Allison Worthington has one of the most distinctive job titles in the industry.

As director of organizational change management at Desert Financial Credit Union ($8.7B, Phoenix, AZ), Worthington is tasked with helping the entire organization understand and adapt to any number of changes — a role that requires deep interpersonal relationships and an understanding of multiple business functions.

Here, she offers insights into her role, why she’s a fit for the job, and how a focus on change management has bled over into her life outside of the credit union.

Why did Desert Financial create the role of director of organizational change management?

Allison Worthington: About two years ago, we recognized change was happening quickly in the industry, and specifically at our organization, and people were often feeling overwhelmed. We came to the realization we needed change management.

After lots of research, we decided to partner with Prosci, the organization we pull best practices from. We started with certifying about 10 people. Those 10 people started to do change management work as a part-time additional task to their regular daily work. It became pretty clear within maybe four or five months that we needed somebody to do this full time. No one person was doing it regularly, we weren’t creating any expertise, and we didn’t have any consistent processes. For us to make a real difference with change management, we needed somebody to own it and for it to take place constantly, consistently. That’s how we made the decision to create a change management vertical in the organization.

The next step was to decide where to house that within the organization. We determined human resources was the right place, which positioned me perfectly for the role. I was one of the few people doing it as an additional item to my traditional job. Now we have a team of one and are actively recruiting to expand the team to two.

Was this role created with you in mind?

AW: We knew we needed it, and I ultimately was the one who wanted the job. I proved pretty quickly that I was the person for the job, but it was created as a job that was necessary for the organization.

What challenges and opportunities does your role address? How do you address them?

AW: My role addresses the challenge of change saturation. It also addresses the challenge of surprising people with change and making change happen to people versus for people. We’re now able to plan intentionally for changes that are impacting our employees. Plan early, plan often, plan for resistance, and ultimately ensure we are bringing information that’s necessary to help somebody adopt change.

Our people are the reason change happens. If we keep throwing it at people, they won’t help it come to life in the best way possible. When we apply change management, we sit down as a project team — with me leading these conversations — and think through how the change is going to impact people? Is it different for different audiences? Is it the same across the board? What should we do about that? Do we need to provide training? Do we need to have meetings? Do we think there’s going to be resistance? If so, what are we going to do to overcome that resistance?

We develop communication plans, training plans, resistance-management plans, and people leader plans. We’ve developed ways in which we ask our people leaders to talk about a particular change with their employees or to help their employees get on board with a change. My job is to build plans and then ensure those plans are executed. I’m not always the one that executes on each item, but people within the organization are responsible for doing things that help our employees want to adopt a new change.

Job titles say as much about the organization as they do the person. The “What’s In A Name” series on CreditUnions.com dives into notable, important, interesting, or just plain fun roles to find out what’s happening at the ground level and across the industry. Browse the whole series only on CreditUnions.com.

Given how many different departments are affected by change, must you be a bit of a Jack or Jill of all trades?

AW: My length of time here at this credit union — and my 19 years or so in credit unions as a whole — has served me well in that I understand how our company does business and what each line of business is responsible for. I have to know a little bit about a lot of different areas in the organization. I don’t necessarily have to know how a particular line of business does every portion of its job, I just need to know enough to ask the right questions. Once I get that conversation rolling, I can rely on the subject matter experts for that area to fill in the gaps. I’m responsible for asking questions and pushing people to think harder and more critically. That’s the role I play.

AW: What goals do you have for this role?

AW: Our strategic vision for the next two-and-a-half years includes being able to evaluate employee sentiment around change. Change is perceived currently in our organization as something that needs to be managed. Our goal is to get to a space where employees feel skilled and empowered to manage change for themselves and we are able to measure that sentiment. We’re leveraging things like internal surveys to help us understand that. Those survey results are part of our goals; we want to hit a certain benchmark there. We also have goals around ensuring that all of our employees have done things like attend the training we offer and that they have an opportunity to participate actively in changes happening in their worlds.

CU QUICK FACTS

DESERT FINANCIAL CREDIT UNION

DATA AS OF 03.31.24

HQ: Phoenix, AZ

ASSETS: $8.7B

MEMBERS: 453,713

BRANCHES: 48

EMPLOYEES: 1,229

NET WORTH: 11.4%

ROA: 1.01%

What projects at Desert Financial are you currently focused on?

AW: I currently have approximately 70 projects in the pipeline. They’re not all active at this moment, but they are becoming active soon. We’re focusing heavily on financial wellbeing, efficiencies, and digital transformation, so I’m partnering with areas across the organization focused on those types of things.

We have quite a few projects in accounting and finance focused on modernizing the systems they use. We are partnering with people across the organization to bring new financial wellbeing services to not only our employees but also our members. That’s products and services we offer now and adding some new things like financial coaching for our members. We’re currently in a pilot phase.

How do you work across the enterprise to execute strategies around change management?

AW: I have the support of our senior leaders. They believe in bringing change management to the organization, so they back me up from a resource standpoint as well as advocate for it when necessary. My tenure at the organization has allowed me to build strong, trusting relationships with employees and leaders across the credit union, and they seek me out for guidance around change. I think I have a unique position to be able to tap into those individuals and bring our strategy to life when it comes to applying change management methodologies to projects they own or are a part of.

What makes you a great fit for the job?

AW: I want to find a way to “yes.” I don’t always know what that looks like, but I will typically find a way to it. And, again, because I have such great relationships across the organization and I have the ears and the trust of other leaders, I can make a recommendation that might look a little different from their original request and get buy in on it.

Are there ways in which a constant focus on change management has carried over into your life outside the credit union?

AW: My job is focused on change, but, really, my job is focused on ensuring change is brought to employees well. I have found that plays a part in my life. I have a son who’s graduating high school and getting ready to apply for college. I want him to do something the way I want him to do it, but I have to sell him on it. He might not want to, or he might not see the value of what I’m asking him to do. So, I find myself thinking about what really is the impact of him going the route I’m recommending over what he thinks he should do? And, how can I convince him and help him see the benefits of what I’m recommending?

What about your past experience has prepared you for this role?

AW: My entire career has been focused on people and has put me where I need to be today because that’s still my job. I have a wide variety of experiences that allow me to be that jack of all trades. I might not know the current situation of how jobs are being evaluated and applied in the workspace, but I know the people and I know just enough to ask questions. My focus on people and my experience with how the credit union functions and how our employees function allows me to seek the information necessary to be able to do my job well.

What is your daily routine?

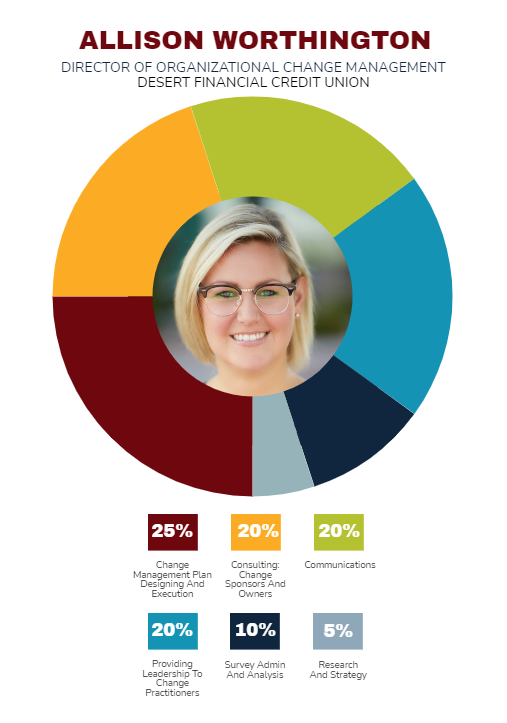

AW: I attend a lot of project meetings and work on a lot of change management plans. Being a team of one, I own the majority of that work myself. I have a few individuals across the organization who report to me when it comes to change management work specifically, so my day might include meeting with them, reviewing their plans, talking about their approach and strategies for a particular change, and then doing those same things for my projects.

I’m recommending activities we should do to make people aware of the change and manage the resistance. I’m partnering with people across the organization — from learning and development and internal communications to human resources and everybody in between — to get their support on the tasks that need to be done.

Once a change plan is created, I spend a lot of time ensuring the execution of that plan. Maybe I draft the communication, maybe I’m reviewing what our internal comms team put together. I’m probably setting up meetings with our sponsors and our leaders of these changes to check in and talk about what’s getting in our way and what’s working. I review data to understand what should the KPIs of this change be pre- or post-implementation? What are the KPIs and data saying now that we’ve actually launched a particular change? Are we meeting our goals and hitting our markers? I’m writing surveys, I’m launching surveys, and I’m analyzing surveys around change management.

Who do you report to and who reports to you?

AW: I report to Veronica Franco, our vice president of talent management. Veronica oversees the majority of human resources, so that’s change management, talent acquisition, employee relations, and learning and development.

I currently have nobody that formally reports to me, but I am working to hire a person that will be a change practitioner. They will report to me.

Desert Financial Credit Union is hiring a change management practitioner to join the change management vertical in the organization. Read the job description today.

How do you track success in your job?

AW: With survey results and project results. Did we hit milestones within the project? Did I complete plans on time? Did we execute on those plans within the timeframe we allotted? After the change has gone live, are we reinforcing it to sustain the change? Are we hitting the mark when it comes to the KPIs?

Additionally, what are people saying? If we surveyed in the middle of a project and people came back and said, “We’re comfortable with it happening, but we don’t have the knowledge,” it’s my job to redirect to make sure we get people the knowledge. So, did I do that? And did we end up in a space where people had the knowledge to move forward? Those survey results are invaluable.

How do you stay current with topics that fall under your role?

AW: We use Prosci as our vendor for change management. It is an industry leader of change management and provides us a simple way to stay connected with what’s happening in the industry through webinars, publishing, those types of things. I take advantage of viewing those and staying on top of things. I also connect with other people and other industries that focus on change management. We have partners in all sorts of industries that are either vendors or people I’ve met throughout the years. We talk about the realities of things that are happening in their world and how they are approaching and handling them.

Have you encountered other credit unions with someone in a similar role?

AW: No, not in the credit union industry.

Is there an industry where you have?

AW: Technology is an area that people focus a little bit more heavily on it. That would be the area I’ve seen it more consistently, but to even say “consistently” feels like a stretch.

What kind of response do you get when you meet new folks within the industry?

AW: The most common thing I get is “What does that mean?” I get that from people inside the industry and I get that from my parents’ friends. I explain that I ensure change is brought to people versus change happening to people.

This article has been edited and condensed.