The Rise Of The Machines

How automated automobiles threaten to disrupt American society and the credit union business.

How automated automobiles threaten to disrupt American society and the credit union business.

A new approach to member service helps credit unions better understand the underlying needs of members and serve them more effectively.

Only in a culture that celebrates process and smart risk-taking does true innovation take root.

The need for credit unions has perhaps never been greater for the average American household.

To better serve our fellow Americans, we must look closely at the “unbanking” phenomenon that is gripping our new middle class.

No credit union in America has come close to the bottom-line financial results of Arrowhead Credit Union’s 3.75% ROA for both 2011 and 2012.

Co-Ops for Change is crowd-sourcing data on each corporate credit union’s portfolio that was taken to collateralize the NCUA Guaranteed Notes (NGN).

Changing market dynamics mean that credit unions have to redouble their efforts to secure their position as members’ go-to financial provider.

The spotlight is on credit unions from coast to coast during the Credit Union Cherry Blossom Ten Mile Run in Washington, DC.

Four can’t-miss data points featured this week on CreditUnions.com.

A cross-functional team comprising nearly 20% of staff helped the Maryland-based credit union manage the crisis while staying focused on helping members.

Four executives share how they are skilling up and soothing nerves as they navigate the AI revolution in real time.

The future of leadership starts now. This week, CreditUnions.com is diving into the strategies shaping tomorrow’s talent: from a bold overhaul of succession planning to how credit unions are tackling the AI skills gap.

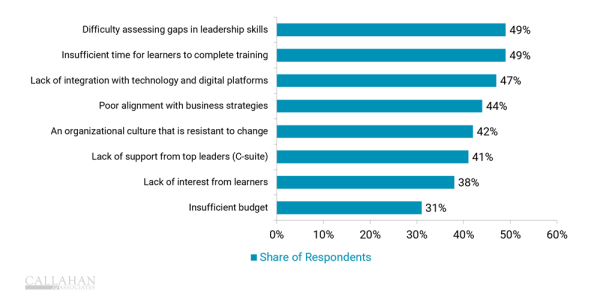

Assessing skills gaps among leaders and providing time to complete training are major hurdles today, but strong leadership development strategies are essential in building a future-ready credit union.

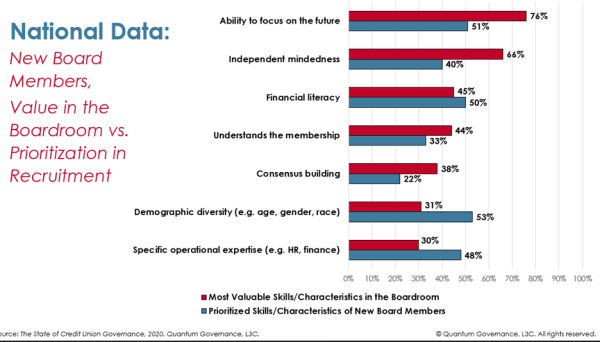

A report from Quantum Governance reveals a gap between board recruitment priorities and the most valuable skills in governance.

Fair, transparent succession helps credit unions strengthen board effectiveness, align leadership with strategy, and safeguard member value.

The California cooperative moves beyond the 9-box to identify skills, gaps, and opportunities to prepare leaders for what’s next.

The right tools and consistent approach make succession planning simpler for credit union leaders and board members.

CreditUnions.com revisits three credit unions to learn how their strategies have evolved since their original spotlight and see what’s in store for the future.

A national leader in urban agriculture shows how front-line insights drive real local impact — and why credit union branches are perfectly positioned to do the same.

The Rise Of The Machines