University of Michigan Credit Union ($1.2B, Ann Arbor, MI) is leveraging the power of the written word to polish its presentations and present its brand in a professional, yet personal, light.

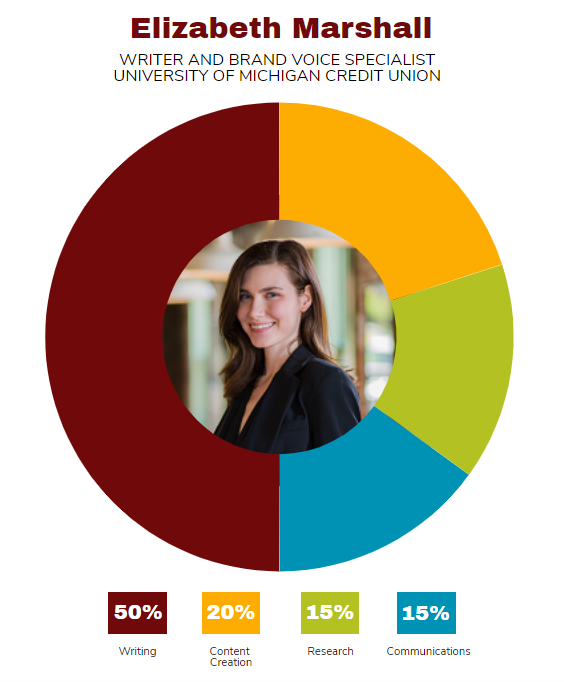

To support that effort, UMCU leans on the talents of Elizabeth Marshall, a 2016 graduate from its sponsoring university who came aboard in June 2020 as the credit union’s first designated writer and brand specialist.

Here, Marshall describes what comes with being responsible for creating a consistent brand tone and voice while providing written communications across multiple channels at her member-owned financial cooperative.

Why did UMCU create the title and role of writer and brand specialist?

Elizabeth Marshall: UMCU identified the need to use writing to help humanize the brand and make it more approachable while still keeping the professionalism of a trusted financial institution. That required a writer with marketing and strategizing experience who could transition the brand voice to be professional but conversational. The credit union designed the role to be more than a copywriter position. In addition to focusing on full-time writing responsibilities to create consistent messaging across the entire organization, it has the dual role of evolving the voice and tone of UMCU’s overall brand.

Did the credit union create the role for you specifically?

EM: No. It just worked out that my experience matched the role.

What challenges and opportunities for the credit union does your role address? How do you address them?

EM: Our brand and community development department has grown rapidly in the past several years. To keep pace, there was a need for someone solely dedicated to developing and implementing a consistent brand voice across all of UMCU’s marketing and communication channels.

There was a great opportunity to overhaul all communications to evolve the brand voice to reflect a professional, yet conversational, tone. The challenge was to be strategic and consistent with our use of marketing language across all channels, including internal and external communications and marketing assets.

Download the job description for University of Michigan Credit Union’s writer and brand voice specialist. Then, visit the Callahan Policy Exchange to see more job descriptions as well as access documents, templates, and policies for every department in today’s credit union enterprise.

Describe what you do in your role.

EM: I write the internal and external copy for all of our organization’s marketing and communications assets. For each asset whether it be an ad for a partnership with the University of Michigan or the Detroit Lions or a member communication about a new product, service, or benefit I am in charge of our brand’s voice. Essentially, I am in charge of how we communicate our brand to audiences both familiar and unfamiliar with us. It’s my job to demonstrate UMCU’s value while ensuring our brand is recognizable, creative, unique, and humanistic.

I also produce copy for all marketing materials, internal and external communications, press releases, financial education documents, quotes, website copy, and more.

CU QUICK FACTS

University Of Michigan Credit Union

DATA AS OF 12.31.20

HQ: Ann Arbor, MI

ASSETS: $1.2B

MEMBERS: 105,129

BRANCHES: 14

12-MO SHARE GROWTH: 27.2%

12-MO LOAN GROWTH: 11.0%

ROA: 0.48%

Who do you report to? Who reports to you?

EM: I report to the brand team manager, Scott Chamberlain. This position currently does not have any direct reports.

What makes you a great fit for this job?

EM: I have a bachelor’s degree in journalism and nearly seven years of experience working in content creation, branding, and marketing. I’ve worked for non-profits, not-for-profits, and startups as a brand manager, marketing director, and marketing consultant. My experience building, modifying, and updating brands as well as creating content and writing across a variety of platforms, audiences, and media lends itself well to this role.

Talk a bit more about your specific areas of responsibility?

EM: I’m responsible for maintaining the integrity of the brand voice. I’m also responsible for writing copy across all of our print, digital, and social channels for a variety of audiences. This includes but is not limited to emails, press releases, video descriptions, video keywords, promotional materials, advertisements, proposals, campaign copy, website copy, and copy for other digital platforms like online banking and our mobile app. It’s my responsibility to ensure this copy is relevant, engaging, informative, cohesive, and consistent as well as SEO-friendly.

What’s your daily routine at UMCU?

EM: No two days are alike at UMCU, and my routine reflects that. Each morning I review my tasks and prioritize what to tackle first. I block my time based on what projects take priority over others. In between brainstorms and meetings, I try to make as much progress as possible on those projects.

During the day, there are always emails, last-minute requests, deadline changes, and new assignments to factor into my workload. Despite the ever-evolving nature of a workday, I appreciate that we have such a dynamic team that can take on any challenge and deliver a quality asset every time. At the end of my day, I reprioritize my tasks for the following day. Then, I do it all over again.

How has the COVID-19 pandemic affected what you do at UMCU?

EM: Like many organizations, the pandemic has affected how we reach our audience. With in-branch services transitioned to drive-thru only and several campaigns pivoted from an in-person approach to a digital-first attitude, we’ve had to switch tactics by increasing our digital impression and using our limited methods of contact to let our audience, members, and communities know we are still here for them during this uncertain time.

UMCU has focused on giving our members as many resources and financial relief assistance options as possible, including several communications surrounding the CARES Act, stimulus payments, small business loans, personal loans, payment programs, financial education workshops, and social distancing banking solutions.

I interviewed and was hired in the beginning of the pandemic, so I’ve been entirely remote the length of my career at UMCU. Not being in person made the learning curve a bit steeper, but I’ve been fortunate to work with a collaborative and patient team.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

How does your role improve member service?

EM: Providing an unparalleled member experience is the foundation of everything we do at UMCU. Ensuring our membership, and our community at large, has the financial and educational services it deserves is our priority.

I work with several departments within our organization to ensure members have the resources they need to make informed decisions and understand all the benefits of their membership. I also provide our member service representatives with the details of member communications around promotions, campaigns, services, and new products so our member service is as unified and seamless as possible. We use member feedback to ensure our communications reflect their questions, comments, and concerns.

How do you track success in your job?

EM: I track success by the responses we get from members. We highlight our members and team members in features on our social channels. To hear how we have helped members or brought some joy to their day makes me feel that our hard work is improving people’s lives. I live in Ann Arbor and can see our influence in the community. Seeing the result of our work in person versus analyzing metrics is much more rewarding because I can see the impact we make on the people we help.

How do you stay current with topics that fall under your role?

EM: I make time to stay updated on emerging marketing trends in the financial institution and credit union space. I attend local, state, and national webinars that offer insight into our market and target audience, with a focus on how to reach an audience where they already are and anticipating their needs.

Studying other credit unions and financial institutions to see how they are interacting with their audience is a great way to stay current with topics that fall under my role. How these organizations brand themselves and stand out from the crowd is a great model.

Writing is fluid and changes for each platform and audience, so I don’t subscribe to just one resource. But the best way to stay current is by listening to our team members who work directly with our members because they understand better than most what our members want.

As well, my brand team members bring a great deal of insight to their respective areas of expertise, so I lean on them to keep me informed.

This interview has been edited and condensed.