In the age of AI, RPA, shrinking margins, and regulatory pressure, financial leaders must focus on innovation as much as margin management. That’s the sweet spot for Kelli Wisner-Frank, chief efficiency officer at Community Choice Credit Union ($1.9B, Farmington Hills, MI).

Wisner-Frank joined Community Choice in 2001 as an accounting manager after working in the automotive industry, where she focused on traditional accounting and financial reporting.

“Transitioning to the credit union space required a shift in mindset, learning which key performance indicators truly matter, understanding the importance of member service, and appreciating how financial decisions impact tens of thousands of members,” she says. “That early exposure to both the financial and service sides of the organization shaped my leadership approach and ultimately led to my current role.”

Although she’s been an essential part of the Michigan cooperative’s executive team for many years as chief financial officer, last year her role rebranded slightly to chief efficiency officer.

What’s the story behind your title?

Kelli Wisner-Frank: Our strategic plan is built around several key strategic initiatives, including efficiency, growth, convenience and access, and engagement. Last year, we intentionally restructured our leadership model to more clearly support each pillar of the plan.

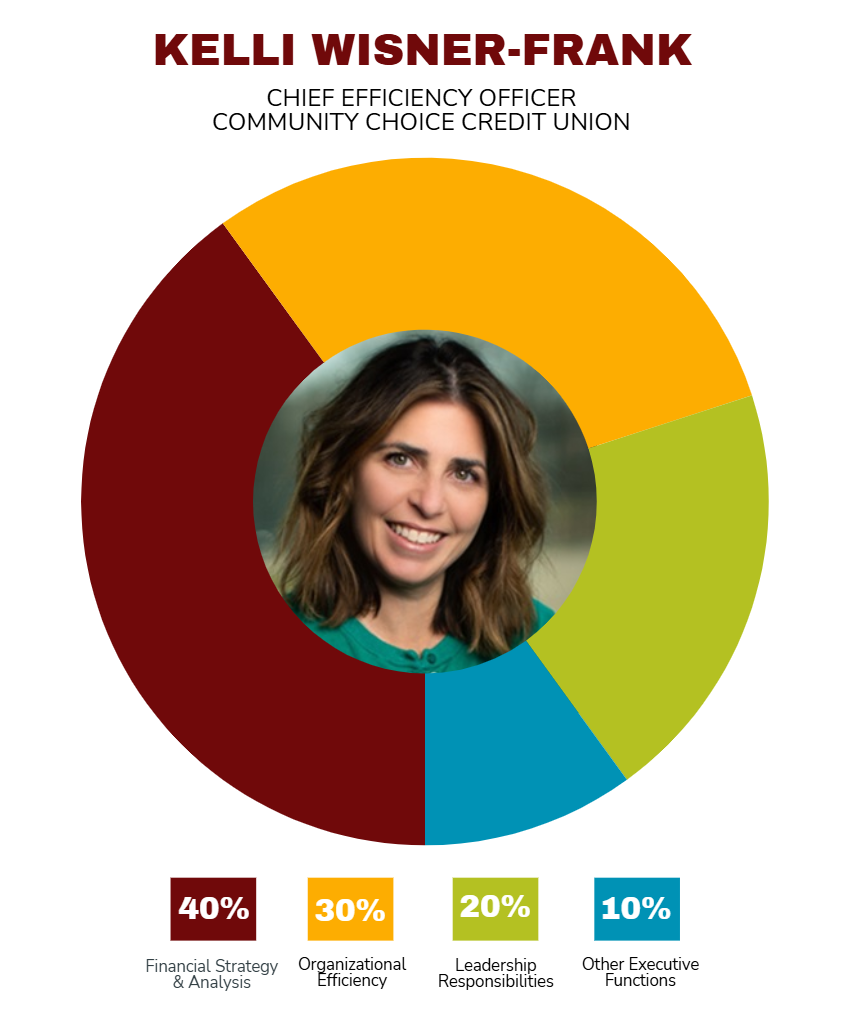

As part of that shift, my role evolved from chief financial officer to chief efficiency officer. The title reflects a broader mandate — not just overseeing financial performance but actively driving organizational efficiency as a core strategic priority.

How would you describe your primary responsibilities and focus under the new role?

KWF: I remain accountable for the financial accuracy, stability, and overall fiscal health of the credit union. However, the role now goes beyond traditional bottom-line results. My focus is on ensuring that we deploy the dollars we spend wisely and maximize returns through not only margin but also smarter ways of working. That includes leveraging process automation and AI tools to streamline workflows, reduce friction, and limit the need for incremental staffing as we grow.

Financial leadership can no longer focus solely on reporting and margin management. To continue delivering strong bottom-line results, credit unions must aggressively manage costs, and the most sustainable way to do that is through efficiency.

What is the No. 1 skill you need to do your job well?

KWF: Strong financial acumen remains essential, but a close second is a continuous-improvement mindset. The ability to constantly question how work is done and how it could be done better is critical to driving sustainable efficiency across the organization.

What part of your role energizes you? Conversely, what part challenges you the most?

KWF: What energizes me most is seeing tangible progress toward greater efficiency. This year, efficiency is our most important organizational goal, with a strong emphasis on saving time by rethinking how we work. We implemented a tracking system that allows team members to capture time saved by improving, redesigning, or even eliminating processes that no longer add value. Seeing those incremental wins add up is incredibly motivating.

The biggest challenge is ensuring that efficiency gains in one area don’t unintentionally create inefficiencies elsewhere. It requires strong cross-functional collaboration and a systems-thinking approach to make sure improvements benefit the organization as a whole.

How does your role and your team contribute to the success of the credit union in ways people might not think of?

CU QUICK FACTS

COMMUNITY CHOICE CREDIT UNION

HQ: Commerce City, CO

ASSETS: $95.8M

MEMBERS: 6,384

BRANCHES: 2

EMPLOYEES: 14

NET WORTH: 15.0%

ROA: 0.32%

KWF: The teams I lead serve as internal problem-solvers and efficiency-enablers. We have subject matter experts who partner with other departments to resolve operational challenges, address complex member issues, and develop creative solutions to long-standing problems. Although much of this work happens behind the scenes, it has a direct impact on both member experience and employee effectiveness.

How do you define success in your role?

KWF: I define success through productivity and efficiency key performance indicators. Many of those KPIs are derived from the budget and performance targets I help establish. When we achieve those goals while maintaining service quality and financial strength, I consider that a job well done.

Why do credit unions need this role?

KWF: In today’s environment of AI, robotic process automation, shrinking margins, and increasing regulatory pressure on fee income, the traditional CFO role must evolve. Financial leadership can no longer focus solely on reporting and margin management.

To continue delivering strong bottom-line results, credit unions must aggressively manage costs, and the most sustainable way to do that is through efficiency. A role dedicated to driving efficiency ensures that innovation, automation, and smarter processes intentionally align with financial strategy.

This interview has been edited and condensed.

Job titles say as much about the organization as they do the person. “What’s In A Name” on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Read the series today.