I see my current work as an extension of what I did before. Payments, fraud, and support channels all carry inherent risk. Now I’m not just assessing it, I’m leading the teams that handle it. That creates real-time risk visibility where it matters.

Todd Link’s title — chief member services officer — might sound like a traditional executive role. But dig into the structure at Dupaco Community Credit Union ($3.5B, Dubuque, IA), and a strategic reshuffling of priorities becomes evident.

Link spent a decade as the Iowa cooperative’s chief risk officer — for which he headed up remote delivery — before moving into the member services role in February. His portfolio now includes card services, enterprise operations, contact center, fraud services, mortgage quality control, and facilities — basically every area where direct member interaction meets complex institutional risk. His leadership underscores a core credit union truth: success depends not just on technology, but on making every transaction and interaction both safe and seamless. That’s especially true in the payments space, where convenience must walk hand-in-hand with compliance and risk management.

From embracing real-time rails like FedNow Service to rethinking how internal processes align with member service, Link is helping lead his shop through change at the critical, complex intersection of service, innovation, and risk.

Here’s what he has to say about his role, his path, and where payments are heading.

Why and when did Dupaco create the role of chief member services officer?

Todd Link: The role came out of an ongoing organizational redesign. I was already working closely with areas like card services and the contact center — places on the front lines of member interaction. As Dupaco evaluated how we deliver service, it made sense to shift enterprise risk management and compliance and bring more member-facing service areas under one umbrella.

We’re aiming for consistency in member support, regardless of how someone contacts us. Whether it’s a phone call, digital chat, or a card dispute, the experience should feel unified. This structure helps us connect the right work with the right teams and in doing so supports both member needs and institutional efficiency.

We’re also building out a centralized service model that can scale. We’re not there yet, but the early signs show it’s the right path for our members and our staff.

Did Dupaco design the role around your background?

TL: The transition was specific to me, but the underlying process was broader. Across the organization, we reviewed the work of each department and asked where it should live to best serve members.

For me, shifting from a risk role into operations wasn’t a huge leap. I see my current work as an extension of what I did before. Payments, fraud, and support channels all carry inherent risk. Now I’m not just assessing it, I’m leading the teams that handle it. That creates real-time risk visibility where it matters.

How is this role an evolution of your previous responsibilities?

TL: People often see risk and member service as opposite ends of the spectrum, but they’re two sides of the same coin. In both, you’re looking to prevent issues, protect members, and create consistency.

Now, instead of overseeing enterprise-level risk, I’m embedding risk management directly into operational workflows. That’s especially crucial in payments and fraud prevention — areas constantly targeted by bad actors. Having that layered oversight means we can catch issues faster and design processes with both security and service in mind.

CU QUICK FACTS

DUPACO COMMUNITY CREDIT UNION

HQ: DUBUQUE, IA

ASSETS: $3.5B

MEMBERS: 173,038

BRANCHES: 23

EMPLOYEES: 613

NET WORTH: 11.9%

ROA: 0.54%

What challenges and opportunities does your role address?

TL: Members today expect both high-tech and high-touch. That means we need to serve them however and whenever they prefer — through branches, online, or in between. And we need to do it efficiently because that’s what allows us to deliver strong loan and deposit rates.

There’s an ever-growing demand for digital capabilities, but it’s not a binary choice between branches or apps. It’s both. Digital complements our physical presence, not replaces it. My role is about making sure the service across all those touchpoints is smooth, consistent, and secure.

What payments strategies has Dupaco put in place?

TL: Payments are where the relationship lives. If you’re the place members trust to move their money, you’re likely the place they trust for everything else. That’s why we’re investing in speed, safety, and flexibility.

We’ve always had strong digital tools, and now we’re preparing for FedNow. At the same time, we’re navigating the fraud risks that come with instant payments and P2P platforms. The good news? Real-time AI fraud tools are getting better, allowing us to stop bad transactions before they cause harm. That’s where innovation and risk management intersect.

How do you work across the enterprise?

TL: Alignment is everything. Siloes kill strategy. To deliver on any member-service initiative, we have to collaborate across departments — from marketing and member experience to digital to data analytics.

A major shift has been how we manage and use data. Instead of each department owning its own silo, we’re moving toward a centralized repository. That helps with decision-making, compliance, member targeting — everything. We’ve seen firsthand how much faster and smarter we operate when everyone’s working off the same data set.

How do you work beyond Dupaco’s walls to advance your initiatives?

TL: We’re lucky to have board support to stay active in industry groups and networks. That external engagement gives us access to shared innovations — like using AI for back-office automation — that we can adapt internally.

Collaboration across institutions isn’t optional anymore. It’s how we all keep pace with the speed of change and avoid reinventing the wheel. In payments, fraud prevention, and member support, we learn a lot from one another.

What makes you a great fit for this role?

TL: I’m a lifelong learner. I read business journals, research, trade publications — anything I can get my hands on. Decisions should be rooted in data and understanding. That’s especially true in a role like mine that balances risk, operations, and member satisfaction.

I encourage others to study how the system works, from the Fed to NCUA to market forces. The better we understand the full picture, the better we can lead inside our credit unions.

How did your background prepare you for this?

TL: I’ve got a wide academic background — bachelor’s degree, master’s degree, and most of a PhD in human and organizational performance. I’m also a graduate of the Stonier School of Banking and the Wharton Leadership Program, and I’ve held various board roles.

But it’s not just about credentials. It’s about using that knowledge to connect dots between people, systems, and strategies. Understanding both the big picture and the day-to-day is what this role demands.

Who do you report to, and who reports to you?

TL: I report directly to our president and CEO, Joe Hearn. Departments reporting to me include card services, deposit ops, fraud services, IRA, contact center, member services, and several others — many via middle managers. It’s a broad span, but the common thread is they all touch the member and carry operational risk.

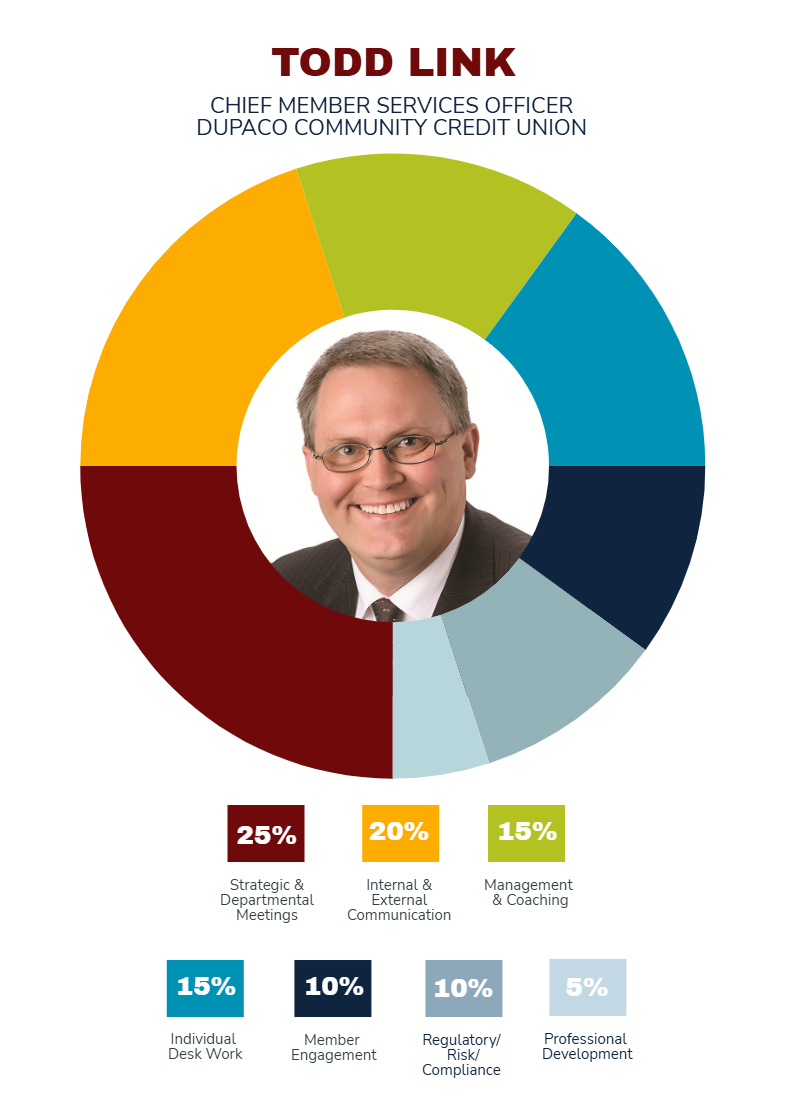

What’s your daily routine?

TL: There isn’t one. I might start with a team huddle and end with a nonprofit board meeting. Some days are driven by urgent calls or issues that surface unexpectedly.

I make it a point to stay close to member feedback. I even take escalated calls. It’s not about firefighting — it’s about finding friction points and routinely fixing them. That keeps me grounded in what really matters for our members.

How do you define success?

TL: At a macro level, we track success through personal, departmental, and organizational goals — all aligned to our strategic plan. But on a day-to-day level, success is when we’ve made life easier for a member and safer for the credit union at the same time.

How do you stay informed?

TL: I start my day with business news, read the Wall Street Journal daily, and spend evenings diving into deeper research or trade insights. I’m an HBR loyalist and stay active on boards to keep learning from peers. I also hold multiple industry certifications — staying sharp isn’t optional in a role like this.

This interview has been edited and condensed.