How To Navigate Risks And Evaluate Your Credit Card Program

Credit card loans have a higher risk profile than any other loans on the balance sheet. Now is the time to perform due diligence on your credit card assets.

Credit card loans have a higher risk profile than any other loans on the balance sheet. Now is the time to perform due diligence on your credit card assets.

Credit card delinquencies have reached a post-recession high; meanwhile, first mortgage delinquencies have hit an all-time low. What gives?

More than one-third of cardholders have increased credit card spending in the past six months. What do you need to know about these consumers?

Now is the time to meet member needs while earning income.

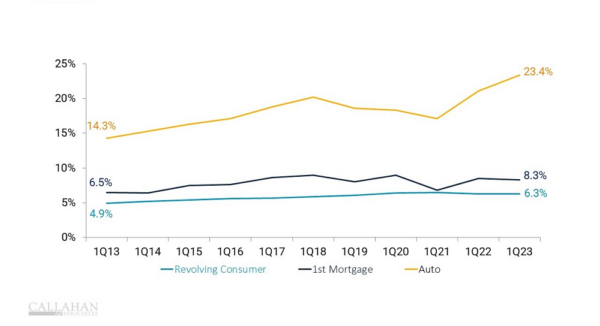

Credit unions increased market share for auto originations in the first quarter, but that wasn’t true across the board.

This session, presented by TRK Advisors and Elan Credit Card, will explore how credit unions are competing against dominant credit card issuers and what to expect in 2023.

How can credit unions protect the planet and encourage members to do the same?

Financial institutions have a wealth of data available to generate insights to inform difficult decisions about how to adapt and thrive in real time.

After seeking a credit card to use during a semester abroad, a college student laments that her credit union couldn’t meet her needs as well as a fintech.

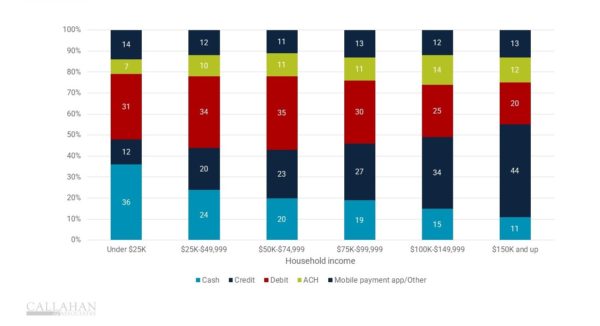

A report from the Federal Reserve finds cash payments have stayed consistent in recent years, but households of modest means are less likely to use other payment methods.

Credit card loans have a higher risk profile than any other loans on the balance sheet. Now is the time to perform due diligence on your credit card assets.

Credit card delinquencies have reached a post-recession high; meanwhile, first mortgage delinquencies have hit an all-time low. What gives?

More than one-third of cardholders have increased credit card spending in the past six months. What do you need to know about these consumers?

Now is the time to meet member needs while earning income.

Credit unions increased market share for auto originations in the first quarter, but that wasn’t true across the board.

This session, presented by TRK Advisors and Elan Credit Card, will explore how credit unions are competing against dominant credit card issuers and what to expect in 2023.

How can credit unions protect the planet and encourage members to do the same?

Financial institutions have a wealth of data available to generate insights to inform difficult decisions about how to adapt and thrive in real time.

After seeking a credit card to use during a semester abroad, a college student laments that her credit union couldn’t meet her needs as well as a fintech.

A report from the Federal Reserve finds cash payments have stayed consistent in recent years, but households of modest means are less likely to use other payment methods.