CECL: A Half-Baked Cake

One year after implementation, there’s still work to be done when it comes to new rules around expected credit losses.

Our Risk page is the top spot to learn about business continuity, compliance, enterprise risk management, fraud, and vendor management.

One year after implementation, there’s still work to be done when it comes to new rules around expected credit losses.

For the past decade, the credit union’s head risk leader has been evangelizing the idea that everyone must be a risk manager to ensure the

The crisis is still unfolding, but the latest high-profile bank failure has plenty of takeaways for credit unions around asset management, net worth, communication, and

Credit unions need to redefine the debate to clarify the difference between for-profit banks and member-owned financial cooperatives.

The NCUA board touts its payback to credit unions, but soaring reserves hide a different story.

Hike the Hill, demand change, join together to encourage state and federal lawmakers to step in and save the system from the regulators.

The regulator listens to no one but itself — keeping more and spending more while the FDIC shrinks. Now, the fund owners have the means to model the fund’s performance.

There is no one-size-fits-all approach when it comes to ensuring the safety of a credit union. That’s why leaders must understand the ins and outs of different strategies before selecting the best fit.

On-the-spot gratification leads to increased activation and use and the opportunity to deepen engagement.

Creating future accounting fictions is at the core of the regulator’s rationale for paying itself more and returning less to credit unions.

How will independent experts view the NCUA’s merger of the corporate credit union bailout leftovers into the share fund?

ADA website demand letters and lawsuits leave the movement seeking regulatory relief through more regulation.

Citadel FCU’s new mobile-responsive website is one part of a larger initiative to build the optimal digital experience.

When money stops making sense, people suffer a crisis of financial confidence. Now’s the time to reconnect with members to help them establish long-term stability.

From the teller line to the corner office, CEO Cheryl Sio’s story spans five decades of industry transformation and enduring leadership lessons.

Structured protection strategies provide potentially higher long-term total returns than bonds while muting the volatility and downside risk traditionally associated with equities.

The CEO of Peninsula Community Federal Credit Union highlights how active listening and lessons from the basket court shape a culture of inclusive banking that serves members and employees.

A cross-functional team comprising nearly 20% of staff helped the Maryland-based credit union manage the crisis while staying focused on helping members.

Four executives share how they are skilling up and soothing nerves as they navigate the AI revolution in real time.

The future of leadership starts now. This week, CreditUnions.com is diving into the strategies shaping tomorrow’s talent: from a bold overhaul of succession planning to how credit unions are tackling the AI skills gap.

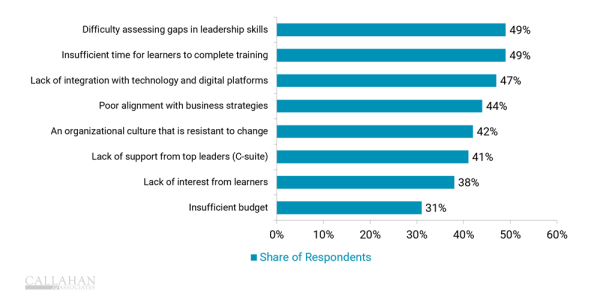

Assessing skills gaps among leaders and providing time to complete training are major hurdles today, but strong leadership development strategies are essential in building a future-ready credit union.

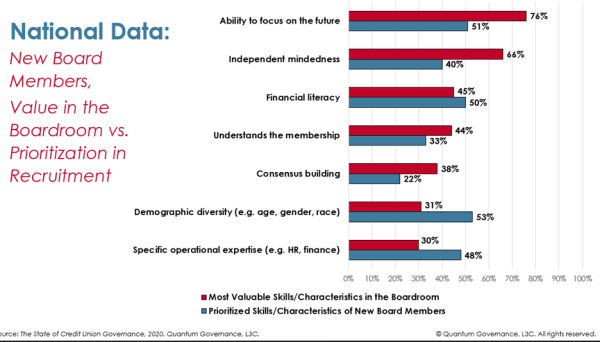

A report from Quantum Governance reveals a gap between board recruitment priorities and the most valuable skills in governance.

Fair, transparent succession helps credit unions strengthen board effectiveness, align leadership with strategy, and safeguard member value.

Words Matter As Bankers Target Big Credit Unions’ Tax Exemption