Desert Financial Leads With Heart To Conquer New Markets

The Arizona cooperative commits time and money to fundraising, grants, and activities that revolve around the idea of giving back.

The Arizona cooperative commits time and money to fundraising, grants, and activities that revolve around the idea of giving back.

Canvas Credit Union wants to be known for its people, and a different way of approaching HR is helping it achieve that goal.

A three-year partnership between SECU Foundation and a North Carolina nonprofit places high-achieving college graduates into community government roles to curb the state’s brain drain.

Employees asked, and Horizon FCU made Black Friday a paid holiday. The Pennsylvania cooperative has made other decisions by following its mission, vision, and values, too.

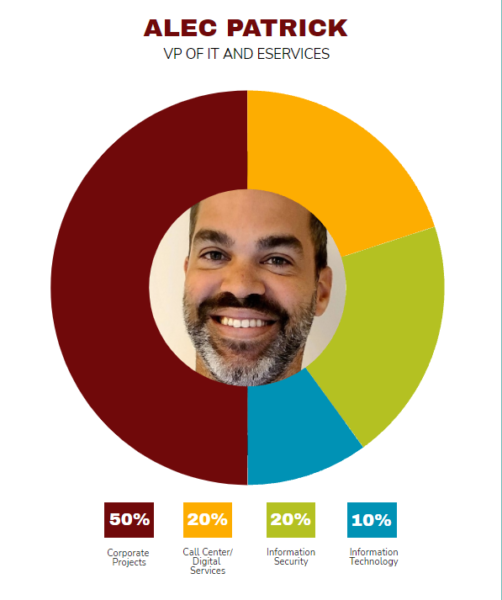

To take on transformation, Signal Financial makes an old-school move and keeps digital services with IT under one manager.

It’s time to show consumers that credit unions across the country are steadfastly working to improve the lives of their members and communities.

In response to fires in the fall of 2020, Oregon Community Credit Union’s Foundation created a relief fund focused on mid-term recovery needs.

Sara Dunlap empowers employees at Leaders Credit Union to help stakeholders meet their potential.

Leaders from three credit unions share insights gleaned from launching and supporting employee resource groups.

Two years after launching a DEI-focused internal initiative, the Washington state cooperative created a fund to donate $5 million over five years to Black-led nonprofits.

The Arizona cooperative commits time and money to fundraising, grants, and activities that revolve around the idea of giving back.

Canvas Credit Union wants to be known for its people, and a different way of approaching HR is helping it achieve that goal.

A three-year partnership between SECU Foundation and a North Carolina nonprofit places high-achieving college graduates into community government roles to curb the state’s brain drain.

Employees asked, and Horizon FCU made Black Friday a paid holiday. The Pennsylvania cooperative has made other decisions by following its mission, vision, and values, too.

To take on transformation, Signal Financial makes an old-school move and keeps digital services with IT under one manager.

It’s time to show consumers that credit unions across the country are steadfastly working to improve the lives of their members and communities.

In response to fires in the fall of 2020, Oregon Community Credit Union’s Foundation created a relief fund focused on mid-term recovery needs.

Sara Dunlap empowers employees at Leaders Credit Union to help stakeholders meet their potential.

Leaders from three credit unions share insights gleaned from launching and supporting employee resource groups.

Two years after launching a DEI-focused internal initiative, the Washington state cooperative created a fund to donate $5 million over five years to Black-led nonprofits.

Reform Credit Unions? No, Rekindle Them!