To better measure its impact as an organization, Blue Federal Credit Union ($2B, Cheyenne, WY) decided to take a new approach that looked beyond traditional KPIs. Using data from biennial internal surveys, the team created the Vitality Index, part of a broader strategy document known as Blueprint 2030.

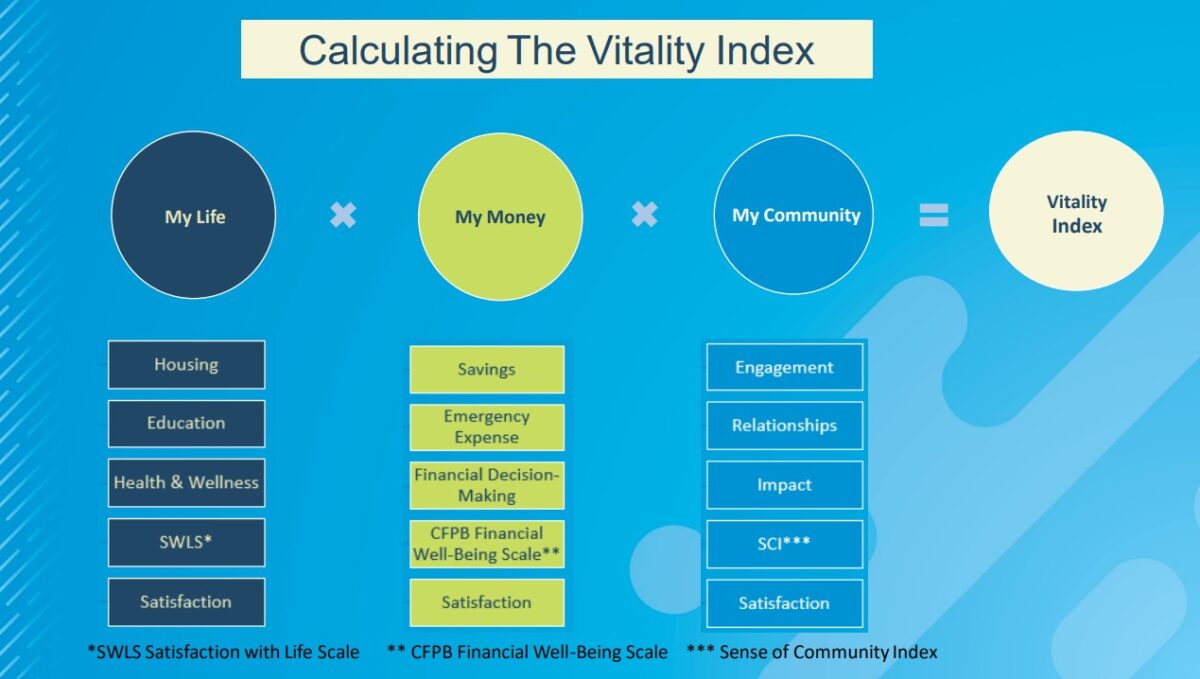

The Vitality Index measures the extent that Blue FCU delivers on its mission to members, employees, and the overall community. Measured every two years, it’s calculated by closely examining the attitudes of both members and non-members toward their lives, their money, and their community.

“What you’re looking at is really the end result of an 18-month effort to set up a 10-year strategy,” Kim Alexander, chief strategy & growth officer at Blue FCU, said during a recent Trendwatch webinar from Callahan & Associates. “A big part of our mission is to be purpose-driven, which for us means being a company that stands for something bigger than just our products and services.”

In the following clip, Alexander offers some key findings gathered from the cooperative’s 2021 and 2023 surveys, and how that data is shaping Blue FCU’s long-term strategy.

Want more? We’ve Got You Covered. Did you know Callahan’s Trendwatch webinars are always available on demand? Every quarter we cover what’s happening in the U.S. economy and break down the most recent credit union performance results. Watch now.