RESIDENTIAL FIRST MORTGAGE ORIGINATIONS AND MARKET SHARE

FOR U.S. CREDIT UNIONS | DATA AS OF 03.31.23

© Callahan & Associates | CreditUnions.com

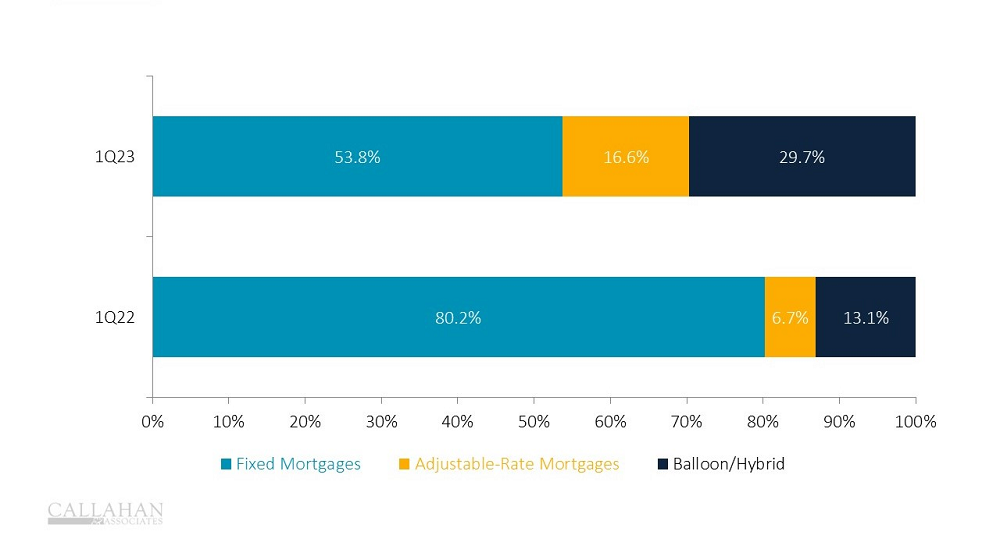

The average rate on a 30-year fixed-rate mortgage spiked significantly in 2022 and remains elevated today as policymakers work to combat inflation. Costlier financing on top of inflated home values has pushed consumers to shy away from long-term mortgage loans in favor of alternative options, such as adjustable-rate and balloon/hybrid products.

- According to Freddie Mac, 30-year fixed rates rose a full percentage point in March of 2022 alone, reaching 4.67% at the close of the quarter. Fixed rates continued to soar throughout the following year and closed the first quarter of 2023 at 6.32%.

- ARMs and balloon/hybrid products generally offer lower monthly payments, initially, compared to a fixed mortgage, giving borrowers a break in today’s pricey real estate environment.

- A year-over-year drop in total mortgage originations contributed significantly to the decline of fixed-rate mortgages. High rates have suppressed demand, especially for refinances, which usually offer fixed rates.

- By opting for non-fixed mortgage types, members are gambling that rates will fall before their introductory period ends. Home equity values also must remain high enough to allow for a future refinance. Although non-fixed loan types can be beneficial given the circumstance, credit unions must educate homebuyers of the risks inherent in these alternative sources.

Does Your Mortgage Performance Stack Up?

Take a data-driven look at leaders and competitors in your financial market with Peer. Backed by data from HMDA, the 5300 Call Report, and the U.S. Census Bureau, Peer offers endless opportunities to pull custom research to make strategic, member-driven decisions for your institution.

Claim Your Mortgage Scorecard

Claim Your Mortgage Scorecard