2 Ways An Indiana Credit Union Builds Revenue

A new strategy at Purdue Federal has delivered a $1.5 million bump in interest income and an anticipated 3-basis-point jump in ROA.

A new strategy at Purdue Federal has delivered a $1.5 million bump in interest income and an anticipated 3-basis-point jump in ROA.

The Tennessee credit union established an enterprise risk committee in 2016 to involve stakeholders and business lines in strategic conversations.

In this Q&A, Terry Settle of Old Ocean FCU talks about serving as a remote CEO, the range of opportunities the model has presented, and the similarities with the models of larger credit unions.

The markets react mildly to yesterday’s Fed meeting.

The NCUA does not need to keep credit union corporate bailout money, if the past is still prologue.

The much-publicized Google memo got me thinking. Finance is a traditionally male-dominated field. In credit union land, 51.4% of CEOs are female yet collectively manage only 18.5% of the industry’s assets.

Free from congressional oversight, how will the still-independent NCUA answer calls for its own financial answerability?

Five can’t-miss data points featured this week on CreditUnions.com.

Interchange income at credit unions swaps places with punitive fees as a growing driver of industry revenue.

Yolo FCU wants new hires to fully understand its brand from the get-go, so it moved employee onboarding from HR to marketing.

Discover how two employee awards honor the Arizona credit union’s commitment to a team-first culture while boosting employee engagement and workplace culture.

AI is removing friction from financial decisions, giving consumers more control over their money and forcing banks and credit unions to compete on real value.

The organizational structures for the marketing teams at 3Rivers FCU and Leaders Credit Union couldn’t be more different, but they share a common goal.

NOLA Firemen’s FCU helps members qualify for a mortgage in a state where poverty is high and insurance premiums are keeping many would-be borrowers out of a home.

Callahan & Associates provides an early look at quarterly performance results. Sneak a peek at the latest trends here.

Don’t stop reading because you think this is a love letter to Zohran Mamdani. It’s not about politics; it’s about connection and authenticity. His people-first campaign offers four lessons for credit unions on speaking with purpose and being heard.

Explore best practices to streamline service, inspire leadership engagement, and improve the member experience.

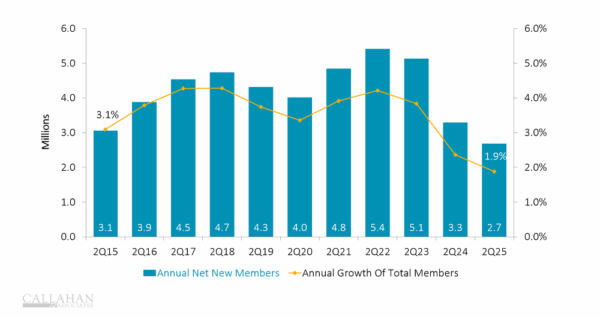

Member growth is slowing. What can credit unions do about it? Callahan experts explore how purpose and financial wellbeing might be the key to sustainable member growth.

Futureproof your credit union. Learn how ASAPP Financial Technology’s bank.io OXP | Omnichannel Experience Platform supports credit unions as they compete against direct-to-consumer fintechs.

Choosing the right credit union core technology provider helps members, employees, and the credit union thrive.

Bond Traders Bet Fed’s Aim Will Be Off