Exit Interview: Hank Hubbard, One Detroit Credit Union

The veteran leader and Motor City hype man looks back on a career centered on living the “people helping people” philosophy.

The veteran leader and Motor City hype man looks back on a career centered on living the “people helping people” philosophy.

A new board strategy at Affinity Plus FCU results in new levels of engagement and diversity.

Governance improves when credit unions pay attention to the structures (form) underlying their governance practices (function).

Constructive action and positive impact are the product of a board engaged in servant leadership — the true calling of a Class A board.

From tweaking communication strategies to embracing diverse perspectives, here’s how three leaders are adjusting to new roles.

Strategic plans should be developed in constructive partnership between a credit union’s board and senior management.

It takes the right people, the right tools, and the right processes to create a data-driven culture.

A veteran CEO is onboarded once again and shares how he — and the process — have evolved.

To ensure they are properly fulfilling their duties, credit union directors typically consult with a variety of stakeholders, but there’s one source of assistance directors might not have considered.

As spring planning sessions get underway, these are the questions credit union leaders need to be asking to ensure maximum impact.

Four executives share how they are skilling up and soothing nerves as they navigate the AI revolution in real time.

The future of leadership starts now. This week, CreditUnions.com is diving into the strategies shaping tomorrow’s talent: from a bold overhaul of succession planning to how credit unions are tackling the AI skills gap.

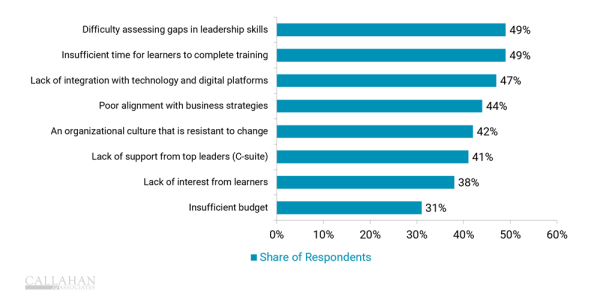

Assessing skills gaps among leaders and providing time to complete training are major hurdles today, but strong leadership development strategies are essential in building a future-ready credit union.

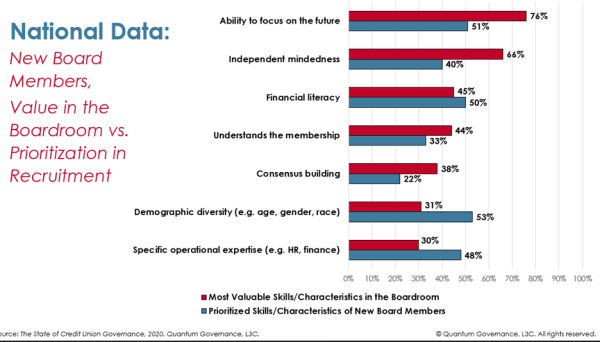

A report from Quantum Governance reveals a gap between board recruitment priorities and the most valuable skills in governance.

Fair, transparent succession helps credit unions strengthen board effectiveness, align leadership with strategy, and safeguard member value.

The California cooperative moves beyond the 9-box to identify skills, gaps, and opportunities to prepare leaders for what’s next.

The right tools and consistent approach make succession planning simpler for credit union leaders and board members.

CreditUnions.com revisits three credit unions to learn how their strategies have evolved since their original spotlight and see what’s in store for the future.

A national leader in urban agriculture shows how front-line insights drive real local impact — and why credit union branches are perfectly positioned to do the same.

Kirtland Credit Union’s five-tiered scoring system and rigorous approval process might look like red tape, but it’s streamlining resource allocation and improving efficiency for credit union for growth.

5 Valuable Governance Guidelines To Adopt Today