Career Advancement? You’re Gonna Need A Network.

A trio of credit union leaders share how tapping into professional networks fueled both professional growth and personal fulfillment.

A trio of credit union leaders share how tapping into professional networks fueled both professional growth and personal fulfillment.

The Oklahoma credit union is deploying new tools that change the game for its staff and its mission-based membership strategies.

Rising electric vehicle usage has led some institutions to install electric vehicle charging stations at branches. The move could help both the planet and the bottom line.

Lessons from five credit unions on using member impact stories to inspire staff and boards, educate members, and add some pizzazz to social media accounts.

Daniel Garcia works across his credit union — and his community — to ensure True Sky FCU has the products, services, and relationships it needs to serve all members in its diverse market.

An employee communications team and formal pathways to individual development help True Sky FCU engage its workforce and encourage employees to aim high.

A look back at strategies and ideas that help credit unions make an even bigger difference in the communities they serve.

Credit unions are entering the incubator space to tap into the innovative mindset of local entrepreneurs.

Tinker FCU’s holiday promotion has become an annual tradition to boost membership growth.

In honor of International Women’s Day, CreditUnions.com offers insight into what makes an effective leader from women executives across the industry.

Fluctuating loan demand upset credit union lending pipelines and balance sheets in the first half of the year. How significant were these impacts?

Six data points showcase what’s happening in the U.S. economy that could direct credit union decision-making for the rest of the year.

Credit unions have made the choice to back away from indirect auto lending, but that has come with a substantial opportunity cost.

Credit unions leverage their member-first mission to better serve all members, even those of modest means, making cooperatives especially valuable in challenging economic times.

Credit unions are reigniting investment strategies amid rate shifts and slowing loan demand.

The need for responsible higher education financing continues to grow, and your credit union has an opportunity to provide affordable, flexible funding for college and technical careers.

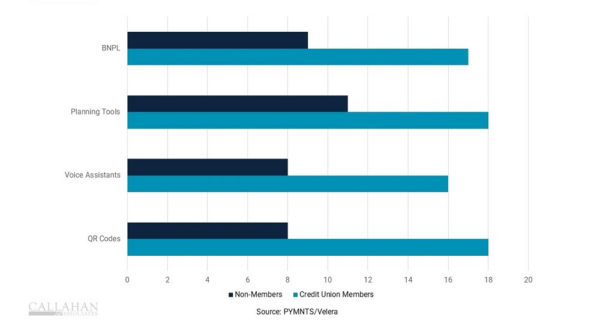

BNPL programs have become a key player in the financial landscape, with some credit unions adopting their own version for their members.

Market pressures and compliance challenges are just two variables pushing cooperatives to hand off their card operations.

How credit card reward programs drive business and loyalty at Alliant and Affinity credit unions.

A March 2024 study determined Buy Now, Pay Later tools are among the top features consumers want from their payments options.