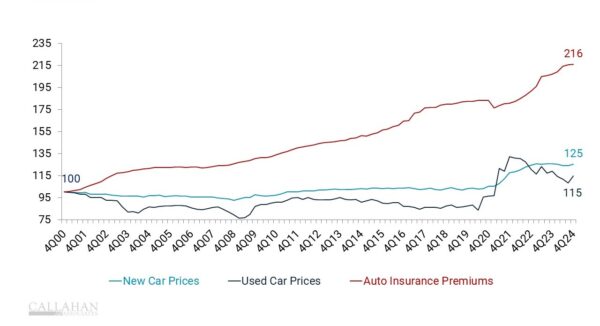

It’s no surprise that car ownership is getting more expensive. New and used vehicle prices have risen 25% and 15%, respectively, since the turn of the millennium.

That’s small potatoes compared to the cost of insuring a vehicle.

In that same time frame, the cost of insurance has more than doubled, rising 116%. By comparison, the consumer price index rose 82% in that same span.

PRICE INDEX OF VEHICLE COST VS. INSURANCE

FOR U.S. AUTO OWNERS

SOURCE: U.S. Bureau of Labor Statistics

Strategic Insights

- The cause for this spike depends on who you ask. According to the insurance companies, this is simply a catch-up to the increased price levels experienced in the wake of the pandemic. But that falls short of explaining the majority of the increase, which took place prior to the spread of COVID-19, although it would explain the spike.

- Some others point to the rise in extreme weather events pushing up damages and the need for claims. Many experts point to the rising cost of technology that goes into cars, meaning that any damages become more difficult to fix and thus more expensive to ensure.

- Many credit union members are struggling to keep to keep expenses in check in the wake of inflation, and rising insurance prices means further strain on finances. Some credit unions are helping by offering auto insurance – as well as ancillary products related to car loans – at affordable rates. Not only does that help members’ wallets, it brings in a vital non-interest income stream for the credit union, too.