4 Ways To Build A Better Credit Card Program

A razor-sharp focus on four areas of credit card lending helps credit unions operate a program that supports critical priorities, provides income, and deepens member relationships.

A razor-sharp focus on four areas of credit card lending helps credit unions operate a program that supports critical priorities, provides income, and deepens member relationships.

The right loan origination system can help ensure loan growth goals are met.

An Idaho credit union uses credit score analysis to build long-term relationships and the loan portfolio.

Credit unions can use their traditional member service strength as an advantage in the digital age.

Learn more about two channels of non-member deposits.

Understanding the role of family and technology can go a long way toward becoming the trusted agent for that most major of purchases.

A layered, comprehensive approach is the key to delivering peace of mind.

Secondary market sales of burgeoning credit union mortgage share remains dominant, but credit unions are selling more loans to each other, too.

New HMDA data shows how credit unions in different NCUA regions fared in 2016. And finally, loan purpose.

Discover how two employee awards honor the Arizona credit union’s commitment to a team-first culture while boosting employee engagement and workplace culture.

AI is removing friction from financial decisions, giving consumers more control over their money and forcing banks and credit unions to compete on real value.

The organizational structures for the marketing teams at 3Rivers FCU and Leaders Credit Union couldn’t be more different, but they share a common goal.

NOLA Firemen’s FCU helps members qualify for a mortgage in a state where poverty is high and insurance premiums are keeping many would-be borrowers out of a home.

Callahan & Associates provides an early look at quarterly performance results. Sneak a peek at the latest trends here.

Don’t stop reading because you think this is a love letter to Zohran Mamdani. It’s not about politics; it’s about connection and authenticity. His people-first campaign offers four lessons for credit unions on speaking with purpose and being heard.

Explore best practices to streamline service, inspire leadership engagement, and improve the member experience.

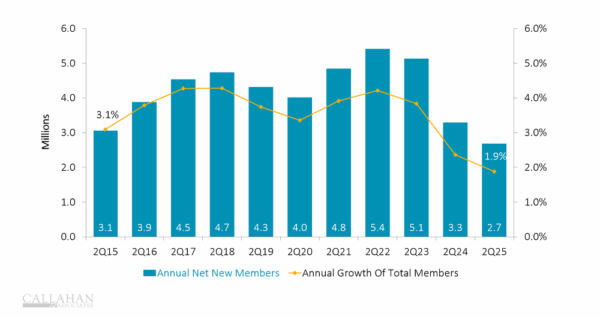

Member growth is slowing. What can credit unions do about it? Callahan experts explore how purpose and financial wellbeing might be the key to sustainable member growth.

Futureproof your credit union. Learn how ASAPP Financial Technology’s bank.io OXP | Omnichannel Experience Platform supports credit unions as they compete against direct-to-consumer fintechs.

Choosing the right credit union core technology provider helps members, employees, and the credit union thrive.

4 Ways To Build A Better Credit Card Program