This is an excerpt from a Callahan Exclusive Client Content. Callahan clients can access the full version of this article right now on the client portal. Read it today.

The prospect of a return to 0% interest rates is more enticing than ever for would-be borrowers. After all, rising rates have dampened affordability in the United States. However, are ultra-low rates really in the best interest of the U.S. economy?

As of early February, the federal funds target range set by the Federal Reserve was 3.5% to 3.75%. The Trump Administration is pressuring the Fed to reduce interest rates in hopes of spurring the economy. Traditional thinking also holds that lower rates reduce monthly housing payments, improving affordability and helping Americans afford homes.

But will this work as promised?

A closer examination of the past few times the Federal Reserve has drastically lowered interest rates suggests the central bank is smart to proceed with caution.

The Impact Of 0% Rates On The U.S. Mortgage Market

Following both the Great Recession and the COVID-19 pandemic, policymakers were concerned that lending would completely stall as the economy cratered. In response, the Federal Reserve lowered the benchmark federal funds rate to 0%, deploying what is known as a zero interest rate policy (ZIRP).

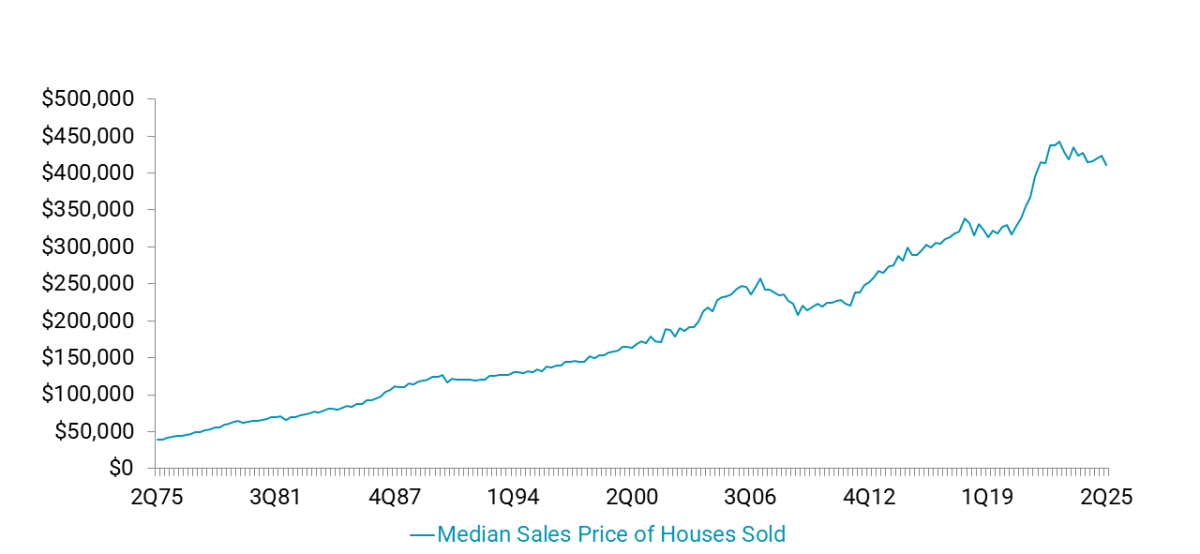

Low rates and a cratered housing market made homes more affordable during the initial recovery following the Great Recession; however, affordability has been falling since 2013. Low rates fueled mortgage demand, which in turn boosted housing demand. Unfortunately, structural supply constraints — including chronic underbuilding following the Great Recession, restrictive zoning in many high-demand markets, and rising construction and labor costs — limited the market’s ability to respond to that demand and home values rose sharply. Pandemic-era migration patterns further intensified regional housing pressures. Together, these forces amplified price increases in a housing market already constrained on the supply side, putting homeownership out of reach for a growing share of would-be borrowers.

MEDIAN HOME SALES PRICE

FOR U.S. HOUSES

SOURCE: FEDERAL RESERVE

According to data on housing affordability from the National Association of Realtors, the median U.S. family income in 2025 was only 1% higher than the qualifying income needed to purchase a median-priced home, signaling a tight market for would-be buyers. By comparison, prior to 2020, the Housing Affordability Index regularly exceeded 160, indicating that the typical family earned far more than was required to qualify for a median-priced home. Increases in home prices are reflected in not only the income of home buyers but also their ages, with first-time homebuyers today more likely to be in their 40s than 20s. What’s more, data from NAR shows the share of first-time buyers has dropped to an all-time low of 21%.

The increase in age of first-time homebuyers coupled with the decline in first-timers as a percentage of total homebuyers has contributed to a K-shaped recovery and negatively impacted perceptions of the U.S. economy, contributing to financial nihilism and low consumer confidence.

The Impact Of 0% Rates On U.S. Credit Unions

Low interest rates have impacted borrowers’ relationship with mortgages, and such changes in borrowers’ behavior have far-reaching consequences.

During both 0% interest rate periods, loans per member rose. In fact, credit union members now hold 20% more products with credit unions than they did before the most recent low-interest rate era. As rates go up, however, the lock-in effect pushes members to hold onto their mortgages, further reducing housing inventory, inflating prices, and shutting out would-be homebuyers.

During this period, yield on loans and investments fell from all-time highs to lows that only recently started to turn around. The low-yield environment pushed credit unions to tap alternative revenue streams, such as other operating income or mortgage sales to the secondary market.

Despite the disruption to their earnings model, credit unions have managed to maintain a healthy return on assets and continue serving members. That resilience underscores the central lesson of past rate-cut cycles: Ultra-low rates might feel like a boost to affordability, but they can create unintended challenges that ripple through housing markets, lenders, and the members credit unions serve.