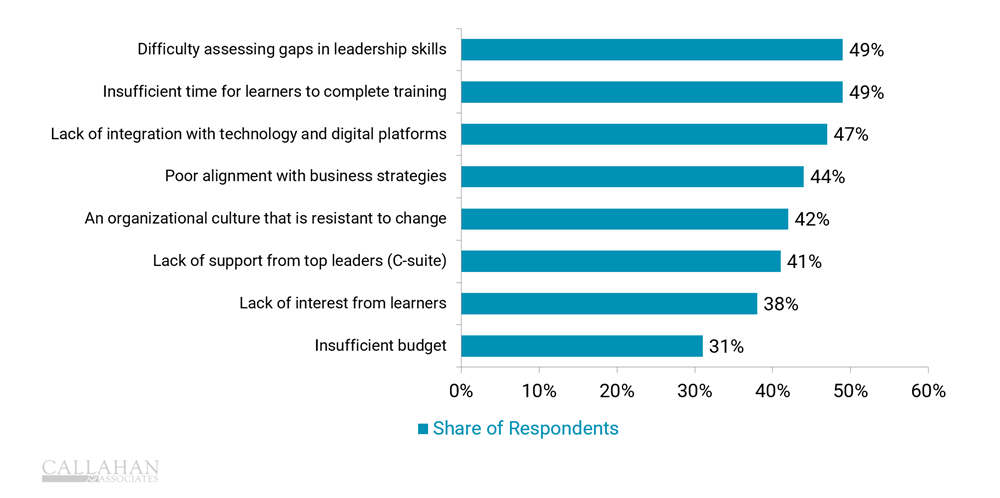

Leadership development belongs at the center of a smart succession strategy. Organizations that neglect it invite stagnation and missed opportunities. The importance of leadership development becomes even clearer when you look at recent research. A spring 2025 study from Harvard Business Review found nearly half of respondents cite lack of time for training and unclear skill gaps as major obstacles, making a deliberate approach to talent development essential.

CHALLENGES TO DEVELOPING LEADERSHIP CAPABILITIES

FOR 1,159 BUSINESS LEADERS | DATA AS OF MARCH 2025

SOURCE: HARVARD BUSINESS REVIEW

For credit unions, the importance of leadership development goes beyond staffing; it safeguards the mission and strengthens member value. Strong leadership development strategies help reduce disruption during leadership transitions and ensure credit unions are well-managed and future-ready. Understanding where gaps exist can be a low-hanging fruit that pays dividends when paired with a clear strategy. For credit unions looking to establish a succession plan, research from Gallup encourages organizations to think outside the box by assessing readiness and defining stages of development.

These principles come to life in practical strategies credit unions are using to strengthen leadership pipelines and retain top talent.

Strategic Insights

- Nearly 50% of organizations struggle with leadership development due to lack of time and unclear skill gaps, according to the HBR study. The pandemic and the Great Resignation taught credit unions that keeping great employees means meeting them where they are and investing in their development regardless of where they sit. “That means offering virtual conferences, webinars, online training — all with the same energy we used to bring to in-person programs,” says Lori Smith, chief human resources officer at Community First Credit Union of Florida ($2.9B, Jacksonville, FL).

- Companies that invest in leadership growth report higher engagement and lower turnover, especially in competitive talent markets. At Chartway FCU ($3.2B, Virginia Beach, VA), an emerging leaders is helping to create a strong internal leadership pipeline. “We wanted intentionality around retention and building a strong internal leadership pipeline for succession planning,” says Jill Edsall, director of learning and talent development. “This program identifies a pocket of high performers where we can invest more time and energy.”

- Organizations that link leadership development to business strategy build stronger succession pipelines. Talent development is a key area of succession planning strategy at Patelco ($9.5B, Dublin, CA). The credit union has a three-tiered system that identifies employees it wants to retain, those ready for new roles and responsibilities, and those who need professional support. “We have clear expectations for our leaders based on talent assessments, cross-functional calibration, and transparent plans communicated to the individual,” says Susan Makris, Patelco’s chief people officer.