Rogue Credit Union ($1.5B, Medford, OR) made creating the most loyal members in the nation a strategic focus in 2008. It even has an executive slot committed to it.

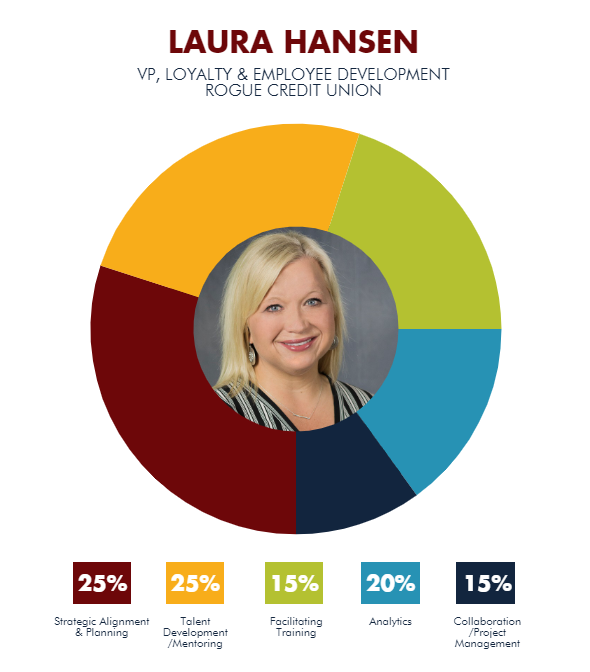

Laura Hansen has filled the role of vice president of loyalty since 2014. In 2017, she added employee development to her portfolio.

“Both departments complement each other,” Hansen says. “We are able to seamlessly couple technical and soft skill development with our loyalty culture training.”

Here, Hansen shares insight on the work life of an executive responsible for building and sustaining the high regard her credit unions members feel toward their member-owned financial cooperative.

What qualifications made you a great fit for this job?

Laura Hansen: I have a degree in innovation and leadership from Southern Oregon University. I’ve interned on Capitol Hill with the U.S. Senate and have completed Net Promoter Score certification. Our president/CEO said I was chosen because of my ability to influence, inspire, lead, and get stuff done. This is critical for someone in this role. My strong public speaking skills and political background were additional assets to the leadership role.

What’s your daily routine?

LH: My day is often filled with meetings and projects between the two departments. Plus, I’m often called into meetings for collaboration or insight.

I review NPS survey data and ensure timely follow-up with our members. I take coaching calls or offer feedback to one of the four employees I mentor. I also do weekly one-on-one meetings with my direct reports in addition to my daily interaction with them.

I block time on my calendar to review and prepare reports or staff communications and to plan for trainings and meetings. Additionally, I try my best to make time daily to read a relevant article or two to stay on top of the industry

I also engage with employees in other departments. Engagement and trust are important in this role. I enjoy getting to know the employees of our Rogue family. I am intentional in recognizing and appreciating others. These are the top two employee motivators that should be practiced daily.

Describe your interactions with different departments and your work directly with members.

LH: I often meet with teams to help them focus on creating loyalty through exceptional service. I oversee the Loyalty Ambassador program, which represents every department and team at Rogue. I train everyone in the organization as it pertains to loyalty, so I’m fortunate to be connected to every department in the organization.

I occasionally speak directly with members either to help resolve an issue or to receive praise from a member regarding an experience with Rogue. Because of my role here, community members reach out to me for assistance or if they have issues. I’ve also been known to show up at a branch just to interact with members or show them how to use our express teller machines. It’s important to stay connected to the channels our members use so I can empathize with them should issues arise. I also interact with members at our annual meeting and volunteer events.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

How do you track success in your job?

LH: The success of my team is my No. 1 priority as a leader. When they win, I succeed. When I assist in the development of others, we succeed.

Transparency is key at Rogue. We have key metrics from our department business plans that we track on an organizational dashboard. We have an annual Net Promoter Score goal of 73. NPS is an indicator of how likely our members are to recommend Rogue to their friends, family, and co-workers. We are currently at 80, which is approaching best in class.

Most importantly, if were serving the needs of our members, exceeding their expectations while remaining financially sound and investing in the communities we serve, thats the true measure of success.

Who do you report to? Who reports to you?

LH: I report to our chief administration officer, Karen Zerger, who oversees both of my departments, among others. I also report indirectly to our entire leadership team. Their guidance and support have been instrumental to my success. They empower me to do the right thing and believe in my abilities, which drives me to do my best.

The employee development manager and loyalty assistant report to me. Our employee development manager oversees two trainers, one instructional designer, a management/soft skills trainer, and an administrative assistant. Our loyalty assistant manages our overall NPS survey program.

How do you stay current with topics that fall under your role?

LH: I attend experience conferences such as Qualtrics as well as NPS and CUNA ELL conferences. I’m a big fan of articles from Harvard Business Review, LinkedIn, Filene, nwcua.org, CreditUnions.com, CUInsight.com, The Financial Brand, and Credit Union Journal. A few of my favorite leadership books are Multipliers, Five Dysfunctions of a Team, Emotional Intelligence 2.0, The Resonant Leader, and anything by Brene Brown. I have Google alerts set up for NPS, member/customer service, and credit unions in general. It’s important to stay on top of our ever-changing environment.

This interview has been edited and condensed.