Industry Performance: Shares (4Q21)

Consumers spent at pre-pandemic levels through the second half of the year.

Consumers spent at pre-pandemic levels through the second half of the year.

The sports analysts at Callahan & Associates wrap up March Madness with predictions based on credit union performance data. Which team will reign supreme?

After stepping up to serve medical marijuana dispensaries, VSECU is positioned to lead the state in banking services for an explosion in recreational sales.

The lasting effects of the COVID-19 pandemic — and the national economic response to it — linger on credit union financial statements.

Chad Knott helps Credit Union ONE keep up with the market by tracking trends and promoting innovation across the enterprise.

Mortgage lending helps drive the loan portfolio to new heights while membership engagement deepens at cooperatives over the decade following the Great Recession.

A monthly collection of Callahan content that, together, addresses a single topic from a variety of perspectives.

Accurate, current data with real-time alerts is key to addressing fraud risk through today’s deposit channels.

Two credit unions with double-digit share growth offer insight into how they are attracting, and keeping, money in the cooperative.

Coastal Federal Credit Union’s Go Green checking account pays dividends based on debit activity … and that’s it.

A radical shift is taking place in the way consumers move money and engage with their financial institution.

How the Michigan-based cooperative’s “Culture of Finance” curriculum is reframing financial education.

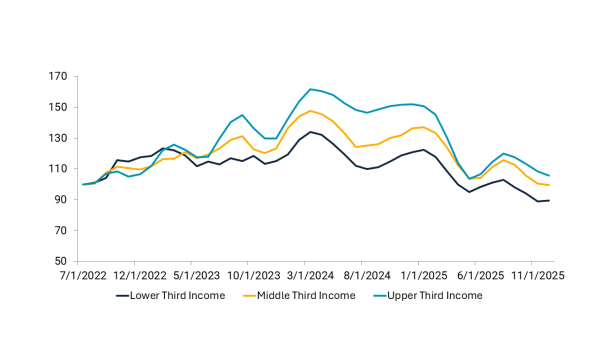

The gulf between the haves and the have-nots has widened in recent years. Credit unions can help members catch up.

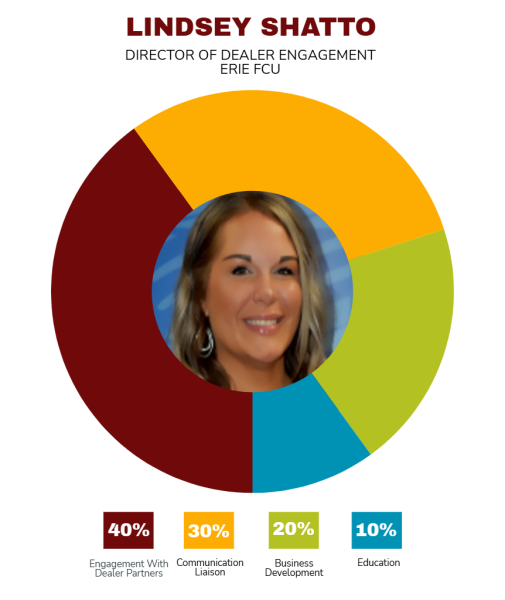

As many credit unions pull back from indirect lending to manage the balance sheet, Erie FCU is leaning in. By elevating dealer engagement to a dedicated role, the cooperative is investing more resources in a business line others are rethinking.

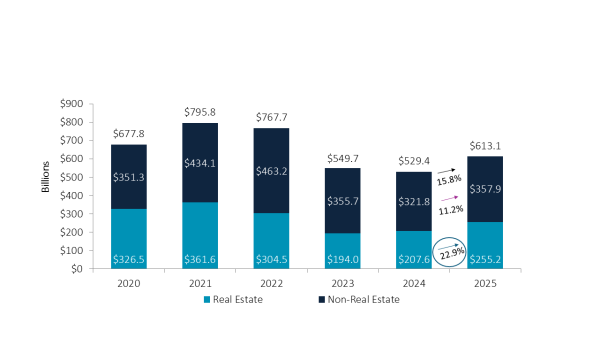

As the Federal Reserve cuts interest rates, credit unions are adapting in tandem, balancing membership needs with asset quality. This balance will be one of many topics discussed during Callahan’s quarterly Trendwatch webinar.

Callahan & Associates provides an early look at quarterly performance results. Sneak a peek at the latest trends here.

On-site coverage at the National Association of Latino Credit Union Professionals’ 2026 conference explores how representation, emotional experience, and community trust are converging to shape the future of credit unions.

Look beyond the headlines to better understand what is driving current market trends and how they could impact credit union investment portfolios.

This year’s finalists are reimagining how credit unions use data to boost service levels and improve efficiencies.

In order to adopt a more proactive strategy, the Iowa cooperative is using a dedicated product development team to promote visibility and follow-through from idea to launch.