Uncertainty Grows For Credit Unions Tied To Government Employees

A substantial portion of the industry is built around serving federal government employees. With federal jobs potentially in jeopardy, credit unions are preparing diverse responses.

A substantial portion of the industry is built around serving federal government employees. With federal jobs potentially in jeopardy, credit unions are preparing diverse responses.

The industry newcomer brings a deep history of development and networking to OnPath Foundation.

A partnership between a North Florida credit union and United Way’s local 211 service addresses an array of social challenges while establishing the cooperative as a trusted local resource.

Stay up-to-date with the latest changes, opportunities, and compliance requirements for CDFIs, including certification, grants, and legislative updates for 2025 and beyond.

Heritage Family Credit Union launches a low-rate lending program to increase the availability of area affordable housing.

Lake Trust Credit Union is driving statewide entrepreneurial spirit with a loan program that has provided more than $22 million in funding.

A partnership between the Michigan-based credit union and a local shelter is changing lives and gradually expanding to other parts of the state.

For some members of Tongass FCU, the nearest branch can be a plane ride away. Local “microsites” have improved service for those remote locations.

The Boost Center by Blue combines the work of local non-profits and Blue FCU to promote health, wealth, and happiness.

Tax season is just around the corner, and two low-income credit unions are gearing up their tax-preparation services.

A radical shift is taking place in the way consumers move money and engage with their financial institution.

How the Michigan-based cooperative’s “Culture of Finance” curriculum is reframing financial education.

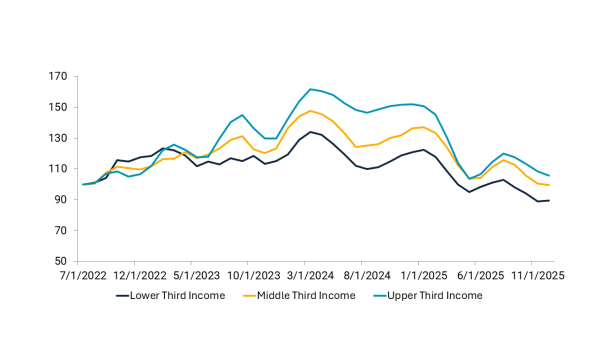

The gulf between the haves and the have-nots has widened in recent years. Credit unions can help members catch up.

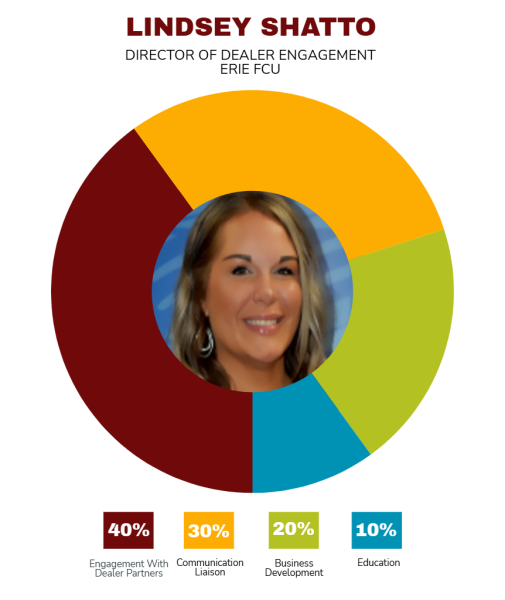

As many credit unions pull back from indirect lending to manage the balance sheet, Erie FCU is leaning in. By elevating dealer engagement to a dedicated role, the cooperative is investing more resources in a business line others are rethinking.

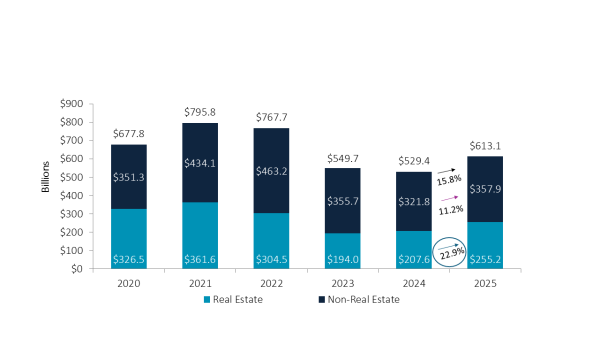

As the Federal Reserve cuts interest rates, credit unions are adapting in tandem, balancing membership needs with asset quality. This balance will be one of many topics discussed during Callahan’s quarterly Trendwatch webinar.

Callahan & Associates provides an early look at quarterly performance results. Sneak a peek at the latest trends here.

On-site coverage at the National Association of Latino Credit Union Professionals’ 2026 conference explores how representation, emotional experience, and community trust are converging to shape the future of credit unions.

Look beyond the headlines to better understand what is driving current market trends and how they could impact credit union investment portfolios.

This year’s finalists are reimagining how credit unions use data to boost service levels and improve efficiencies.

In order to adopt a more proactive strategy, the Iowa cooperative is using a dedicated product development team to promote visibility and follow-through from idea to launch.