Texas Trust Credit Union ($2.0B, Arlington, TX) bridges the gap between day-to-day branch operations and broader organizational goals with a role dedicated to retail quality control.

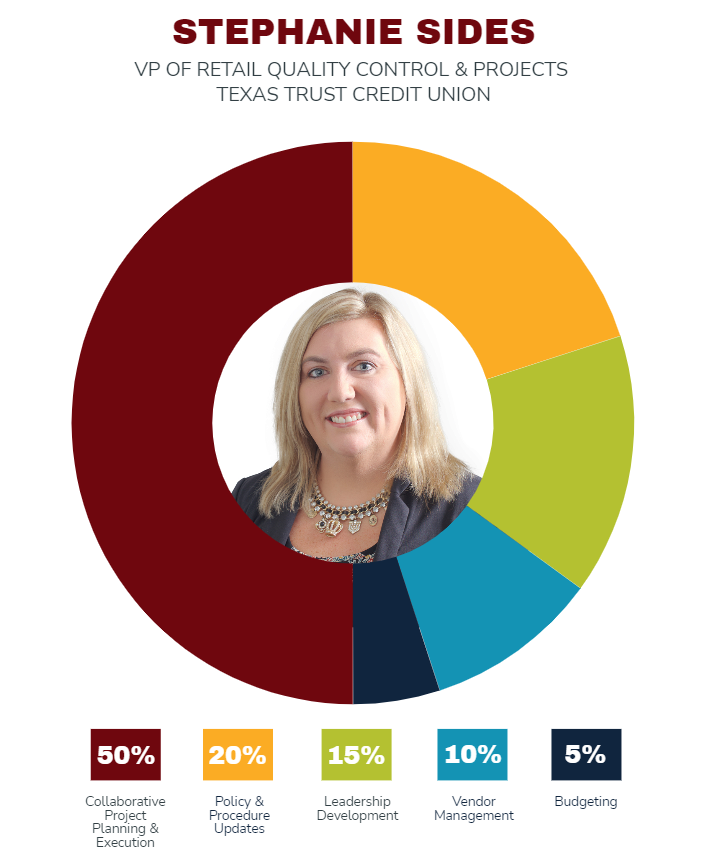

As the vice president of retail quality control and projects, Stephanie Sides works to ensure smooth communication across 21 locations, integrates operational expertise into new products and services, and guides process improvements that make it easier for members to engage with the credit union.

Here she describes more about her position.

Why did Texas Trust create this retail quality control role?

Stephanie Side: Texas Trust created this position in 2013 following rapid growth. The credit union built nine new branches and undertook several mergers within a four-year period. That pace of growth created operational challenges that required a dedicated retail resource to manage the resulting operational needs.

Did the credit union create this role for you, specifically?

CU QUICK FACTS

TEXAS TRUST CREDIT UNION

HQ: Arlington, TX

ASSETS: $2.0B

MEMBERS: 138,090

BRANCHES: 21

EMPLOYEES: 319

NET WORTH RATIO: 10.0%

ROA: 0.18%

SS: The position existed before I stepped in. However, as an AVP of branch operations, I worked closely with the previous vice president of retail quality control and projects since 2018, which gave me great insight into the job.

How is your new role different from that AVP role?

SS: As an AVP of branch operations, I oversaw multiple locations and evaluated the needs of branches, members, and employees. Because of that experience, I have a first-hand perspective of what our employees need to create a positive member experience. In my current role, I collaborate with other departments in the development and execution of projects, such as our digital banking conversion, to ensure the branch viewpoint is considered.

What challenges and opportunities does your role address?

SS: Retail banking is evolving. My position allows us to stay current with trends so we can remain competitive and forward-thinking. Almost all our organizational projects impact retail in some way — the most challenging part is communicating changes across 21 locations.

To address this, we use multiple channels and post updates to a designated retail intranet page that everyone can access. We also have regular virtual meetings to communicate across the department.

Share, loan, and membership growth at Texas Trust has been challenging since the pandemic. Those numbers appear to be ramping back up now. What is your role in helping that upward momentum continue?

SS: The biggest factor in driving upward momentum is process improvement. We want to make sure it’s easy for our members to do business with us and make sure our processes are easy for employees to perform their jobs.

That might sound simple, but process improvement can include technology, procedures, branch design, and ever-changing operations. My role is to stay current on what’s happening throughout the credit union and make sure our branch operations are looking ahead and keeping pace with the growth.

What projects and strategies do you have in place toward that goal?

SS: As an organization, we strive to deliver exceptional service and financial solutions to delight and inspire our loyal members. We’re enhancing our current products and services, overhauling our retail training program, and reviewing our current procedures to achieve this.

How do you work across the enterprise to execute strategies and projects?

SS: Many of the projects involve multiple departments, so it’s important to communicate with all stakeholders throughout the organization. I meet with several departments on a regular basis to plan and allocate resources for upcoming projects.

Job titles can say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

What makes you a great fit for the job?

SS: I’m a lifelong learner. I learn something new every day in this position, which helps strengthen our retail team’s operational performance. I also enjoy the collaboration with other departments, which is crucial to executing a cohesive strategy.

Who do you report to and who reports to you?

SS: I report to the senior vice president of retail delivery. I have a branch manager that reports to me, which allows me to stay updated on branch operations and receive member feedback. I also work closely with our retail support and development team, which serves as an internal “help desk” for the branches.

What’s your daily routine at the credit union?

SS: My days mostly consist of meeting with other business units to understand how we will effectively implement changes. When I’m not planning for retail projects, I might be working on vendor management, budgeting, updating procedures, or meeting with a branch manager from one of our 21 locations. Each day is different depending on the needs of the department and organization.

How do you track success in your job?

SS: Success in my role is determined by meeting project deadlines and earning positive feedback from our members and employees.

How do you stay current with topics that fall under your role?

SS: I’m an avid reader. I follow a number of industry resources, such as Callahan & Associates and Creditunions.com, and I attend as many roundtable discussions as I’m able to as well as listen to podcasts and webinars. I also follow other credit union professionals on LinkedIn to keep up with what’s trending.

— This interview has been edited and condensed.