“We wanted local operations supporting the sales team because we felt market knowledge from both a sales and operations perspective would make us most competitive,” Darmanin says. “This decentralized operation is an extra value-add we bring to loan officers when we try to recruit them.”

UNFCU hires outside loan officers when it makes sense and looks for culturally diverse individuals to mirror its own membership.

“Our staff represents who our members are,” Darmanin says. “Together, our employees in DC and Tysons Corner can speak eight different languages.”

It also looks for hires with at least five years of experience who can bring in existing networks of potential members. The credit union can then leverage these existing networks and focus more time and resources on pipeline management rather than on distributing and tracking leads and marketing.

Controlled Loan Growth

Each location offers loan products the credit union portfolios as well as those it sells on the secondary market. But because both New York City and Washington, DC, are high-cost markets, the credit union tends to originate higher average loan amounts, including jumbo loans.

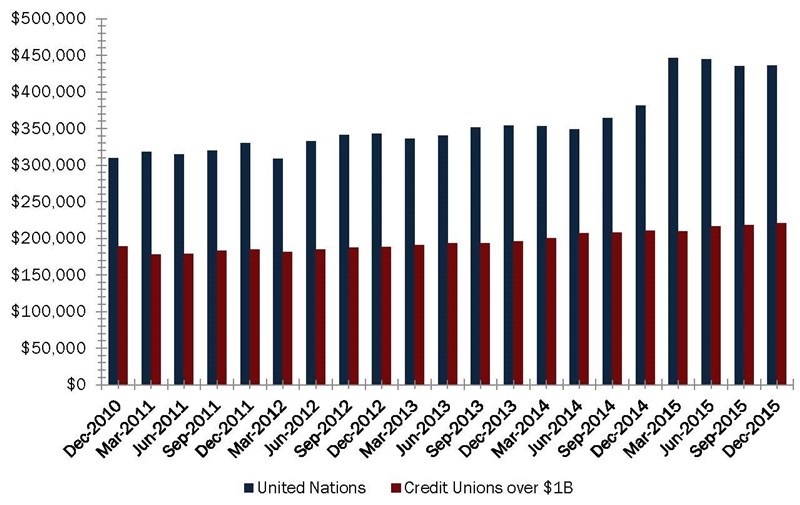

As of fourth quarter 2015, UNFCU’s average first mortgage origination of $435,865 was nearly 50% greater than the $220,779 average originated by its asset-based peers.

AVERAGE FIRST MORTGAGE ORIGINATION

For all U.S. credit unions | Data as of 12.31.15

Callahan Associates | www.creditunions.com

But with expensive real estate comes affordability challenges. So in late 2014, UNFCU started taking advantage of Fannie Mae’s 97% loan-to-value financing options. The credit union has for many years also worked closely with its mortgage insurance partners to offer affordable, low-down payment options to first-time homebuyers.

Overall, lending at the institution has picked up considerably. Based on fourth quarter data from Callahan Associates, UNFCU posted year-over-year loan growth of more than 18.73%. Much of that was driven by mortgages. And according to Darmanin, the credit union’s year-over-year increase in mortgage volume for 2015 was 167%. Of that growth, its DC and Tysons Corner locations contributed 63%.

The DC office has also contributed, as planned, to gains in deposits and consumer loans, Darmanin says.

“One of the reasons we put member service representatives in the office was so the focus would not be solely on mortgage loan production,” he says. “Mortgage loans are the lead product, but we are able to offer all our services to our members.”