Credit Unions Deliver Impact. Members Are Here For It.

Better rates, lower fees, and steadfast community presence are returning real financial results for the credit union movement.

Better rates, lower fees, and steadfast community presence are returning real financial results for the credit union movement.

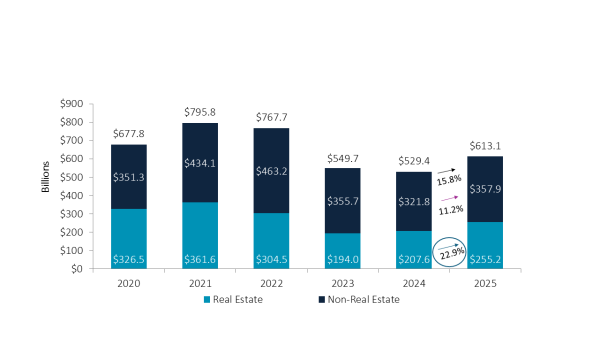

Credit union performance in the third quarter echoed that of the second, with continued tightening of liquidity, diminishing ROA, and deteriorating asset quality.

Will it be the D-Backs or Rangers in this year’s Fall Classic? Callahan’s credit union data could have the answer.

Strong certificate demand and higher cost of funds boosted annual dividends per member to $153 in the second quarter. What’s happening in other member engagement metrics?

Ongoing interest rate increases have driven credit unions to raise dividend payouts to keep funds in-house.

The sports analysts at Callahan & Associates wrap up March Madness with predictions based on credit union performance data. Which team will reign supreme?

In honor of International Credit Union Day, a look at how credit union dividends have shifted over time and why a rebound might be just around the corner.

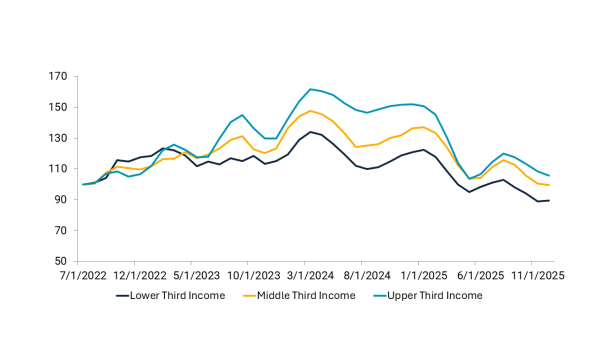

Inflation and international trade sanctions cast shadows over member spending behavior in the near future.

Six credit unions talk about their strategies to offer members an annual payback while still ensuring adequate coverage in loan loss accounts.

This Fourth of July, Callahan & Associates is celebrating patriotically named credit unions with a look at how they return value to their member-owners.

A radical shift is taking place in the way consumers move money and engage with their financial institution.

How the Michigan-based cooperative’s “Culture of Finance” curriculum is reframing financial education.

The gulf between the haves and the have-nots has widened in recent years. Credit unions can help members catch up.

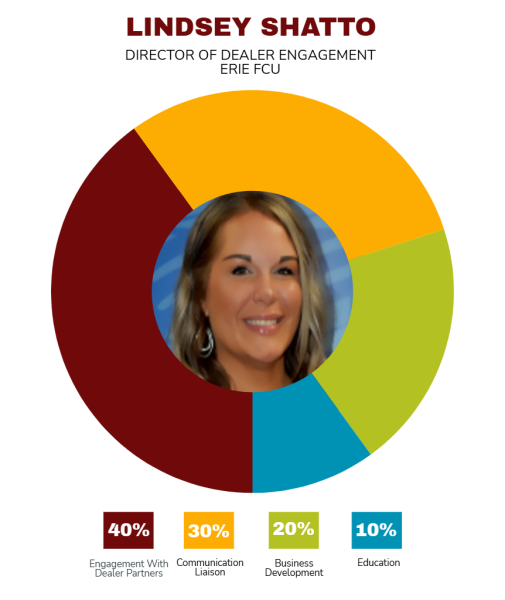

As many credit unions pull back from indirect lending to manage the balance sheet, Erie FCU is leaning in. By elevating dealer engagement to a dedicated role, the cooperative is investing more resources in a business line others are rethinking.

As the Federal Reserve cuts interest rates, credit unions are adapting in tandem, balancing membership needs with asset quality. This balance will be one of many topics discussed during Callahan’s quarterly Trendwatch webinar.

Callahan & Associates provides an early look at quarterly performance results. Sneak a peek at the latest trends here.

On-site coverage at the National Association of Latino Credit Union Professionals’ 2026 conference explores how representation, emotional experience, and community trust are converging to shape the future of credit unions.

Look beyond the headlines to better understand what is driving current market trends and how they could impact credit union investment portfolios.

This year’s finalists are reimagining how credit unions use data to boost service levels and improve efficiencies.

In order to adopt a more proactive strategy, the Iowa cooperative is using a dedicated product development team to promote visibility and follow-through from idea to launch.