Top-Level Takeaways

-

Credit unions pay back millions of dollars every year in a variety of rewards programs.

-

American 1 and Ent credit unions have recorded credit card and overall loan growth grow after launching reward programs.

Valentine’s Day comes once a year, but credit unions show off their love for members year round.

Laura Pryor, VP Marketing Communications, American 1 Credit Union

Last year, members at American 1 Credit Union ($368.0M, Jackson, MI) cashed in nearly $500,000 in points earned through the credit union’s ScoreCard Rewards program. The program gives members one point per dollar spent and also includes quarterly promotions such as triple points for restaurant and travel spending or double for gas purchases.

What members got in return ran the gamut from retail gift cards to international travel, according to Laura Pryor, the credit union’s vice president of marketing and communications. And that’s all aside from the more than $1.5 million the credit union returned to members in loan interest rebates and bonus dividends.

You have to do this if you want to remain competitive, Pryor says of the credit card reward program. But it’s also a good feeling. We build affinity and loyalty between member and credit union with this program.

ContentMiddleAd

These programs build business, too. American 1 began its rewards program nearly 15 years ago, but it took off after the credit union renamed the program in 2016.

We started calling it our Rewards Credit Card, says Pryor, whose 20-something youngest son gave her a Bed Bath Beyond gift card he scored through his rewards card. It’s the only card we offer. It’s simple, and it works.

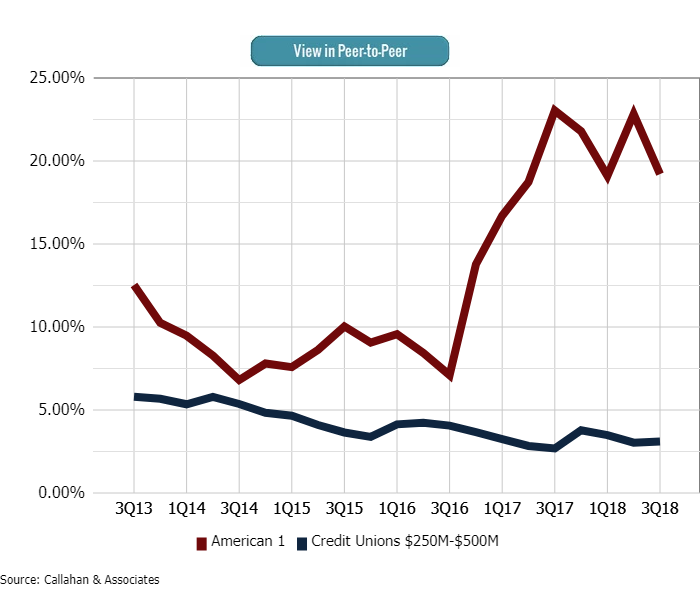

CREDIT CARD LOAN GROWTH

FOR CREDIT UNIONS $250M-$500M | DATA AS OF 09.30.18

American 1’s credit card growth has soared since renaming its rewards card in 2016. Annual growth of 19.2% in the third quarter put the credit union in the top 10% of its asset-based peer group, according to data from Callahan Associates.

Source: Callahan Associates.

A Colorado Credit Union Encourages Ent-gagement

Ent Credit Union ($5.6B, Colorado Springs, CO) spreads the bread based on the breadth of a member’s involvement with the Rocky Mountain State cooperative.

Victoria Selfridge, VP Corporate Communications, Ent Credit Union

Unlike special member dividends, the Ent Extras program rewards members based on their engagement and use of credit union products and services, not their account balance, says Vicki Selfridge, Ent’s vice president for corporate communications.

Ent Extras payouts include annual awards ranging from $10 for actively using online or mobile banking to $25 for an auto loan, $75 for a mortgage, and $250 for a corporate loan. The program has paid out $30.7 million since it began in 2014, including $11 million last year alone.

We use it as another way to differentiate Ent and the value we provide our members, Selfridge says.

Ent calculates payout amounts in October and deposits them on Dec. 1. It also sends members an annual awards communication that tells them what they should expect to see deposited on that special day.

Ent sends personalized mailings to individual members that report the cash rewards they will receive. Click here to see the complete mailer.

In standardized direct mailings, Ent touts that its program offers a real, tangible benefit for credit union membership; rewards based on usage, not money; and incentives to bank the way a member already does.

Members are returning the love. Ent’s growing payouts have coincided with strong loan growth after it introduced its Ent Extras program in 2014.

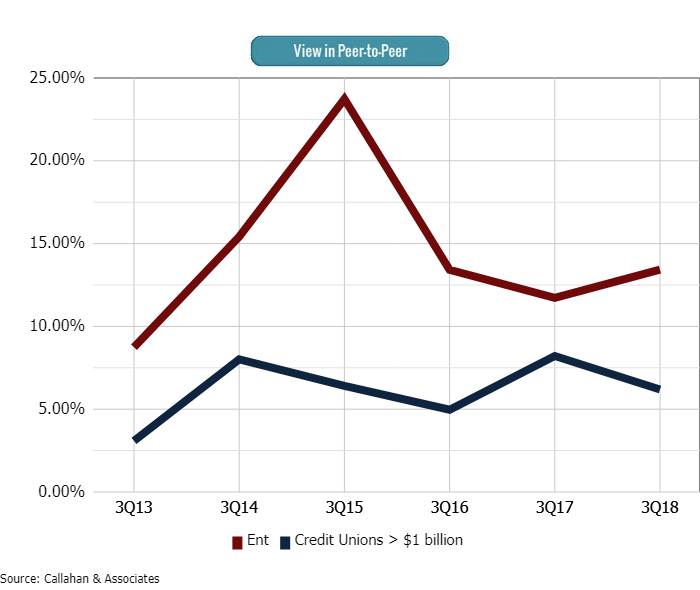

LOAN GROWTH

FOR CREDIT UNIONS $1B+ | DATA AS OF 09.30.18

Ent’s 14.01% loan growth in the third quarter placed it in the top third of its asset-based peer group.

Source: Callahan Associates.

Variations On The Theme

Credit unions take a variety of approaches to rewards programs, providing a movement-wide variation on the theme.

Dupaco Community Credit Union ($17B, Dubuque, IA), for example, paid out $2.6 million in 2018 to nearly 50,000 of its approximately 112,000 members through its Thank Use program.

David Klavitter, Chief Marketing Officer, Dupaco Community Credit Union

The Hawkeye State credit union rewards members when they save, borrow, pay (via Dupaco debit or credit cards), plan (with Dupaco Insurance Services or Dupaco Financial Services), access the credit union’s digital services, or just improve their credit scores.

What engages a member varies by individual, but the basic components of engagement are emotion, attitude, and feeling that the member has about the credit union, said the Iowa credit union’s chief marketing officer, David Klavitter, in a 2018 article on CreditUnions.com. Emotional bonds are hard to break. The more emotionally connected members are, the less likely they are to leave and the more likely they are to do more business and refer others to the credit union.

Members can track their participation in the program throughout the year via a personalized dashboard available in online banking. And every October on International Credit Union Day, the credit union pays out Thank Use dividends to further highlight the cooperative difference.

Dupaco Community offers an annual payout to members who save, borrow, spend, and use ancillary services at the credit union. Learn more in 2.6 Million Ways To Thank Members.

Matt Stephenson, EVP, Rogue Credit Union

Also notable is the Rogue Ownership Account from Rogue Credit Union ($1.5B, Medford, OR). Benefits include cash back on credit card use, rounding up debit card charges, e-statement sign-up bonuses, youth account incentives, and sweeps from other deposit accounts. Members can keep their money in the Ownership Account as long as they want and currently earn a return of 3%, well above market rate but once they take it out, they can’t re-deposit it.

Rogue launched the Ownership Account program in February 2016 as a way to reward members for engaging with the institution and to promote what it means to bank with a credit union.

It’s probably the best tool we’ve ever seen to help credit union members recognize the credit union difference, executive vice president Matt Stephenson told CreditUnions.com last year. They own their credit union, and they get a lot of value out of that ownership.

And isn’t that what credit union love is all about?

A growing list of cash-back rewards for member engagement is a linchpin of Rogue Credit Union’s loyalty strategy. Learn more in An Account Of Ownership Benefits.