GreenState Foundation Invests In Data To Improve Its Community

A partnership with United Ways of Iowa is uncovering insights about employed community members who struggle under limited assets and constrained income.

Our Purpose page is your central resource to explore strategies that elevate products and services from run-of-the-mill commodities to powerful tools that support members and communities and set credit unions apart from competitors.

A partnership with United Ways of Iowa is uncovering insights about employed community members who struggle under limited assets and constrained income.

Steph Harrill Kyle helps UW Credit Union take a holistic approach to doing business by the cooperative principles.

A dashboard at Marine Credit Union helps the Wisconsin cooperative focus on member and community impact.

A college loan can be, and often is, the foundation of a long-lasting relationship between a member and a credit union.

Three ways credit union understandings and practices have changed.

In episode No. 635, Callahan senior industry analyst Michelle Parker shares how credit unions in Iowa, Arkansas, Ohio, and Mississippi lead the nation in mortgage lending growth.

Why participants of the program say Callahan’s Leadership Team Development is boosting their performance and success rate.

Legal fine points for credit unions interested in creating a charitable foundation.

The California credit union gained the framework for team collaboration on innovation through the Callahan Leadership Team Development program.

The chief financial officer of First Community in Texas talks about questioning authority, the regulatory environment, and the future of credit unions.

Five data points from this week on CreditUnions.com.

The latest news should be good for credit unions invested in the failed corporates, but lack of regulator clarity makes it hard to know what’s really going on.

The vice president of human resources at SECU of Maryland shares insights on managing HR through organizational change, branch modernization, and shifts in brand and culture.

A cross-functional team comprising nearly 20% of staff helped the Maryland-based credit union manage the crisis while staying focused on helping members.

When money stops making sense, people suffer a crisis of financial confidence. Now’s the time to reconnect with members to help them establish long-term stability.

From the teller line to the corner office, CEO Cheryl Sio’s story spans five decades of industry transformation and enduring leadership lessons.

Structured protection strategies provide potentially higher long-term total returns than bonds while muting the volatility and downside risk traditionally associated with equities.

The CEO of Peninsula Community Federal Credit Union highlights how active listening and lessons from the basket court shape a culture of inclusive banking that serves members and employees.

Look beyond the headlines to better understand what is driving current market trends and how they could impact credit union investment portfolios.

Four executives share how they are skilling up and soothing nerves as they navigate the AI revolution in real time.

The future of leadership starts now. This week, CreditUnions.com is diving into the strategies shaping tomorrow’s talent: from a bold overhaul of succession planning to how credit unions are tackling the AI skills gap.

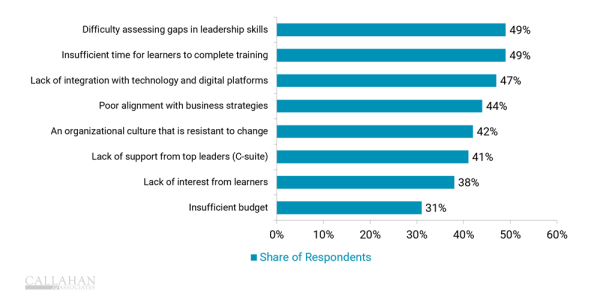

Assessing skills gaps among leaders and providing time to complete training are major hurdles today, but strong leadership development strategies are essential in building a future-ready credit union.

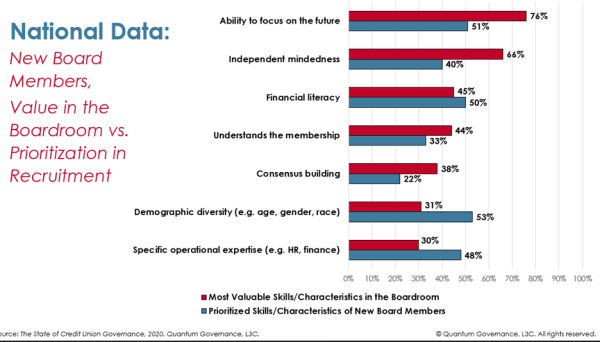

A report from Quantum Governance reveals a gap between board recruitment priorities and the most valuable skills in governance.

Leadership Team Development: Elevating Credit Unions’ Daily Operations