The CFPB’s proposed crackdown on payday lending products might make it difficult for Redstone Federal Credit Union ($4.4B, Huntsville, AL) to offer its own Member Solutions.

Member Solutions is a three-person operation that offers financial counseling, short-term loans, and loan modifications to struggling members of the northern Alabama cooperative.

We’ll refinance a member’s unsecured debt owed to RFCU on an unsecured basis if doing so results in improved probability of repayment, says John Cook, vice president of lending. The minimum requirement for us to do so is an ability and willingness of the member to pay something acceptable.

The Member Solutions team comprises two experienced financial counselors and a 25-year consumer loan underwriter-manager working out of the Huntsville headquarters. The idea percolated for a couple years before the credit union soft-launched it in January 2015.

|

| John Cook, VP of Lending, Redstone FCU |

We carved out enough of the right people from our existing staff and stood it up as a pilot program and fully supported department of its own, Cook says. The results speak for themselves.

The Member Solutions team works with members who reach out on their own as well as reaches out to members who have fallen behind on their payments. The team has served more than 3,200 members in the 18 months since its inception. Many of those encounters are simply financial counseling sessions, but a growing number are resulting in new or modified loans.

Cook says the team takes a holistic approach that varies with each case. And he’s concerned that looming CFPB rule changes as opposed to the existing Payday Lending Alternative (PAL) rule the NCUA has in place could make it no longer feasible to offer some of the short-term loans that are part of the package.

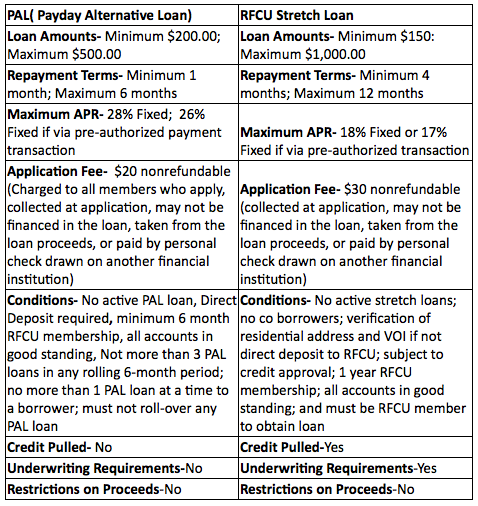

Redstone offers two loans as part of its Member Solutions program.

The new CFPB rule is now out for comment and is not expected to be finalized for another year. Then, implementation would take another 18 months.

Among its most worrisome provisions, Cook says, is the all-in-APR limit of 36%, which includes application fees. Another is the requirement that lenders refund origination fees to all borrowers if the loan default rate exceeds 5% during a defined period, right now 30 days.

Our delinquency rate for this type of loan is about 2.45%, Cook says. We want to lend deeper and make more of these loans, and this default rate rule could discourage us from offering these types of alternatives to borrowers.

He adds that the APR on Redstone’s short-term loans are much lower than from payday lenders and check cashers. Plus, Redstone offers these loans as part of a holistic approach that includes budgeting plans and modifications of existing loans.

What’s being proposed by the CFPB could be a discouragement for us and other financial institutions that offer these kinds of alternative solutions that have the members’ best interest at heart, Cook says.

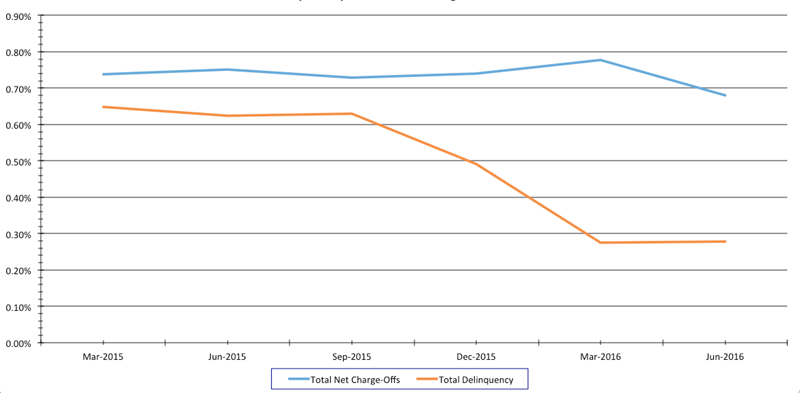

ASSET QUALITY

FOR REDSTONE FCU | DATA AS OF 03.31.16

Callahan Associates | www.creditunions.com

Source: Peer-to-Peer Analytics by Callahan Associates

Modifying Member Solutions

Learning as it goes, the Member Solutions program already has undergone some modifications of its own, most notably in the willingness in some circumstances to refinance outside debt.

For example, when the Member Solutions team reached out to a troubled member who had let their HELOC payments slip to 60 days past due, it found the member also had a title loan and unpaid taxes.

There was no mortgage on the home, just the HELOC. The solution? A customized mix of products and services that included: a budget; securing the HELOC to the property; an auto-secured loan, as there was some equity in the vehicle’s value; and a short-term, unsecured loan to clean up the other debt problems.

Don’t reinvent the wheel. Get rolling on important initiatives using documents, policies, and templates borrowed from fellow credit unions. Pull them off the shelf and tailor them to the credit union’s needs. Visit Callahan’s Executive Resource Center today.

Their Problem Is Not Always Ours

Although Redstone has no plans to take on other lenders’ problems, Cook says, each situation is different. But the general idea is the same: To go beyond simply promising repossession and foreclosure to working with the member to determine if there’s a better way.

Many times we find they’re ready and able and willing to pay something, Cook says. That’s a better solution for both sides than going to collection and liquidation.

Doing this takes some thinking out of the box for any financial services operation, and the 390,000-member, 23-branch Redstone is no exception.

CU QUICK FACTS

redstone fcu

Data as of 06.30.16

- HQ: Huntsville, AL

- ASSETS: $4.4B

- MEMBERS: 387,293

- BRANCHES: 23

- 12-MO SHARE GROWTH: 6.0%

- 12-MO LOAN GROWTH: 8.8%

- ROA: 0.7%

It took a culture change that started at underwriting and continued into loan modifications, restructuring, and refinancing.

Whatever it takes, based on our ability to assess the ability and willingness of the borrower to repay, Cook says.

Member Solutions has its success stories now, but the Redstone lending executive says the program got off to a slow start.

As compelling as all this rationale sounds, old habits die hard, Cook says. It took a while to ramp up, especially in our collections department.

And sometimes all that help just doesn’t make sense.

This isn’t for everybody, Cook says. Sometimes what a member can and will pay is simply not enough to keep them out of the ditch. In that case, all we’re doing is delaying the inevitable. At that point, why bother? Let’s go ahead and deal with this today. Let’s do what has to be done.

FOLLOW THE LEADER

Explore dozens of leader tables and hundreds of pages of credit union performance data in Callahan’s Credit Union Directory. It’s the gold standard for reliable insight. Read the digital download today.

Measuring Progress, Moving Forward

The Member Solutions team provides a systematic way for the member-facing branch and call center staff to refer people with financial difficulties, both people coming in on their own and those identified as the staff moves beyond their quarterly reviews of credit scores.

Now the analytics will be coming more into play. Cook says the Member Solutions team will be growing its ability to analyze data to spot developing problems before they become a fiscal crisis for the member’s household.

That’s crucial, the Redstone vice president says.

By the time the borrower reaches out to us for help, they’ve been in certified problem territory for a long time, and they’re now almost out of gas, Cook says. We think we can do a better job helping them and preserving more of their financial well-being if we can intercept the problem at an earlier stage. But many borrowers are proud aren’t we all? and they want to fix the problems themselves. Or worse yet, they’re in denial.

Right now, however, the team is doing its best to keep up with the demand from the referrals. It’s a time-consuming process. Each client takes two to two-and-a-half hours of analysis time, and that’s not talking about real estate-secured cases. Compare that to the time involved in an auto approval.

An effort is now underway to quantify the impact of the Member Solutions solution. New data collection points will include credit score and payback performance changes, and perhaps more.

We’ve only just begun to put some measurable parameters around the way we’re improving the financial well-being of our Member Solutions clients, Cook says. I don’t know about other credit unions’ experience, but I do know a dollar collected through repayment is better than 66 cents collected through recovery. That’s the cost/benefit justification. It’s good for members and it’s good for the credit union.

You Might Also Enjoy

- Great Meadow FCU Scores Big While Thinking Small

- Credit Unions Set A Record For Dollar Amount Originated

- Lending Highlights From First Quarter 2016

- Indirect Lending Grows Its Direct Impact On Credit Unions